USDJPY declines ahead of key economic data

The USDJPY rate is undergoing a slight correction for the second consecutive trading session. Find out more in our analysis dated 27 August 2024.

USDJPY forecast: key trading points

- BoJ Governor Kazuo Ueda hints at possible monetary policy revision

- Federal Reserve Chair Jerome Powell emphasises the need to adjust monetary policy due to employment market risks

- Investors believe the Federal Reserve may lower interest rates more significantly

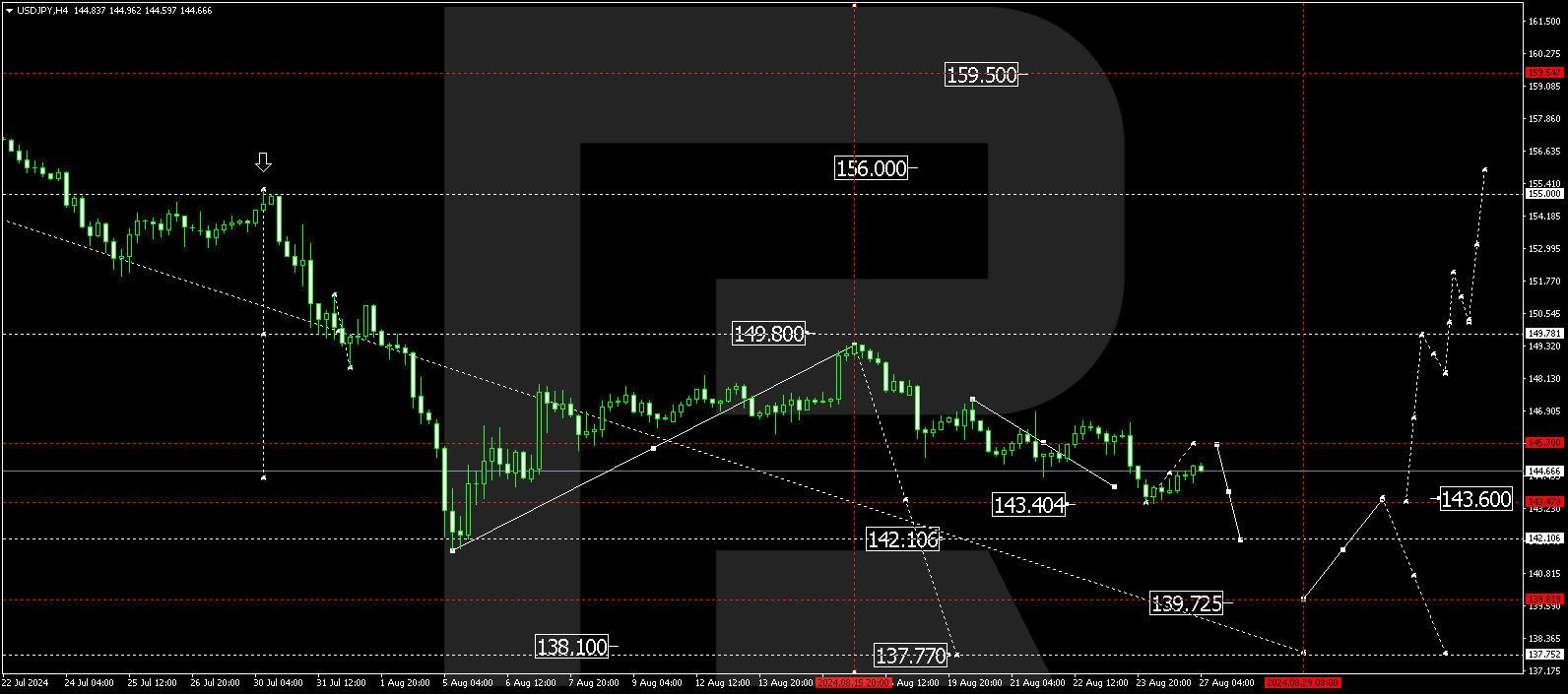

- USDJPY forecast for 27 August 2024: 142.10, 139.72, and 137.77

Fundamental analysis

The USDJPY rate has rebounded from the support level but remains in a downward momentum. Analysts note that the market may have paused in anticipation of the release of crucial economic data, including retail sales and the unemployment rate in Japan.

Last week, BoJ Governor Kazuo Ueda said that monetary policy could be revised if economic forecasts are accurate. This would signal the regulator’s readiness to hike interest rates again. The statement supported the yen, driving it to a three-week high.

Meanwhile, the Federal Reserve chair stressed the need to adjust monetary policy amid rising risks to the employment market, expressing confidence that inflation will return to the central bank’s target.

The question is not whether the Fed will lower interest rates in September but how significant this cut will be. Powell clarified that larger cuts are possible if employment market conditions deteriorate. Investors believe the regulator may reduce rates more significantly than expected, and according to today’s USDJPY forecast, this could exert pressure on the US dollar.

USDJPY technical analysis

The USDJPY H4 chart shows that the market maintains its upward trajectory to 145.70 (testing from below). A consolidation range has formed around 145.70. The USDJPY rate is expected to fall to 142.10 today, 27 August 2024. A breakout below this level may signal that the wave could continue to 139.72, potentially extending to 137.77, the main downtrend target for the USDJPY rate.

Summary

The USDJPY rate remains under pressure in anticipation of crucial economic data from Japan, which could further strengthen the yen. Technical indicators in today’s USDJPY forecast suggest a potential decline to the 142.10, 139.72, and 137.77 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.