EUR is on standby, awaiting news

The leading currency pair is consolidating. Investors are conserving energy ahead of a new batch of statistics and external information.

The euro against the US dollar is stable around the 1.0738 mark on Thursday. The EURUSD pair has been rising for three consecutive days, but current market conditions have set the stage for a temporary pause.

Yesterday, no significant statistics were published due to the Juneteenth holiday in the US and a quiet day in the eurozone. However, the macroeconomic calendar is set to liven up today. Germany will present data on the Producer Price Index for May, where some improvement in numbers is expected. Subsequently, the US will release reports on the number of building permits issued in May and the number of new housing starts. Both are expected to show a slight increase.

The US will also present fresh weekly data on the number of initial unemployment claims. The figure has likely improved compared to last week’s parameters and is expected to be 235,000 compared to the previous 242,000.

Overall, the currency market looks calm. The excitement about the Federal Reserve interest rates discussion has somewhat subsided, allowing major currencies to stabilise.

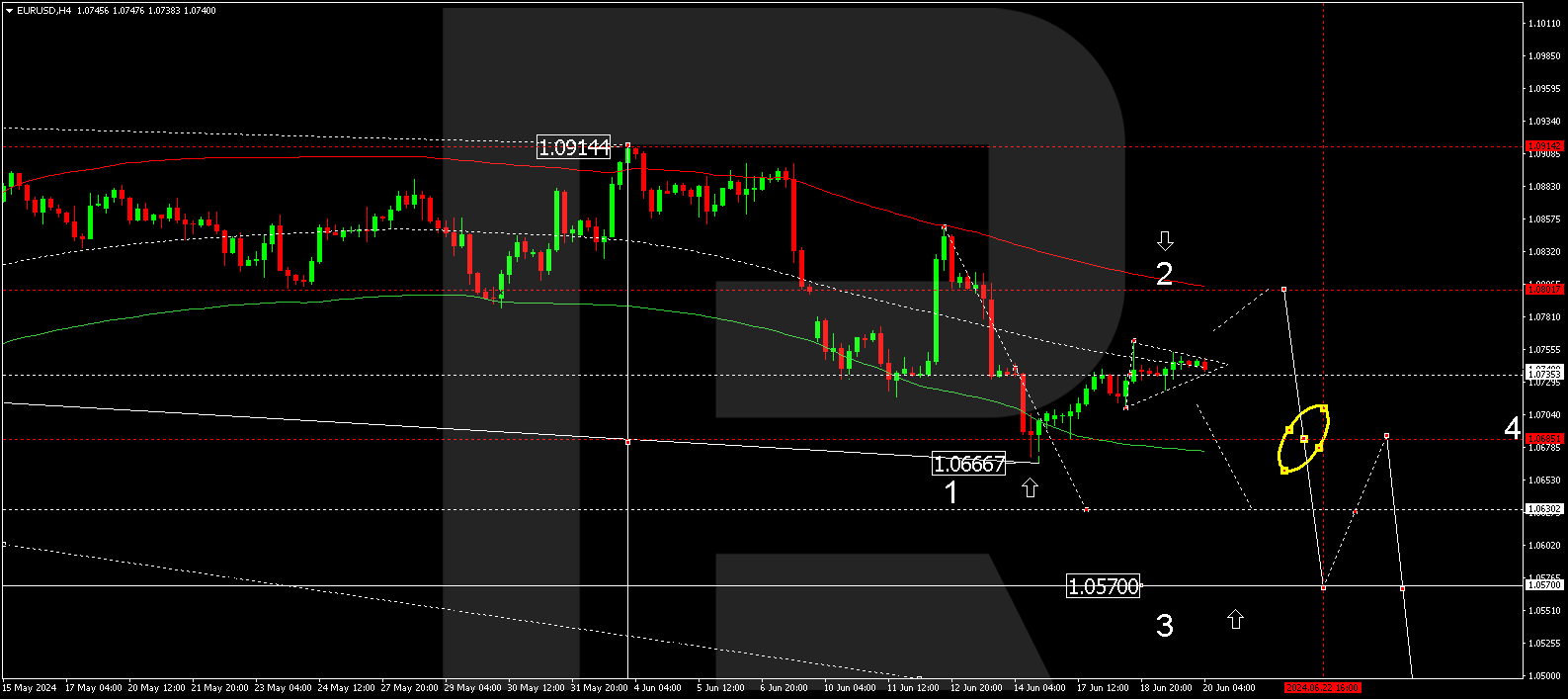

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range is forming around the 1.0735 level, a crucial development for today’s EURUSD forecast. An upward breakout of the range will open the potential for a further correction towards 1.0800. Once the correction is complete, a new decline wave might develop, aiming for 1.0680. With a downward breakout, the trend could continue towards 1.0630. If this level also breaks, this will open the potential for a decline wave towards the local target of 1.0570.

EURUSD technical analysis 20.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. This level is considered crucial for a downward wave in the EURUSD rate. The market has received support at the 1.0724 level and is attempting to secure above the Envelope’s centre. Practically, a further rise to the Envelope’s upper boundary could follow. After the price tests this boundary, a decline wave is expected to start, aiming for the Envelope’s lower boundary.

Summary

The EURUSD technical analysis points to a potential corrective wave towards 1.0800 with an onward decline to the targets of 1.0570 and 1.0450. Collectively, the news factor may contribute to this scenario.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.