USDCAD declines further in anticipation of index data

A deterioration in the actual US index data may push the USDCAD pair lower. Find out more in our analysis dated 14 August 2024

USDCAD forecast: key trading points

- The Thomson Reuters/Ipsos primary consumer sentiment index in Canada (PCSI): previously at 46.97

- The US consumer price index (m/m) for July: previously at -0.1%, projected at 0.2%

- The US consumer price index (y/y) for July: both previous and projected at 3.0%

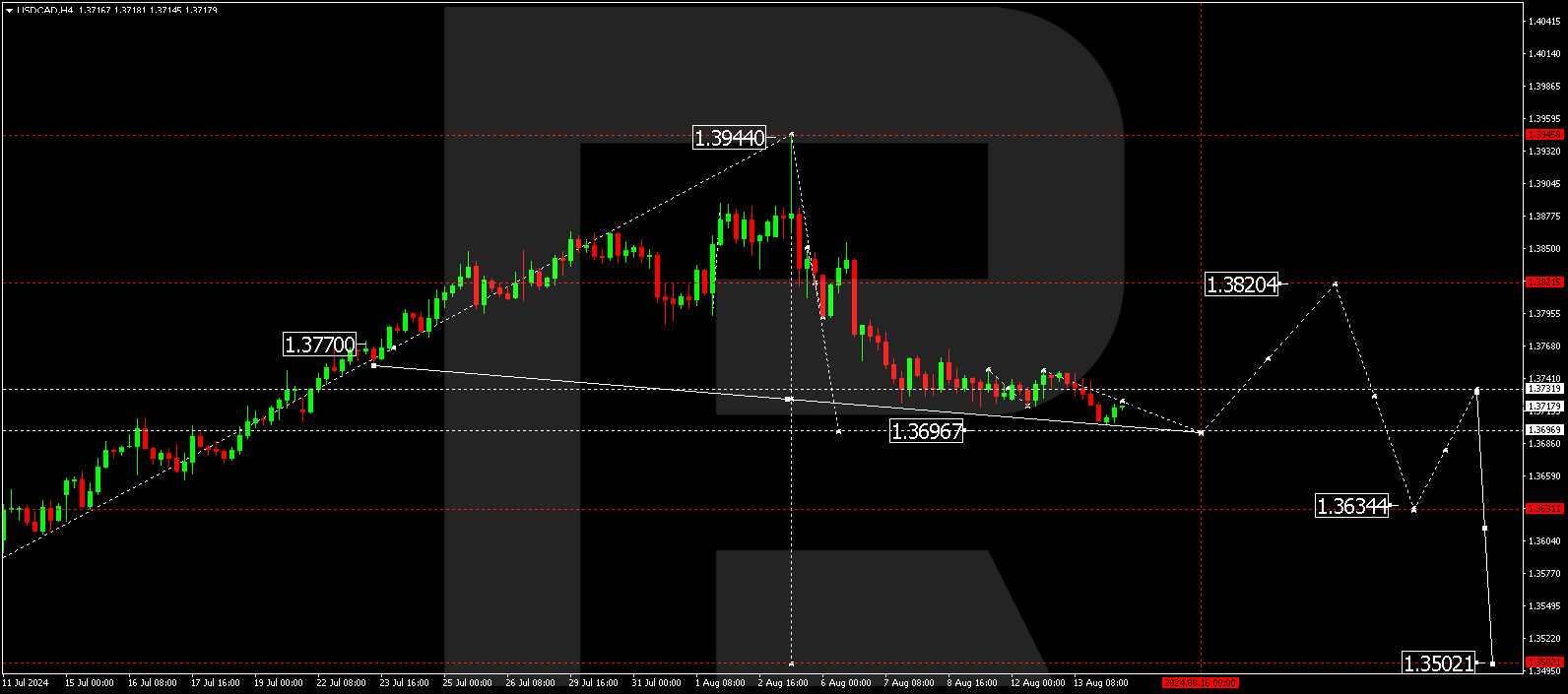

- USDCAD forecast for 14 August 2024: 1.3696, 1.3636, and 1.3500

Fundamental analysis

The Thomson Reuters/Ipsos Primary Consumer Sentiment Index measures consumer sentiment based on a target group survey. The index has gradually declined over the past three months, with the previous reading at 46.97, indicating negative consumer sentiment. Although the forecast for 14 August 2024 based on actual data may be disappointing, it will unlikely have a significant impact on the USDCAD rate.

Today’s USDCAD forecast does not favour the US dollar. The US will release a set of data, including July’s year-over-year and month-over-month consumer price indices, which may aggravate the situation.

The Consumer Price Index reflects changes in consumer goods and services prices and is a key indicator for the direction of purchases and US inflation. Readings below the forecast are considered negative for the US dollar, while those above are considered positive. The forecast suggests that the index may rise 0.2% month-over-month and remain flat at 3.0% year-over-year. Expectations that the estimates will align with actual data are so far low.

A decrease in the indicators may push the USDCAD rate further down. Actual data aligning with the forecast may also cause the US dollar to lose ground against the Canadian dollar.

USDCAD technical analysis

Analysis for 14 August 2024 shows that the USDCAD pair continues its downward momentum towards 1.3696, the first target. The price is expected to reach this target level today. Subsequently, a correction towards 1.3820 could follow. Once the correction is complete, a downward wave could develop, aiming for 1.3636 and potentially continuing towards 1.3500.

Summary

A decrease in the actual US index readings will confirm the results of the USDCAD technical analysis. Today’s USDCAD forecast suggests that a downward wave could develop towards the 1.3696, 1.3636, and 1.3500 levels, driven by the dollar’s loss of position.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.