Gold (XAUUSD) has found support and attempts to reverse upwards

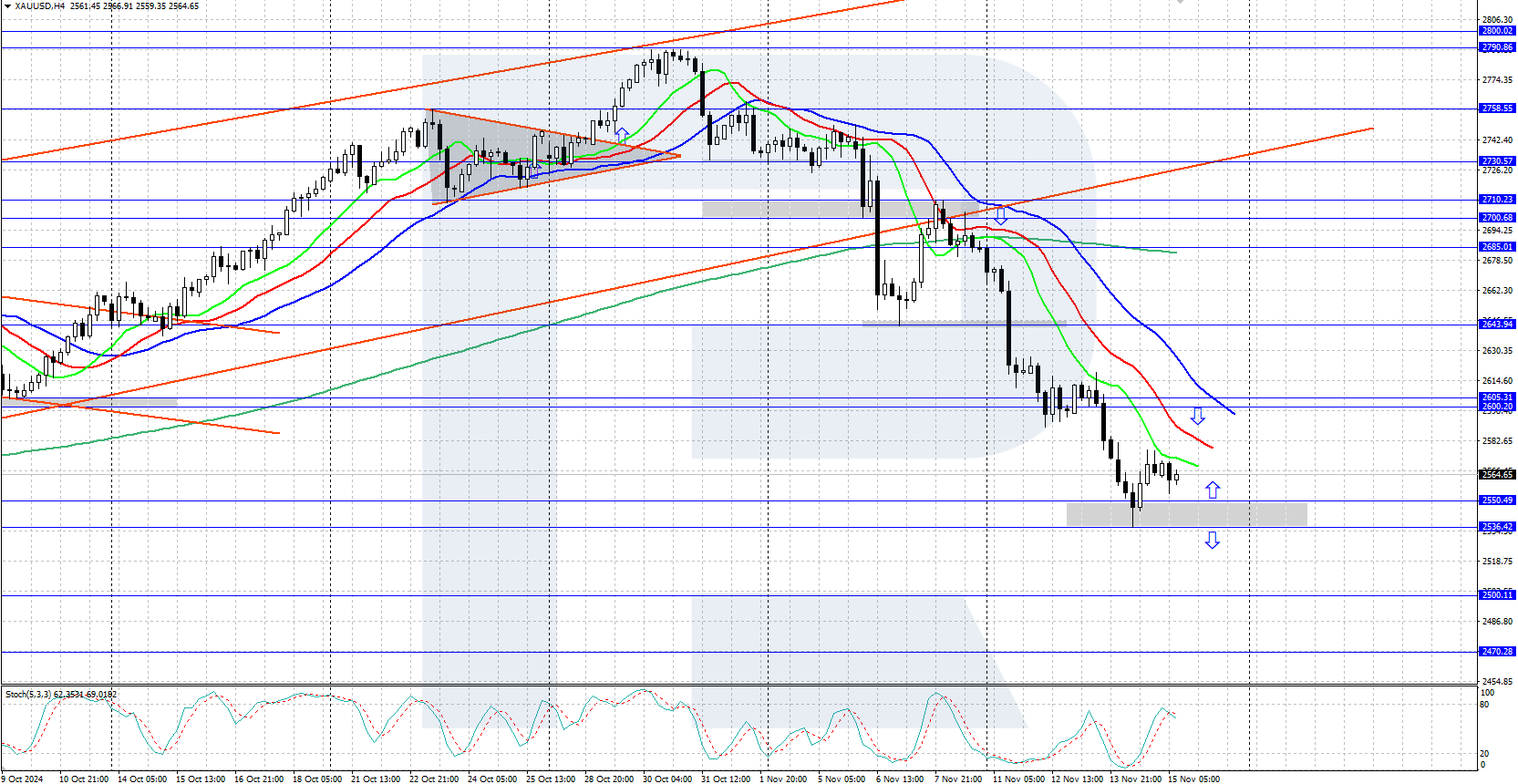

XAUUSD prices plunged to 2,536 USD within a correction amid the significant strengthening of the US dollar. The asset encountered strong demand at this level and is attempting a reversal upwards. Find out more in our XAUUSD analysis for today, 15 November 2024.

XAUUSD forecast: key trading points

- Market focus: market participants await US retail sales today

- Current trend: a downward movement is underway

- XAUUSD forecast for 15 November 2024: 2,536 and 2,600

Fundamental analysis

XAUUSD quotes are trading within a downward correction, but there are signs that the downward movement may be nearing its end, with a potential upward reversal. The Producer Price Index ( PPI) data released yesterday showed a 2.4% rise in annual US inflation, almost in line with the forecasted 2.3%.

Today, the market will focus on US retail sales data for October, which is expected to show an increase of 0.3%. Weaker-than-forecast statistics could pressure the US dollar and help strengthen XAUUSD. Conversely, more robust data would support the US dollar and lower prices.

XAUUSD technical analysis

On the H4 chart, the XAUUSD pair is in a solid downward correction following the US presidential election. Asset prices plunged to 2,536 USD yesterday, where they encountered strong demand and reversed upwards, closing above 2,560 USD. This could be a local trough, from which growth might begin as the long-term trend remains upward.

The short-term XAUUSD price forecast suggests the correction could continue towards 2,500 USD if bears push the price below 2,536 USD. Conversely, if bulls retain the initiative and continue pushing prices upwards, they could soon return to 2,600 USD.

Summary

Gold (XAUUSD) quotes tumbled to 2,536 USD yesterday, where they encountered strong demand. Today, market participants will focus on US retail sales data.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.