JPY has locally risen, driven by statistics

The USDJPY pair paused its systemic growth after the release of Japanese statistics. Export data supported the yen.

The USDJPY pair halted its ascent, but only temporarily

The Japanese yen is consolidating against the US dollar. The USDJPY pair is hovering near 157.80 and appears quite confident.

On the other hand, after falling for four consecutive sessions, the yen received support from the latest Japanese statistics. Data showed that Japan’s exports in May increased more than expected amid the weak national currency and steady foreign demand.

Earlier this week, Bank of Japan Governor Kazuo Ueda informed the Japanese government of the possibility of an interest rate hike at the July meeting. Although this will typically depend on the upcoming economic data, it is promising that such a possibility exists.

Ueda noted that higher import costs from the weaker yen may impact household spending. However, wage growth has the potential to offset this factor and stimulate consumption.

Thus, there is renewed intrigue regarding the outcome of the Bank of Japan’s meeting in July.

As expected, the BoJ left the interest rate unchanged last week and should provide a plan to wind down the bond purchase program next month.

USDJPY technical analysis

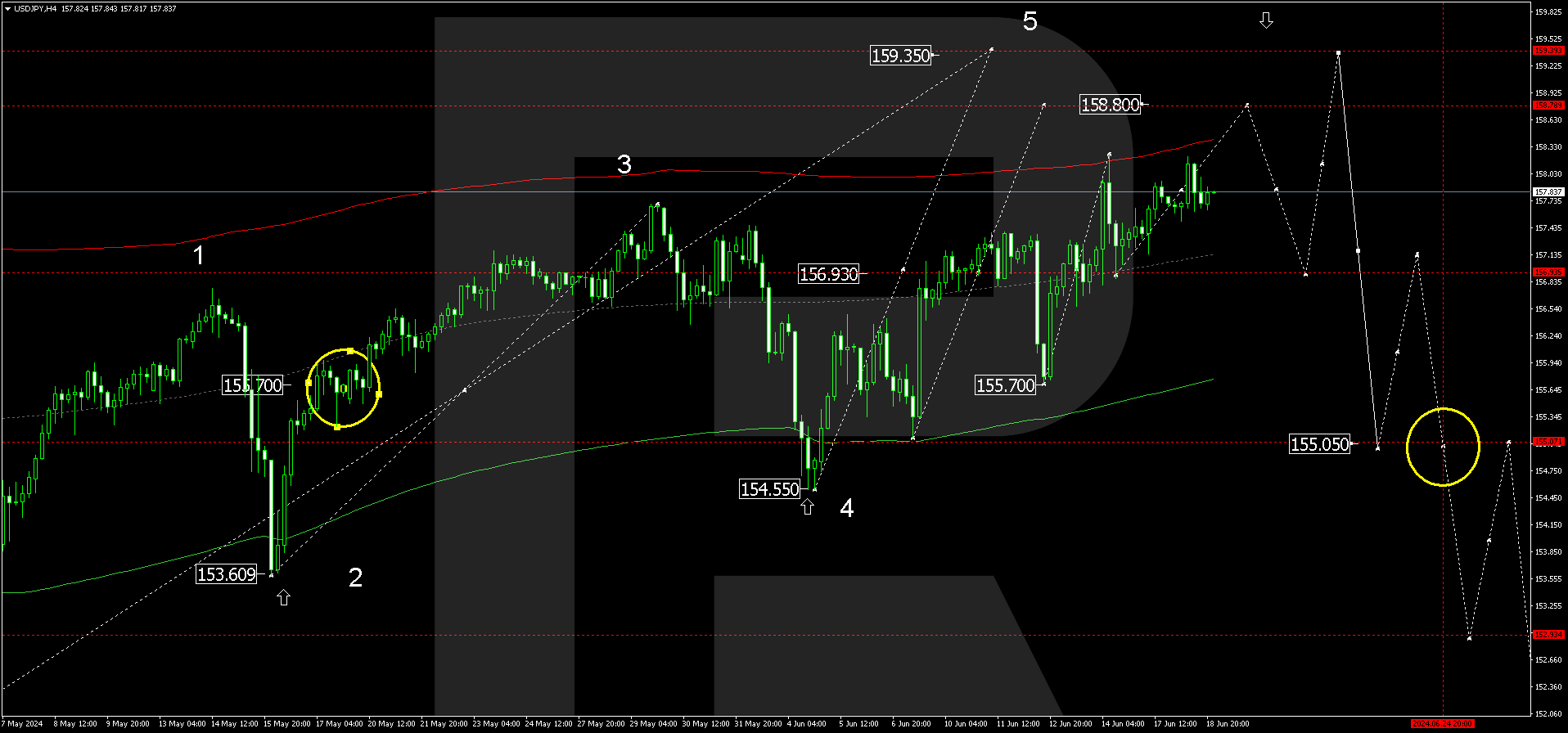

On the USDJPY H4 chart, the fifth corrective wave continues to develop, with a target at 159.35. A consolidation range has formed around 156.93, a crucial development for today’s USDJPY forecast. The range extended upwards to 157.93, and the price declined to 156.93. Today, 19 June 2024, a rise to 158.80 is expected, potentially followed by a decline to 156.93 (testing from above). Subsequently, the price might increase to 159.35. Once it reaches this level, a decline wave could begin, aiming for 155.50.

USDJPY technical analysis 19.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 155.70. The market has declined to the Envelope’s lower boundary at 154.55 and is forming a growth structure, aiming for its upper boundary. The price has touched the Envelope’s upper boundary at 158.20 and technically returned to its centre - 156.93. Today, another growth wave structure is forming, targeting 159.35.

Summary

The USDJPY technical analysis points to a potential corrective wave towards 158.80 with an onward decline to the target of 156.93 and the wave continuation towards 159.35.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.