AUDUSD is strengthening amid the Reserve Bank of Australia’s hawkish stance

The AUDUSD rate is stabilising following a speech by the RBA’s chief. Find out more in our analysis for 5 September 2024.

AUDUSD forecast: key trading points

- The Australian dollar stabilised amid the RBA’s hawkish stance and positive foreign trade data

- Australia’s trade surplus reached a five-month high of 6.01 billion AUD

- The market expects a potential RBA interest rate cut at the end of 2024, while analysts believe the easing cycle will not start until Q2 2025

- AUDUSD forecast for 5 September 2024: 0.6650

Fundamental analysis

The AUDUSD rate has slightly risen since Reserve Bank of Australia Governor Michele Bullock’s speech. Despite inflation easing to 3.5% in July, the regulator kept the cash rate unchanged, emphasising the need to monitor economic indicators further.

Although Australia’s inflation is slowing, it is still above the 2-3% target range. The RBA plans to assess the full Q3 data, which will be released on 30 October, before making further decisions on interest rates. Markets expect a potential interest rate cut in November or December, while analysts believe the monetary policy easing cycle will not start until Q2 2025.

Australia still delivers strong foreign trade results despite some economic slowdown to 0.2% in Q2. A trade surplus reached a five-month high in July, reaching 6.01 billion AUD. Goods exports grew by 0.7% to 43.81 billion AUD, mainly due to increased supplies of fuel and lubricants. At the same time, imports decreased by 0.8% to 37.79 billion AUD. As part of today’s AUDUSD forecast, such dynamics may strengthen the AUD’s position and exert additional pressure on the RBA to maintain its current monetary policy.

AUDUSD technical analysis

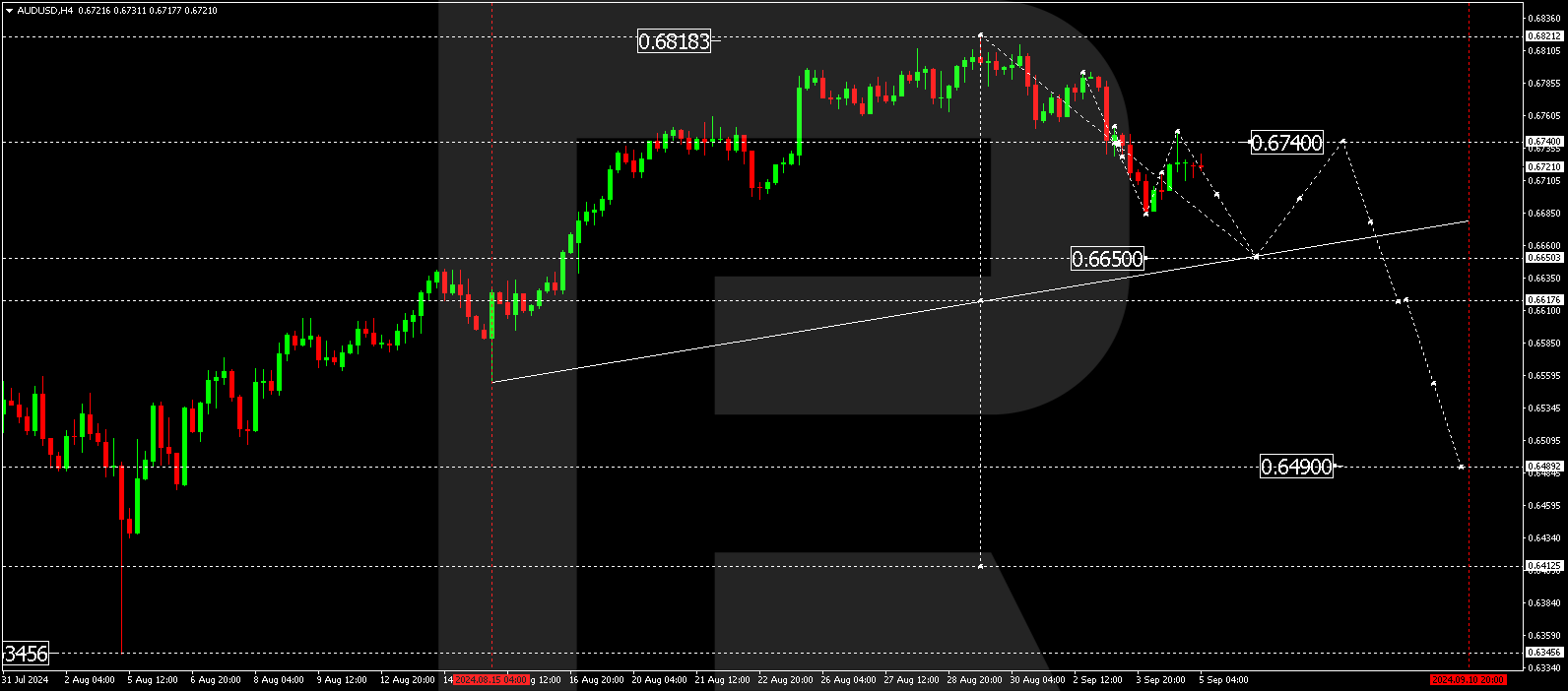

The AUDUSD H4 chart shows that the market has corrected towards 0.6740. A decline to 0.6700 is expected today, 5 September 2024. A breakout below this level may signal further movement towards the first target of 0.6650. After reaching this level, the price could correct towards 0.6740 (testing from below).

Summary

The AUDUSD rate still has the potential to strengthen thanks to stable foreign trade and the Reserve Bank of Australia’s tight monetary policy stance, even amid easing inflation. The regulator is expected to keep interest rates unchanged until the end of 2024, with the easing cycle potentially beginning only in Q2 2025. Technical indicators in today’s AUDUSD forecast suggest a potential further movement towards 0.6650.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.