USDJPY falls to a seven-week low

The USDJPY pair continues to decline. The market believes the Bank of Japan will raise interest rates next week.

USDJPY trading key points

- JPY is rising amid expectations of an interest rate hike

- The Bank of Japan may raise the borrowing cost as early as next week

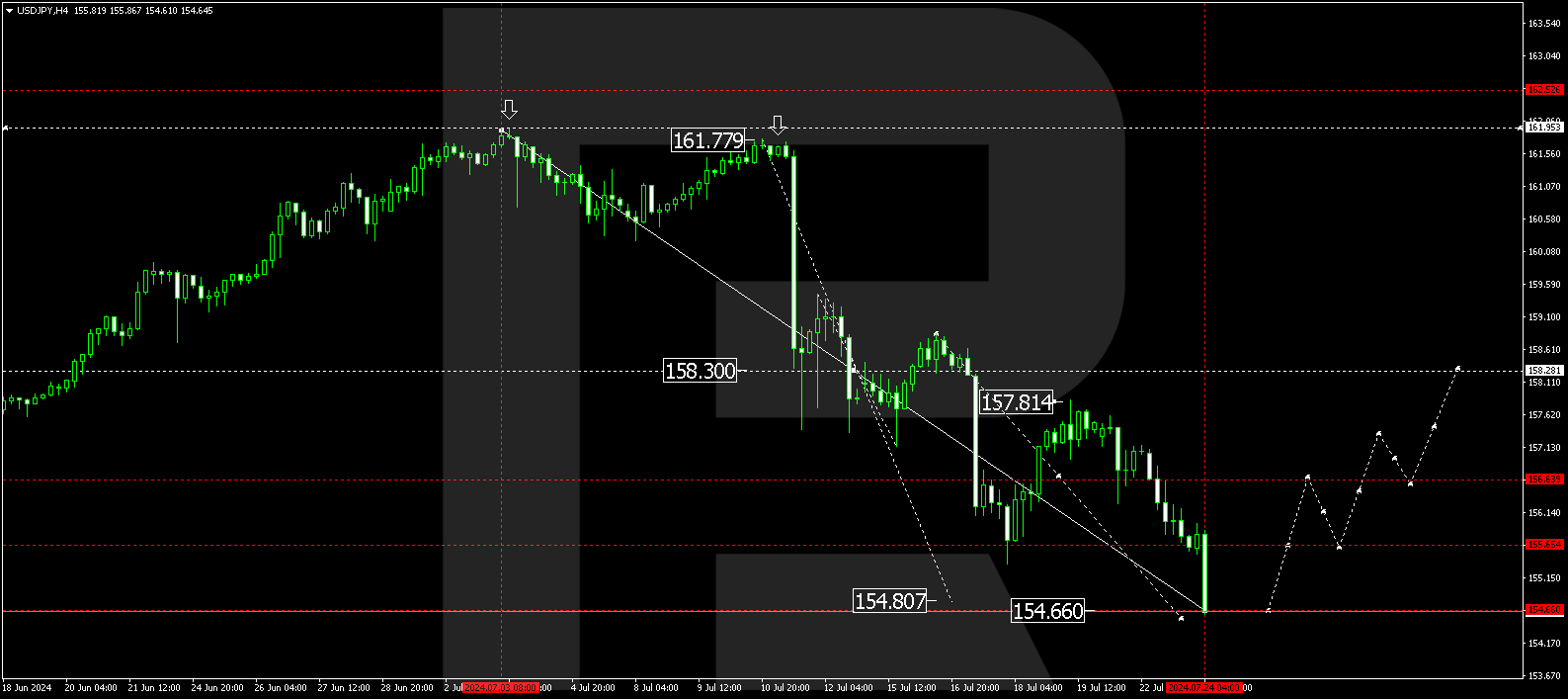

- USDJPY forecast for 24 July 2024: 156.60, 157.33, and 158.28

Fundamental analysis

The Japanese yen is steadily strengthening against the US dollar. The USDJPY pair fell to 154.50 on Wednesday.

Based on statements from monetary policymakers, investors believe the Bank of Japan will decide to tighten monetary policy at its meeting at the end of the month. This will prompt market participants to exit short positions, among other things.

Yesterday, a high-ranking official, Toshimitsu Motegi, called for the Bank of Japan to formulate a more precise plan for monetary policy normalisation by resolutely raising interest rates. He believes a sharp JPY depreciation negatively impacts the country’s economy.

According to Japan’s Prime Minister Fumio Kishida, normalising monetary conditions may support Japan’s economy as it transitions towards growth.

The market estimates the likelihood of a BoJ interest rate hike next week at 44%.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a decline wave, reaching 154.35. A consolidation range is expected to form above this level today, 24 July 2024. With an upward breakout, the USDJPY rate could rise to 156.60, representing the first target. A growth wave starts developing to 158.28.

Summary

Despite the USDJPY pair continuing to fall, technical indicators for today’s USDJPY forecast suggest a growth wave to the 156.60, 157.33, and 158.28 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.