USDJPY declines amid weak US producer inflation data

For five consecutive trading sessions, the USDJPY rate has been constrained within a sideways range. Find out more in our analysis dated 14 August 2024.

USDJPY forecast: key trading points

- The US Producer Price Index (PPI) increased by just 0.1% in July, falling short of forecasts

- Weak producer inflation data has reinforced expectations for an aggressive Federal Reserve interest rate cut

- A Reuters poll indicated a decrease in the sentiment index among Japanese manufacturers due to reduced demand from China

- USDJPY forecast for 14 August 2024: 145.80, 145.60, and 145.00

Fundamental analysis

The USDJPY quotes declined after rebounding from weekly highs. Weaker-than-expected US producer inflation data drove the fall. The release increased the likelihood of aggressive Federal Reserve interest rate cuts, contributing to strengthening the Japanese yen.

The US Producer Price Index (PPI) rose by only 0.1% in July, below economists’ forecasts. This data has bolstered expectations that upcoming consumer inflation figures will also show a slowdown in price growth. As part of today’s USDJPY forecast, such expectations may contribute to the pair’s decline.

Meanwhile, investors have analysed the results of the recent Reuters poll conducted in Japan. The survey revealed a deterioration in business sentiment among Japanese manufacturers in August due to reduced demand from China. The sentiment index for manufacturers fell to 10 points, signalling concerns about growth prospects.

Traders are also assessing potential BoJ actions amid recent financial market volatility. Statements from a former central bank official suggesting that the regulator cannot raise interest rates this year due to market shocks have reinforced expectations that the BoJ will maintain its soft monetary policy.

USDJPY technical analysis

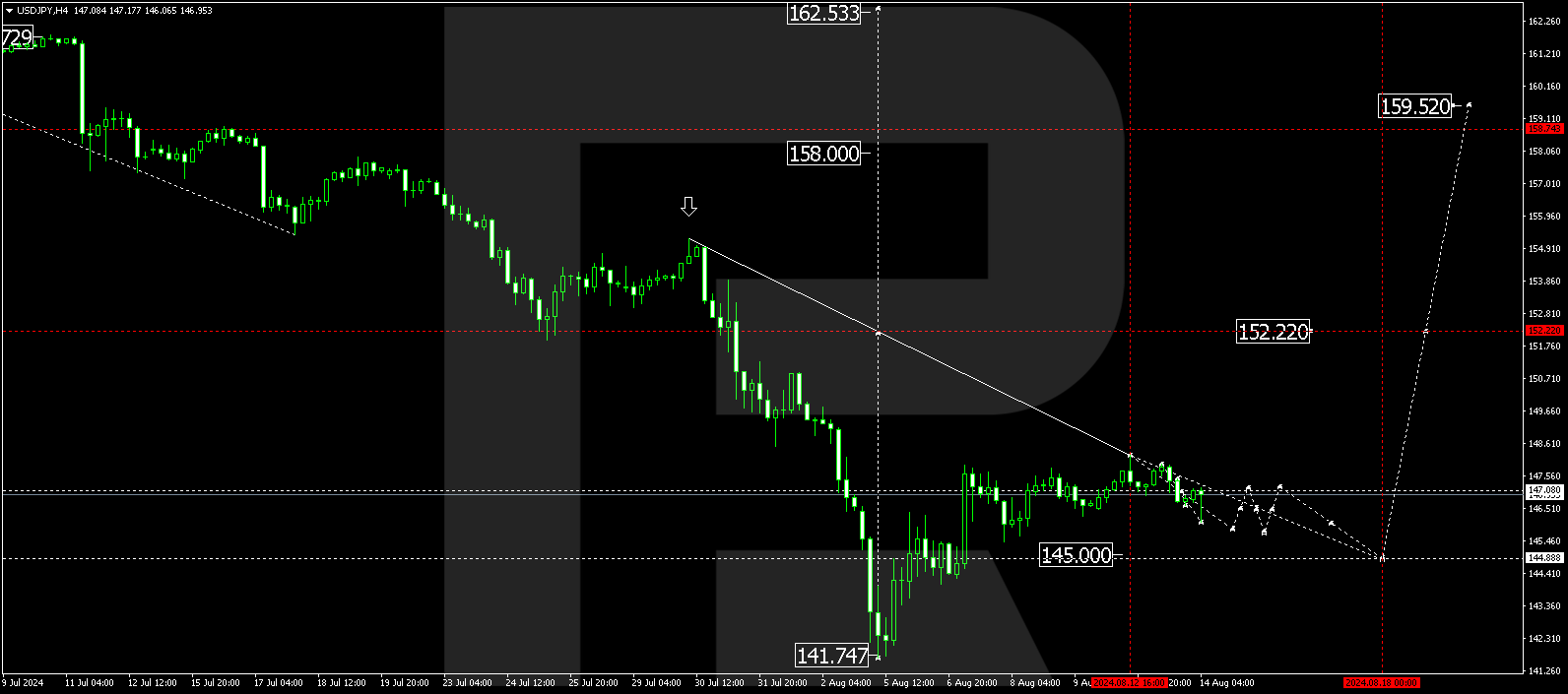

The USDJPY H4 chart shows the market is forming a consolidation range around 147.80. A correction towards 145.00 is expected today, 14 August 2024. Once the correction is complete, a new growth wave might develop, aiming for 150.00. If the price breaks above this level, it is expected to maintain its upward trajectory towards 152.22, potentially continuing the trend to 159.50, the local estimated target.

Summary

Weak US producer inflation data increased the likelihood of a Federal Reserve interest rate cut, which might pressure the USDJPY rate. Technical indicators in today’s USDJPY forecast suggest a correction towards the 145.80, 145.60, and 145.00 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.