AUDUSD declines further following a correction

The AUDUSD pair is falling despite improved trade balance and increased commodity price index. Find out more in our analysis dated 1 August 2024.

AUDUSD trading key points

- Australia’s balance of trade (June): previously at 5.052 billion, currently at 5.589 billion

- Australia’s commodity price index (y/y): previously at -4.1%, currently at -3.0%

- The US ISM manufacturing PMI: previously at 48.5, forecasted at 48.8

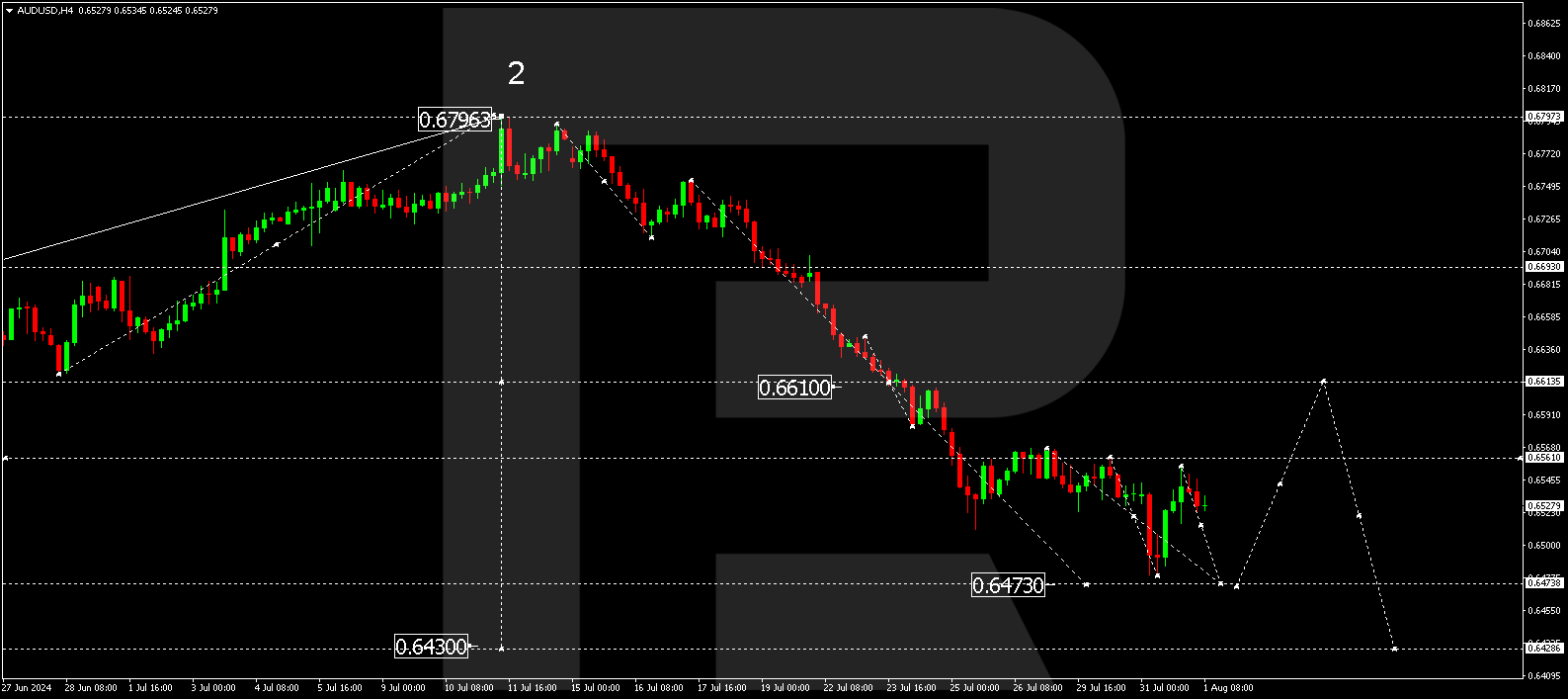

- AUDUSD forecast for 1 August 2024: 0.6473 and 0.6430

Fundamental analysis

The balance of trade reflects the difference between the monetary value of exports and imports. An increase in exports indicates economic development, while import volumes indicate domestic demand. Positive trade balance readings, above both the expected and previous values, are considered a positive factor for the national currency. Australia’s trade balance has increased to 5.589 billion, highlighting economic development and potentially positively impacting the AUDUSD rate.

The commodity price index shows changes in sales of exported goods. Rising prices increase returns on exports and impact the trade balance. Although the current reading is negative, the index has increased from its previous level, which is generally considered positive for the national currency.

The PMI shows the country’s production activity level over the previous period. A reading above 50.0 indicates economic growth, while below 50.0 signals a decline. The index is currently projected to be 0.3 points higher than the previous reading, which may theoretically be considered positive. However, as the index remains below 50.0, it shows negative results. Although today’s AUDUSD forecast based on fundamental analysis appears favourable for the Australian dollar, it does not prevent the currency pair from declining.

AUDUSD technical analysis

The H4 chart shows that the AUDUSD pair maintains its downward momentum towards the local target of 0.6473. The AUDUSD rate is expected to reach this target today, 1 August 2024. Subsequently, a correction could follow, aiming for 0.6610 (testing from below). Once this correction is complete, another decline wave could develop, targeting 0.6430.

Summary

Overall, fundamental data aligns with the AUDUSD indicator-based technical analysis, suggesting that the downtrend might continue to the 0.6473 and 0.6430 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.