Gold (XAUUSD) enters a local correction towards the historical high of 2,685 USD

As part of a localised downward correction, the XAUUSD price dipped below 2,650 USD. This week, market participants will focus on US labour market data. For more details, read our XAUUSD analysis, including signals, news, and outlook for today, 30 September 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are anticipating US labour market statistics this week

- Current trend: a correction within the uptrend is underway

- XAUUSD forecast for 30 September 2024: 2,685 and 2,630

Fundamental analysis

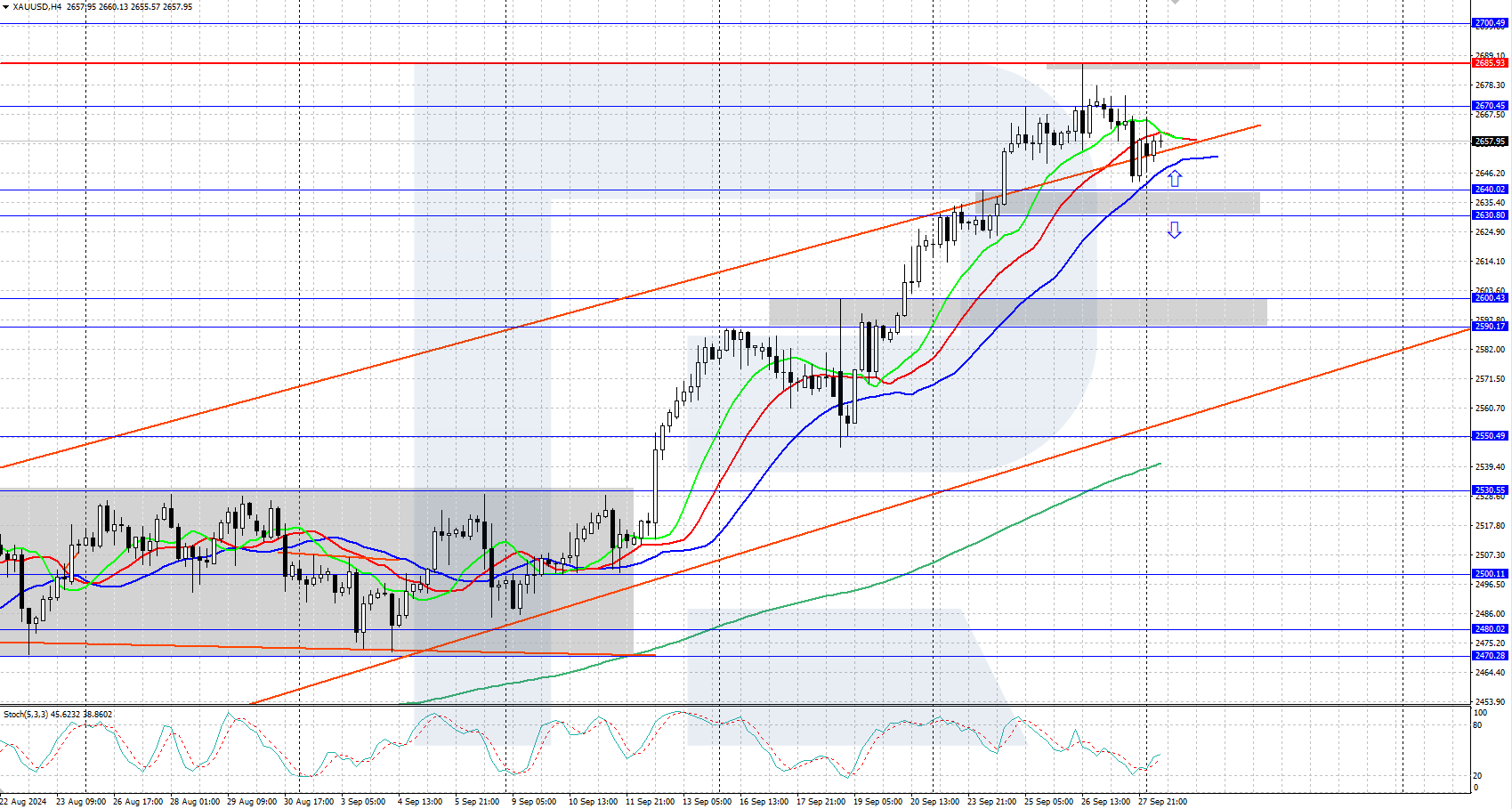

XAUUSD shows a moderate downward correction after hitting an all-time high of 2,685 USD last week. Gold remains within a strong uptrend, which began when the Federal Reserve initiated its rate-cut cycle. This week’s US employment data release may be critical in the XAUUSD outlook, providing signals for further price action.

The labour market report from Automatic Data Processing Inc. (ADP) is due on Wednesday, followed by the Nonfarm Payrolls and unemployment reports on Friday. A decline in employment could pressure the USD and push XAUUSD higher, while an increase in jobs could strengthen the USD and lead to further correction in XAUUSD prices.

XAUUSD technical analysis

On the daily chart, XAUUSD remains in a strong uptrend, trading above the upper boundary of its price channel. However, the current XAUUSD outlook indicates a local downward correction, with prices falling towards the 2,630-2,640 USD support area, where buyers’ demand re-emerged.

In the XAUUSD forecast, if the bulls continue to push prices above 2,685 USD, further growth towards 2,700 USD is expected. Conversely, if the bears succeed in driving the price below the 2630-2640 USD support area, the decline could extend towards 2,600 USD.

Summary

XAUUSD prices fell below 2,650 USD within the correction, but the daily trend remains upward, and the growth may continue. This week, the market will focus on US employment data, which could provide crucial signals for the next move in XAUUSD.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.