RBA’s hawkish comments support AUDUSD

The AUDUSD rate is rising on Thursday morning; buyers are testing the resistance area. Find out more in our analysis dated 8 August 2024.

AUDUSD trading key points

- The Reserve Bank of Australia left the interest rate unchanged at 4.35% for the sixth consecutive time

- The Australian dollar reached a two-week high against the US dollar

- RBA Governor Michele Bullock stated a readiness to raise interest rates further to combat inflation

- The regulator dismissed the likelihood of an interest rate cut in the next six months

- AUDUSD forecast for 8 August 2024: 0.6630 and 0.6200

Fundamental analysis

The Australian dollar reached a two-week high, rising to 0.6560. Growth was driven by hawkish comments from Reserve Bank of Australia Governor Michele Bullock, who highlighted the central bank’s readiness to raise interest rates further to address inflation.

The RBA maintained the interest rate at 4.35%, noting that a tight monetary policy is necessary to bring inflation down to the 2.00-3.00% target range. The regulator’s chief also ruled out the possibility of lowering rates in the next six months, dispelling investor hopes for a relaxation of RBA monetary policy.

The AUDUSD rate was also bolstered by expectations that the Federal Reserve might more actively lower interest rates in the coming months amid signs of US economic weakness.

According to today’s AUDUSD forecast, markets remain cautious despite the RBA’s tight stance. Investors continue to weigh the possibility of a November interest rate cut, while a December rate cut is already nearly fully priced in, which might support the AUDUSD’s short-term strengthening.

AUDUSD technical analysis

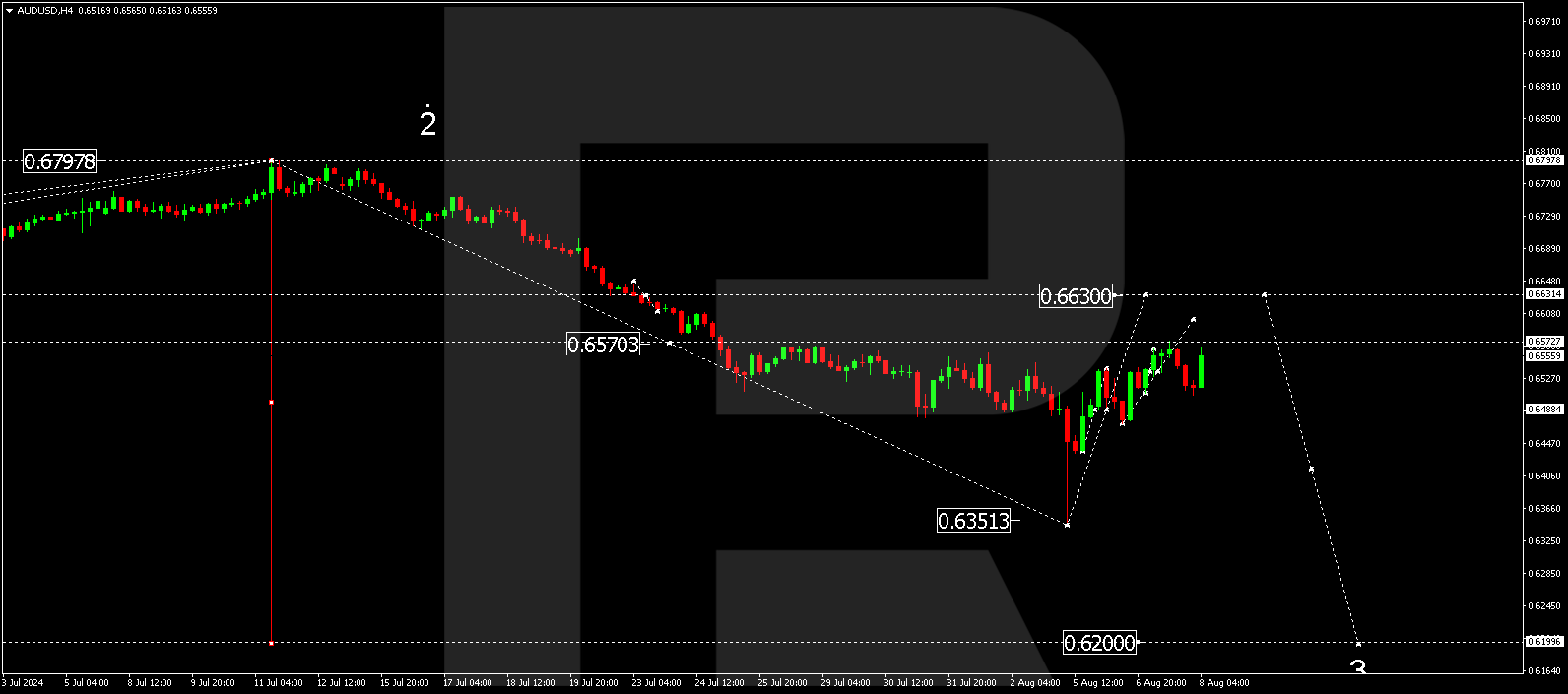

The H4 chart shows that the AUDUSD pair has completed a corrective wave, reaching 0.6572. The AUDUSD forecast for today, 8 August 2024, indicates a consolidation range forming around 0.6535, potentially extending to 0.6630. After the price reaches this level, another downward wave is expected to start, targeting the local level of 0.6200.

Summary

The Reserve Bank of Australia’s hawkish comments have propelled the AUDUSD pair to a two-week high, and market expectations of a potential interest rate cut in December could support further growth. Technical indicators suggest a possible correction in the AUDUSD rate to 0.6630 today. Subsequently, the trend is expected to extend down to 0.6200.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.