USDCHF: the US dollar is poised to recoup losses

The Swiss franc may lose ground amid rising consumer confidence in the US. Find out more in our analysis dated 27 August 2024.

USDCHF forecast: key trading points

- The non-seasonally adjusted US composite home price index S&P/CS Composite-20, y/y: previously at 6.8%, projected at 6.2%

- The CB US consumer confidence index: previously at 100.3, projected at 100.9

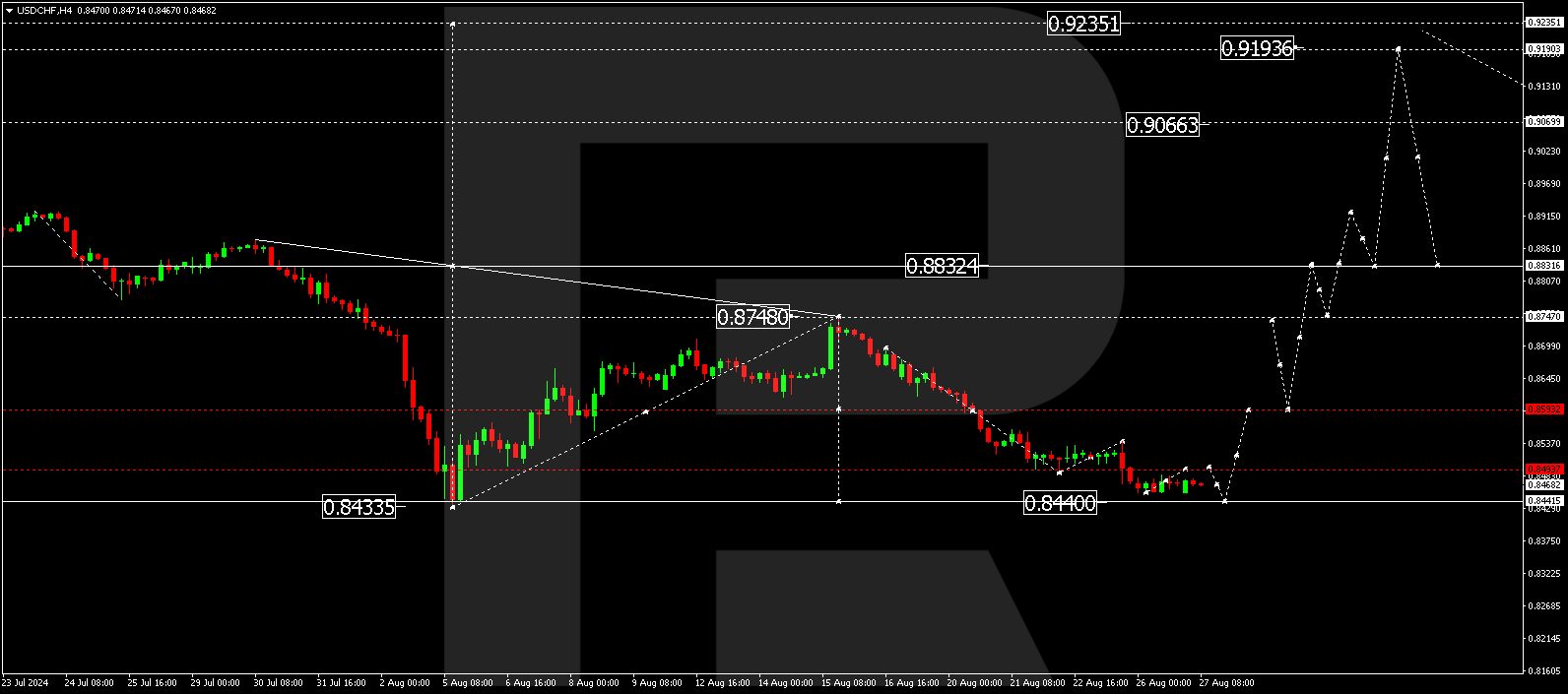

- USDCHF forecast for 27 August 2024: 0.8590 and 0.8748

Fundamental analysis

With no news expected for the Swiss franc due today, fundamental analysis will be based on US data, which may help the US dollar regain ground.

The S&P/CS Composite-20 index tracks changes in home prices across 20 major metropolitan areas in the US over the past year. This indicator provides significant insights into the real estate market's performance, allowing an assessment of the overall state of the US economy. Higher-than-forecasted figures are considered a positive factor for the US dollar. However, the expected reading of 6.2% is lower than the previous one, which may negatively impact the USD. Despite a potential 0.6% decline in the index, the market might overlook the data.

The Consumer Confidence Index measures the degree of consumer confidence in the current economic situation. This leading indicator predicts future consumer spending, a significant driver of economic activity. High index readings indicate positive sentiment and optimism among consumers. Analysis for 27 August 2024 shows that the index has risen for two consecutive months and is projected to reach 100.9 points during this reporting period. Positive consumer sentiment may favourably impact the USDCHF rate.

USDCHF technical analysis

The USDCHF H4 chart shows the market has completed a downward wave, reaching 0.8457. A consolidation range is forming above this level and could extend to 0.8440 today, 27 August 2024. With an upward breakout of the range, a growth wave could start, aiming for 0.8590. A breakout above this level would open the potential for an upward movement towards 0.8748. This could signal a potential continuation of the trend to 0.8833, the first target.

Summary

Rising consumer confidence in the US and technical analysis in today’s USDCHF forecast suggest a potential completion of the downward wave, followed by a rise to the 0.8590 and 0.8748 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.