Gold (XAUUSD) continues its ascent, rising above 2,650 USD

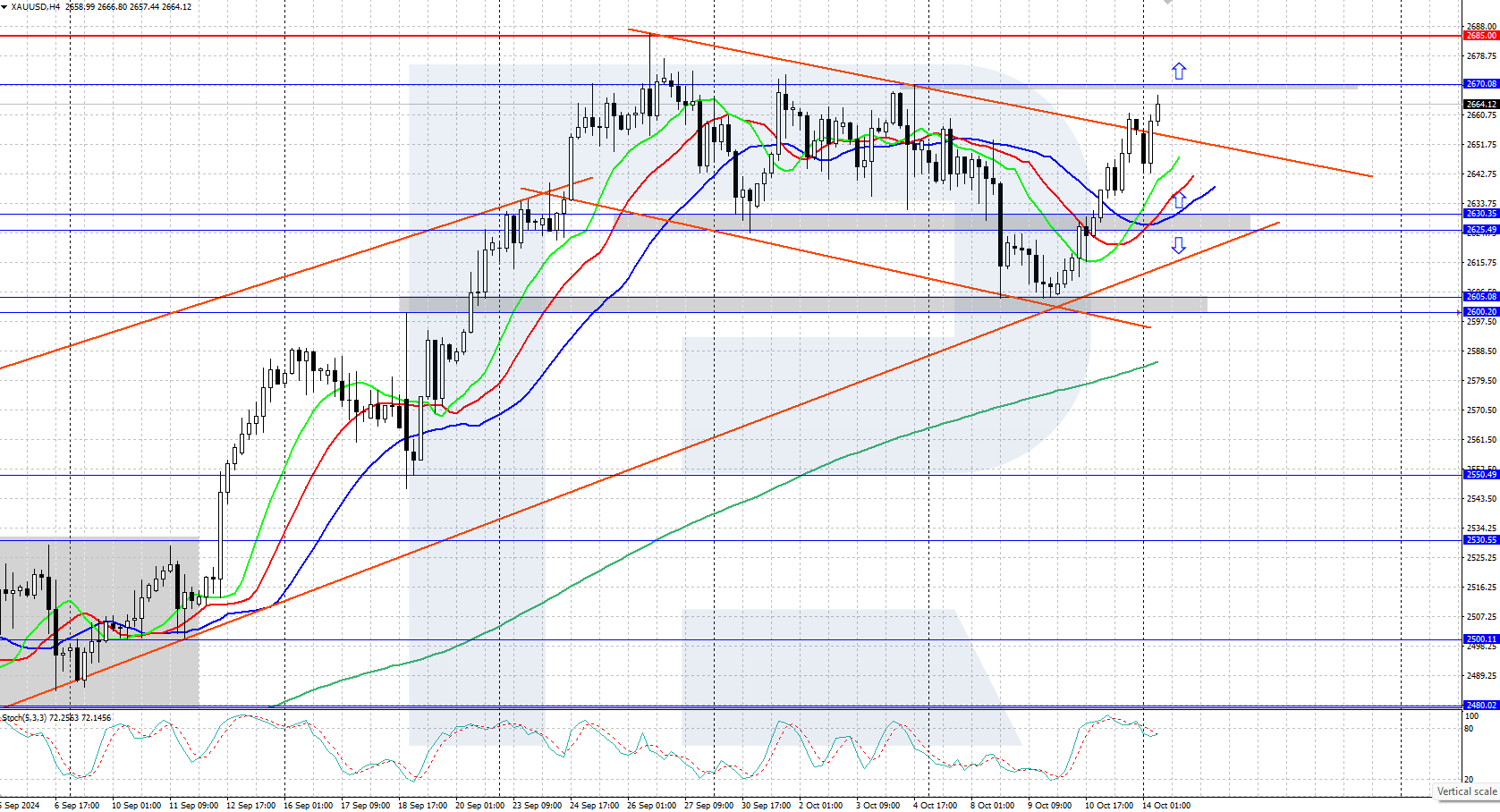

XAUUSD price has completed a downward correction and decisively reversed upwards. The price is expected to continue ascending and potentially hit a new all-time high of 2,685 USD. Discover more in our XAUUSD analysis for today, 14 October 2024.

XAUUSD forecast: key trading points

- Market focus: last week’s US inflation statistics came out roughly in line with forecasts

- Current trend: trading in an uptrend

- XAUUSD forecast for 14 October 2024: 2,630 and 2,685

Fundamental analysis

XAUUSD quotes have completed a downward correction and reversed upwards in line with the trend, receiving active support from buyers at around 2,600 USD. Gold is in demand from global central banks and investors, with escalating geopolitical tensions in the Middle East adding to its appeal.

Last week’s US inflation data, particularly the Consumer Price Index (CPI) and the Producer Price Index (PPI), roughly aligned with forecasts. The stock market responded to the released statistics with a rise, and gold also strengthened against the US dollar.

XAUUSD technical analysis

Gold has completed its decline as part of a downward correction. Last week, a bullish, engulfing candlestick reversal pattern formed on the daily chart, indicating the completion of the downward movement and an upward reversal. Following the pattern formed, the quotes showed a steady upward movement.

The short-term XAUUSD price forecast suggests that another decline to 2,600 USD could follow if bears push the quotes below the 2,630-2,625 USD support area. If bulls hold the price above 2,630-2,625 USD, further growth to an all-time high of 2,685 USD is likely. The growth scenario currently seems the most probable.

Summary

Gold prices have completed a downward correction and confidently reversed upwards. The price could reach an all-time high of 2,685 USD in the short term.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.