A further rise in the JP225 index is jeopardised by an increase in the number of bankruptcies

The JP225 index is experiencing a weak uptrend. The Bank of Japan’s verbal interventions continue to exert pressure on the market.

The uptrend in the JP225 index may change amid an increase in bankruptcies

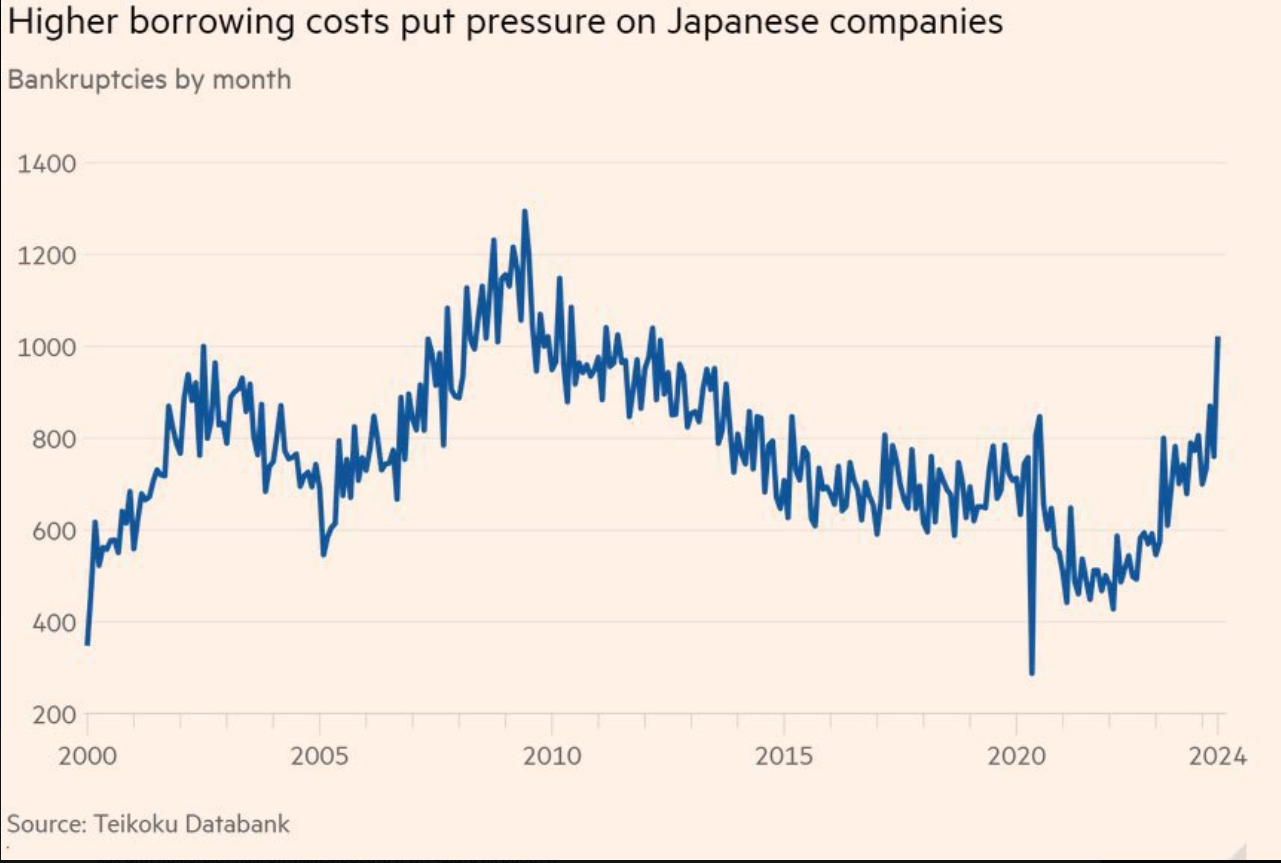

The number of corporate bankruptcies in Japan surged to the highest level since 2012 due to the yen’s devaluation and an interest rate hike by the BoJ. Small and medium-sized businesses are primarily affected as they have limited access to cheap credit resources. However, large companies are also under pressure. The Norinchukin Bank with a capital of 357.0 billion USD reported a loss of 9.5 billion USD when selling 63.0 billion USD worth of US and European assets as it could not hold these securities at the increased Bank of Japan discount rate.

Corporate bankruptcies in Japan 25.06.2024

Source: https://x.com/MacroEdgeRes/status/1804658540751331342

Bank of Japan Deputy Governor Shinichi Uchida said on Friday that the central bank would adjust the degree of monetary support if the economy and prices meet the forecasts, signalling readiness for a further interest rate hike. He also added that underlying inflation in Japan would likely accelerate gradually towards the Bank of Japan’s target of 2% as rising wages and prices increase inflation expectations.

