Gold (XAUUSD) rises steadily, trading above 2,500 USD per troy ounce

XAUUSD price closed the previous week above 2,500 USD, exhibiting a steady uptrend driven by fundamental factors. Find out more in our XAUUSD analysis for today, 26 August 2024.

XAUUSD forecast: key trading points

- Market focus: gold reached a new all-time high of 2,532 USD last week

- Current trend: gold is trading in a strong uptrend, with growth likely to continue

XAUUSD forecast for 26 August 2024: 2,532 and 2,483

Fundamental analysis

XAUUSD quotes showed sustained growth last week, reaching a new all-time high of 2,532 USD. The rise in gold prices was primarily driven by demand from global central banks and heightened expectations of a Federal Reserve interest rate cut this year.

In his speech at the recent Jackson Hole Symposium, Federal Reserve Chair Jerome Powell confirmed the beginning of a monetary policy easing cycle. A September interest rate cut is a done deal, while further Fed actions will depend on economic data. Market participants expect at least one more interest rate reduction by the end of the year.

XAUUSD technical analysis

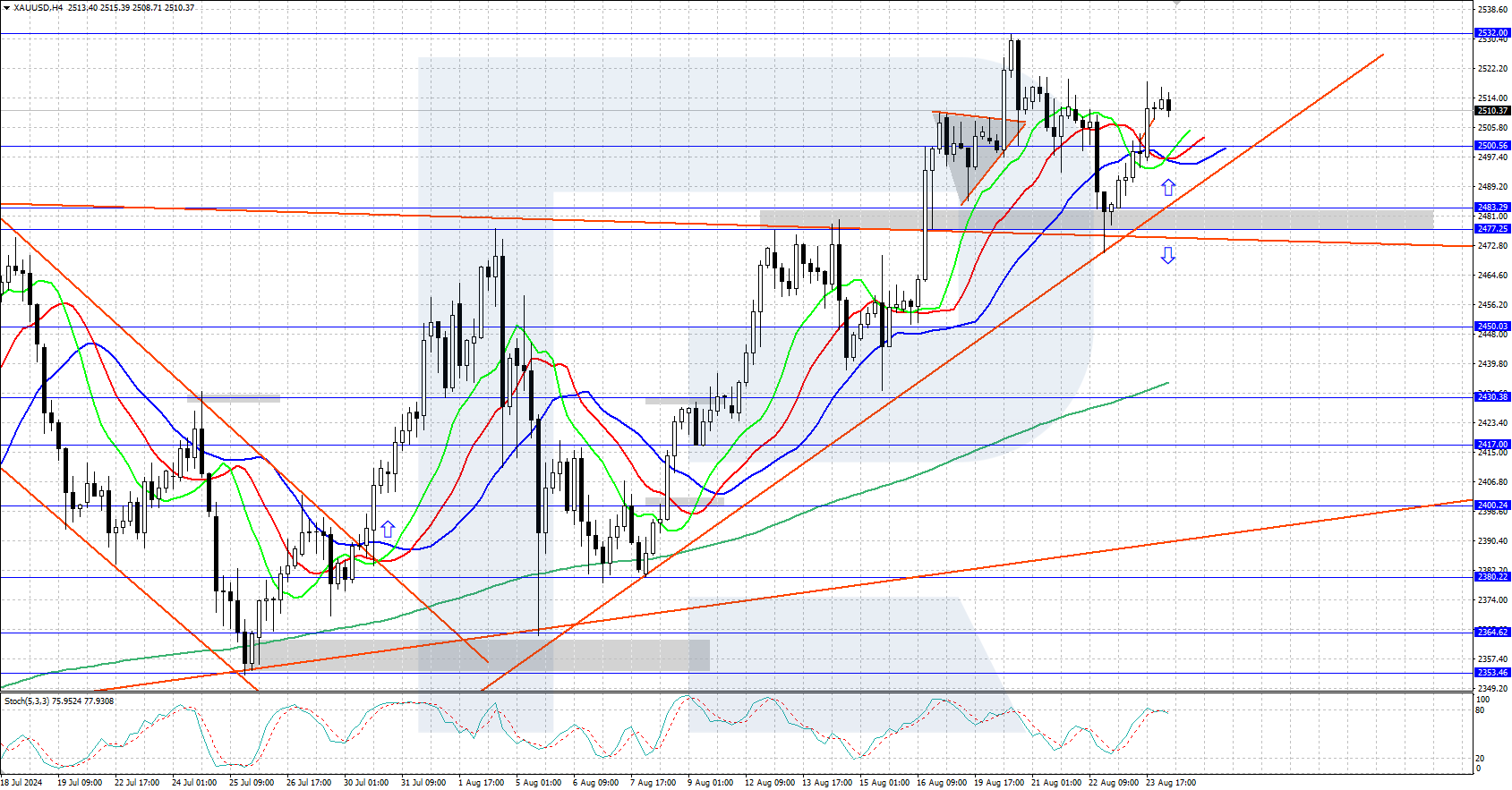

On the H4, XAUUSD quotes are experiencing a steady uptrend with the formation of a triangle price pattern. Last Thursday, the quotes declined to the pattern’s upper boundary as part of a correction, where they encountered robust demand from buyers and returned to the area above 2,500.

The short-term XAUUSD price forecast suggests that growth could continue, with the price likely reaching the 2,600 USD level if bulls hold the price above the triangle’s upper boundary. A decline below the 2,483-2,477 USD support area will invalidate this scenario and create conditions for a downward correction.

Summary

XAUUSD quotes are steadily rising, after reaching a new all-time high of 2,532 USD last week. The rise in gold prices is supported by the beginning of a Federal Reserve interest rate-cutting cycle, demand from central banks, and political tensions in the Middle East.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.