GBPUSD rises amid potential easing of US monetary policy

The GBPUSD rate is slightly correcting after rising for seven consecutive trading sessions. Find out more in our analysis dated 26 August 2024.

GBPUSD forecast: key trading points

- The GBPUSD rate has reached the highest level in the past two years

- Federal Reserve Chair Jerome Powell signalled an imminent interest rate cut

- The market responded by increasing the likelihood of a 25 and even 50-basis-point Federal Reserve interest rate cut

- GBPUSD forecast for 26 August 2024: 1.3103 and 1.3010

Fundamental analysis

The GBPUSD rate hit a new two-year high on Friday after Federal Reserve Chair Jerome Powell hinted at an imminent US interest rate cut. In his speech, Powell stated that monetary policy must be adjusted to address inflationary threats and rising employment risks. He emphasised that the Fed seeks to maintain a strong employment market when inflation reaches the required target of 2%.

The market responded to these comments immediately. Traders raised the probability of a 25-basis-point Federal Reserve interest rate cut in September to 65%, with the likelihood of a more significant 50-basis-point reduction also increasing.

Chicago Fed President Austan Goolsbee also supported monetary policy easing. Investors believe the weakening of the US dollar amid rate cut expectations was the main driver of the pound sterling’s strengthening based on today’s GBPUSD forecast. Furthermore, Powell’s comments coincided with signs of a strengthening UK economy.

GBPUSD technical analysis

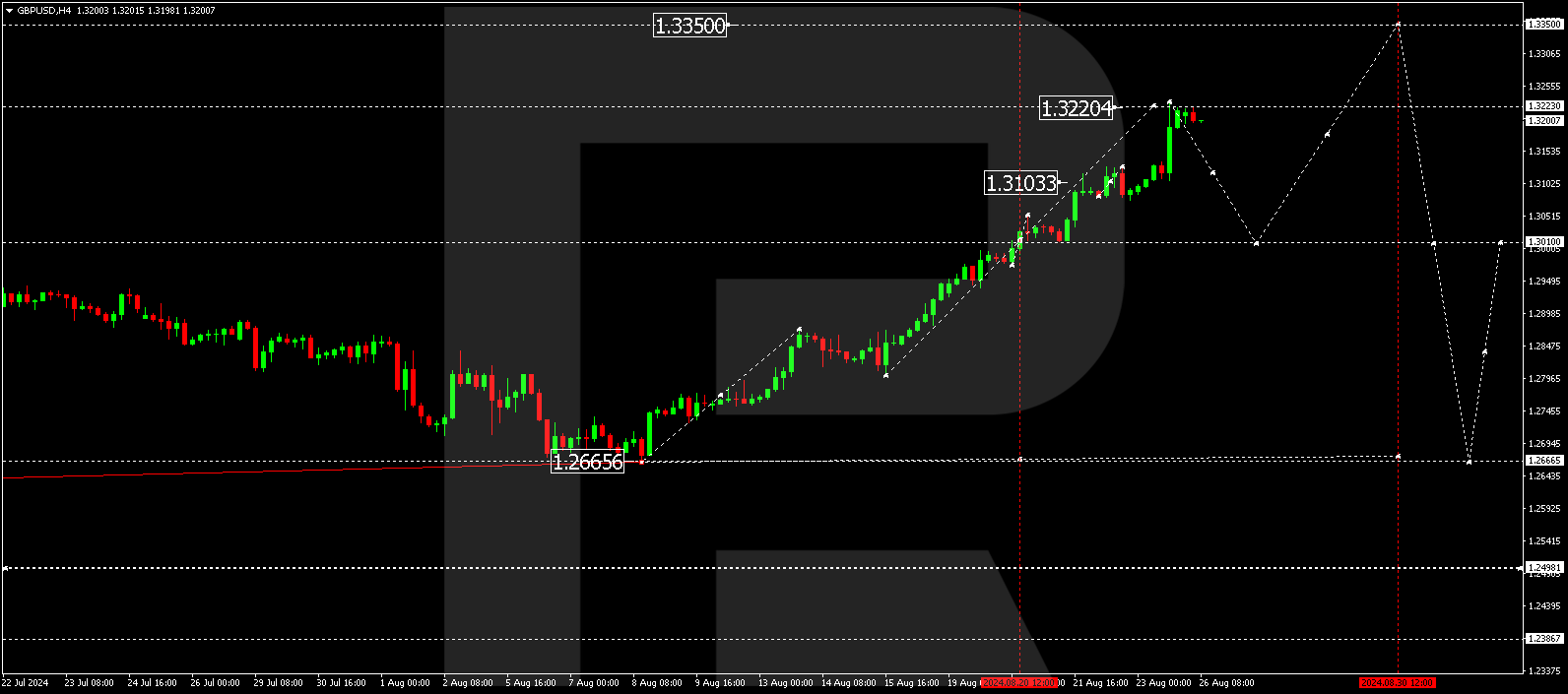

The GBPUSD H4 chart shows that the market has formed a narrow consolidation range around 1.3103 and, breaking above it, reached the growth wave’s target of 1.3220. Nearly the entire growth wave potential has been exhausted. The GBPUSD rate is expected to decline to 1.3103 today, 26 August 2024, with a potential continuation to 1.3010, the first target. After reaching this level, further movement could extend the growth wave to 1.3350. Subsequently, a downward wave could develop to 1.2666.

Summary

Powell’s comments on a US interest rate cut and signs of a recovering UK economy propelled the GBPUSD pair to a two-year high. Technical indicators in today’s GBPUSD forecast suggest a decline to the 1.3103 and 1.3010 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.