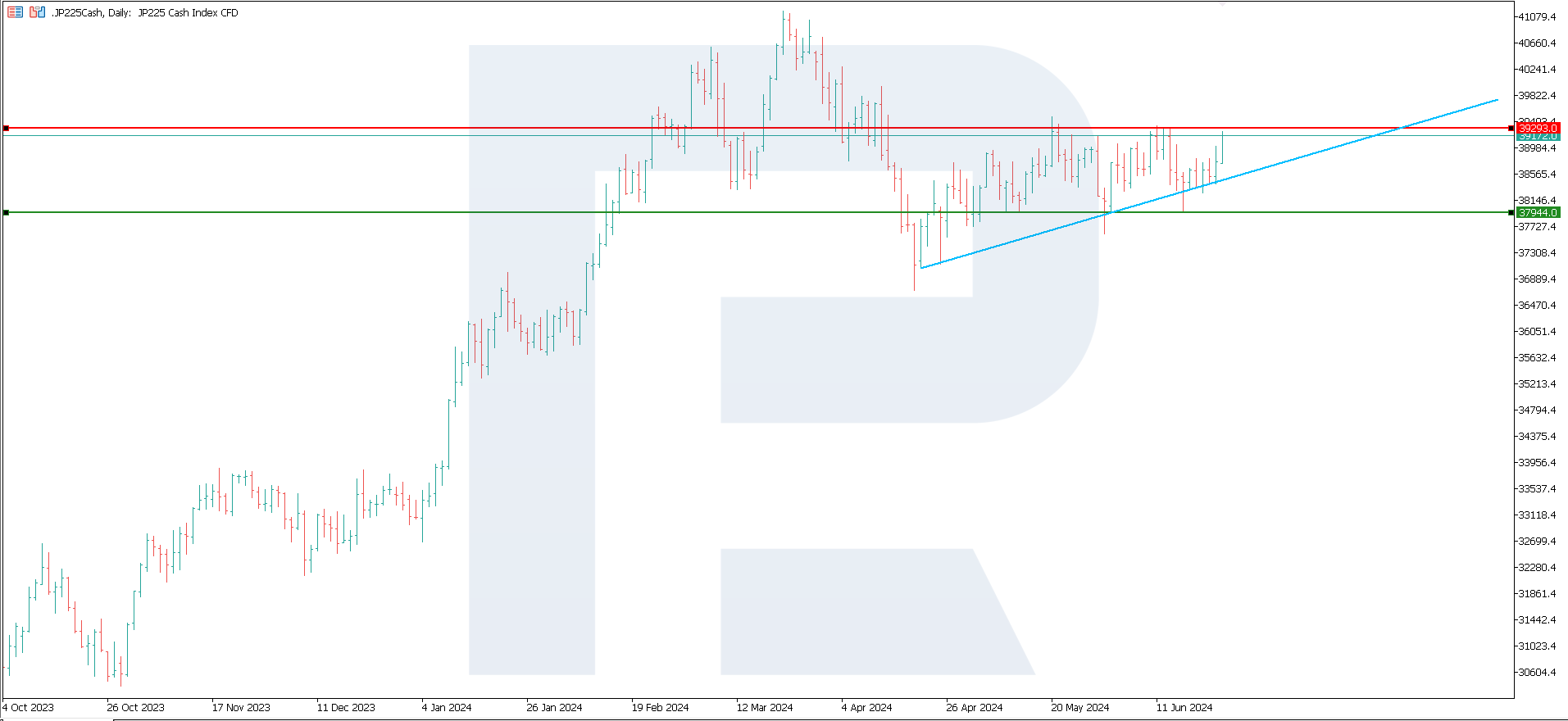

JP225 technical analysis

Although the JP225 stock index remains in a sideways channel, a weak uptrend is forming within it, aiming for a breakout of the upper boundary. Given the BoJ’s current policy, the quotes will likely remain in this range for an extended period, without exiting the channel.

The JP225 index chart (D1) 25.06.2024

A resistance level has formed at 39700.0, with support at 36700.0. This channel will likely exist for an extended period. If the resistance level breaks, the target might be the 40230.0 mark. Alternatively, the price might break below the support level in a move towards 35680.0 and reach a new all-time low.

Summary

The number of corporate bankruptcies in Japan surged to the highest level since 2012 due to the yen’s devaluation and an interest rate hike by the BoJ. Bank of Japan Deputy Governor Shinichi Uchida hinted on Friday that the regulator would further tighten monetary policy. From a technical analysis perspective, the JP225 stock index price will hover within the channel with boundaries at 39700.0 and 36700.0.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.