The likelihood of a Bank of Canada interest rate cut in July decreases

The USDCAD rate remained unchanged on Wednesday, 26 June 2024, trading at 1.3660 under pressure from increased inflation in Canada.

Inflation in Canada has risen unexpectedly

The USDCAD pair plummeted on Tuesday following the release of the May consumer price index figures. The data showed an unexpected rise in inflation compared to April, lowering expectations for a further interest rate reduction by the Bank of Canada (BoC).

Annual inflation in Canada rose to 2.9% in May 2024, surpassing a three-year low of 2.7% recorded in April and falling short of market forecasts of a 2.6% decline.

According to Geoff Phipps, Picton Mahoney’s trading strategist, it is difficult to say whether the May CPI is a temporary surge or pointing to a new round of inflation. However, the decision on a further interest rate reduction at a July meeting will depend on incoming data, which will be enough by that moment.

Investors currently estimate the likelihood of an interest rate cut by the Bank of Canada at its next meeting (24 July) at 45%, while they priced in 65% before the inflation data release. This is what provides temporary support for the Canadian dollar.

USDCAD technical analysis

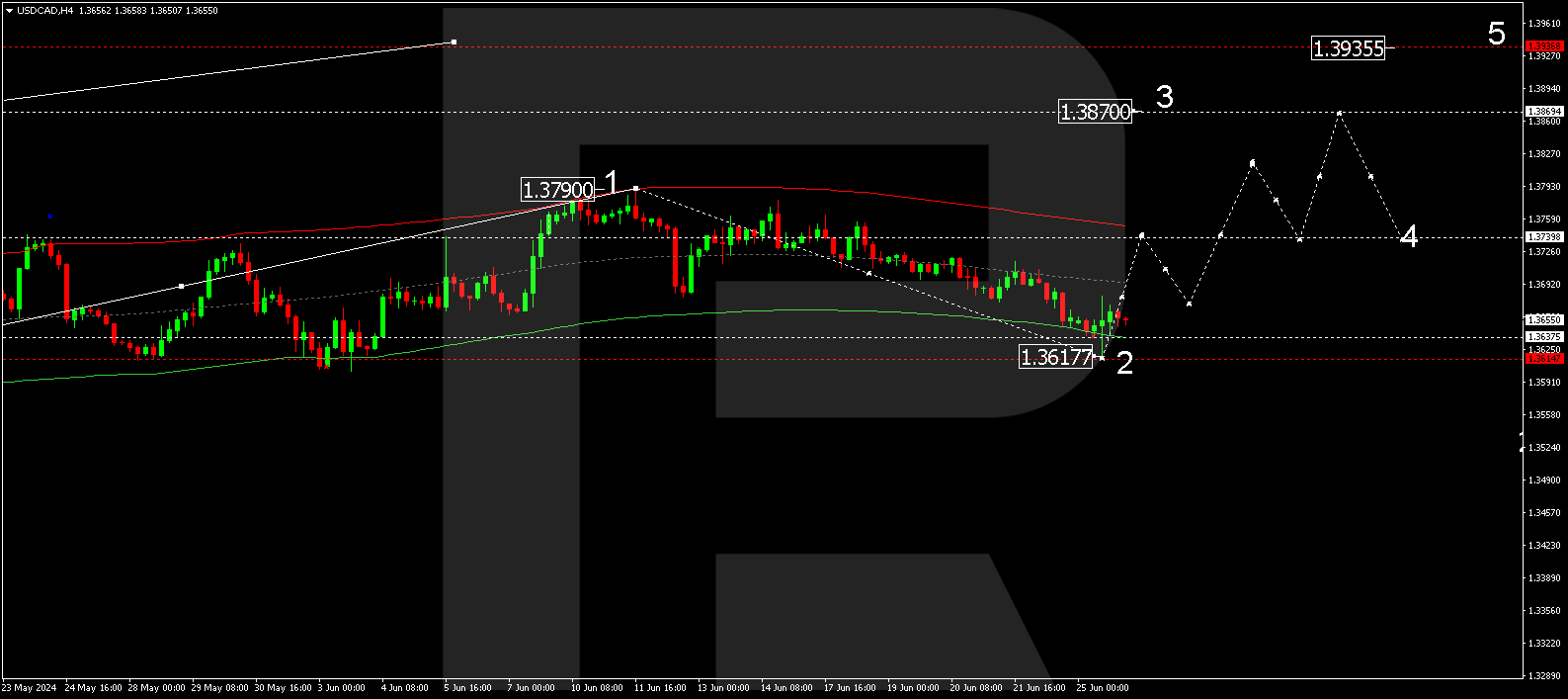

According to the analysis for 26 June 2024, USDCAD has completed a correction, reaching 1.3617. The market has experienced a growth impulse towards 1.3680 and a correction to 1.3640. Today, the USDCAD pair is expected to continue its ascent towards 1.3740, representing the first target. This level is crucial for the next growth wave. A new growth wave might start, aiming for 1.3870 as the local target.

USDCAD technical analysis 26.06.2024

The Elliott Wave structure and a wave matrix with a pivot point at 1.3740 technically confirm this USDCAD scenario. The market has received a rebound from the Envelope’s lower boundary. It is relevant today to consider the beginning of a new growth wave towards its upper boundary.

Summary

The likelihood of a Bank of Canada rate cut decreased by 20% as inflation rose unexpectedly, temporarily supporting the Canadian dollar. The USDCAD technical analysis points to the potential trend development towards 1.3740, 1.3820, and 1,3870 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.