USDJPY reaches a new low for the year: a decline is just beginning

The USDJPY pair is rapidly falling, with investors having three reasons for this. Find out more in our analysis dated 5 August 2024.

USDJPY trading key points

- The USDJPY pair has fallen to a low not seen since 3 January

- The market is concerned about a US recession

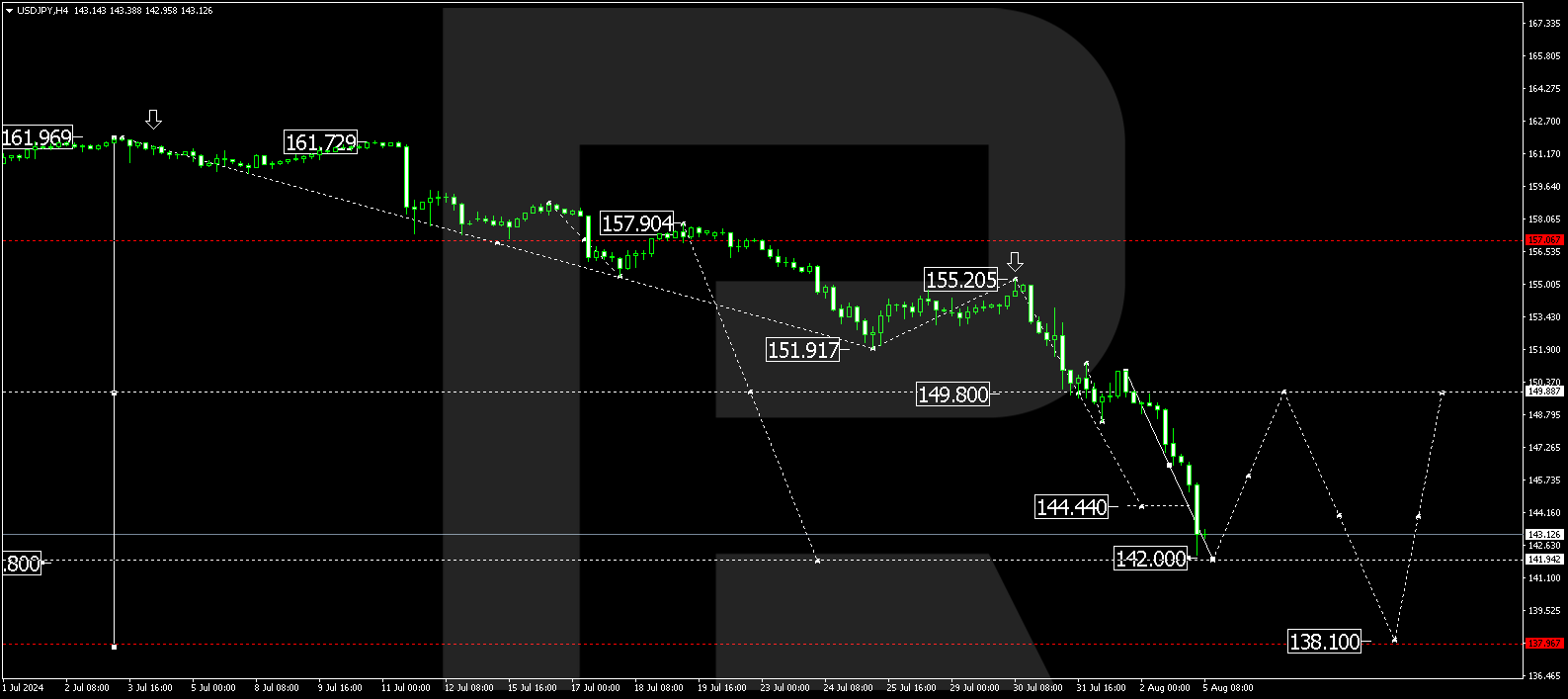

- USDJPY forecast for 5 August 2024: 138.10, 149.80, and 142.00

Fundamental analysis

The USDJPY rate is plummeting to 142.96. The market is actively engaging in sales for at least three reasons.

The first reason is the active exit of investors from carry trade operations. Market participants began to exit short positions in the yen after the Bank of Japan signalled its readiness to tighten monetary conditions.

The second reason is concerns about a US recession. Last Friday, the US released a block of weaker-than-expected employment data. Investors are worried that the Federal Reserve might be late in easing monetary conditions, potentially allowing for an economic contraction.

The third reason is the increasing appeal of the JPY as a safe-haven asset amid tensions in the Middle East and their potential global implications.

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range has formed around 149.80. Following the news, the quotes broke below this level. The USDJPY rate may decline to the local target of 142.00 today, 5 August 2024. A correction could follow after the price reaches this level, aiming for 149.80 (testing from below). Subsequently, the price might fall to 138.10, the first target.

Summary

The USDJPY pair is rapidly declining; sellers are highly active. Technical indicators for today’s USDJPY forecast suggest that the downward wave could continue to 142.00 and correct towards 149.80.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.