Gold (XAUUSD) is correcting downwards after strong nonfarm payrolls data

XAUUSD price is moderately correcting downwards after Friday’s positive US employment market data release, while a triangle pattern continues forming on the chart. Read our XAUUSD analysis for today, 7 October 2024, for more detailed insights.

XAUUSD forecast: key trading points

- Market focus: US employment market statistics exceeded forecasts

- Current trend: a moderate correction is underway as part of the uptrend

- XAUUSD forecast for 7 October 2024: 2,670 and 2,630

Fundamental analysis

XAUUSD quotes are moderately declining following last week’s US employment market statistics release. According to the data, nonfarm payrolls increased by 254,000 jobs, exceeding the projected 140,000, while the unemployment rate decreased from 4.2% to 4.1%.

After the release, the US dollar strengthened against major currencies, with gold also declining to 2,630 USD but then recovering to 2,650 USD. This week, market participants will focus on US inflation data – Consumer Price Index (CPI) and Producer Price Index (PPI).

XAUUSD technical analysis

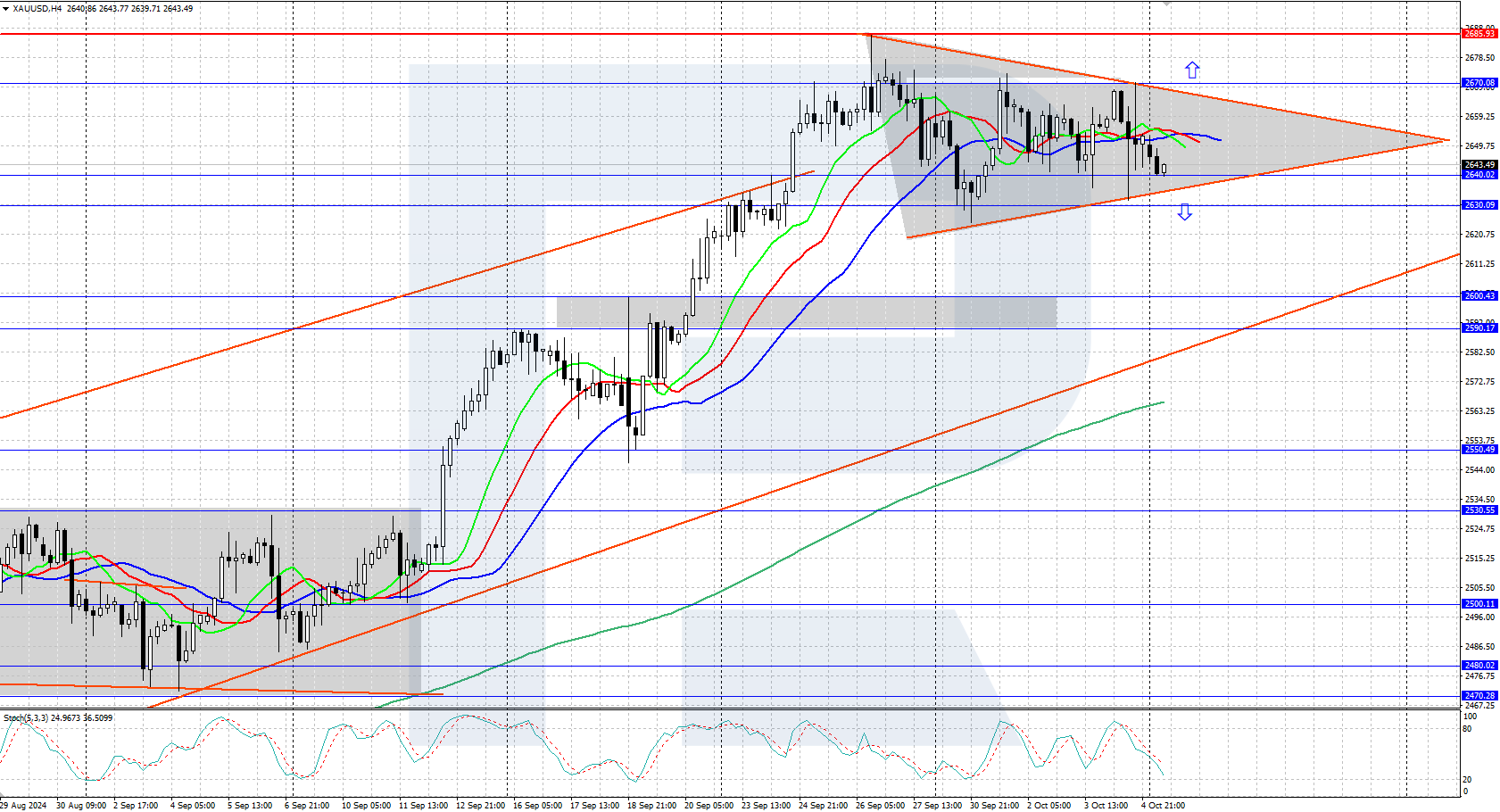

Gold continues to trade within an uptrend. Following Friday’s release of US employment market statistics, XAUUSD’s price is consolidating within a limited price range of 2,630-2,670 USD. A triangle technical pattern has formed on the H4 chart, with the quotes currently trading around its lower boundary.

The short-term XAUUSD price forecast suggests that the price could decline further to the 2,600 USD support level if bears push the quotes below 2,630 USD (the triangle’s lower boundary). If bulls drive the quotes above 2,670 USD (the triangle’s upper boundary), the price might rise and hit an all-time high of 2,685 USD.

Summary

Gold prices tumbled to the 2,630-2,640 USD area after the strong US employment market statistics. This week, market participants are awaiting the release of US inflation data.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.