USDJPY plummets: the market had been anticipating the BoJ’s decision

The USDJPY pair is falling rapidly. The Bank of Japan has done its utmost to support the yen. Find out more in our analysis dated 31 July 2024.

USDJPY trading key points

- The Bank of Japan raised the interest rate to 0.25%

- The USDJPY rate is declining rapidly

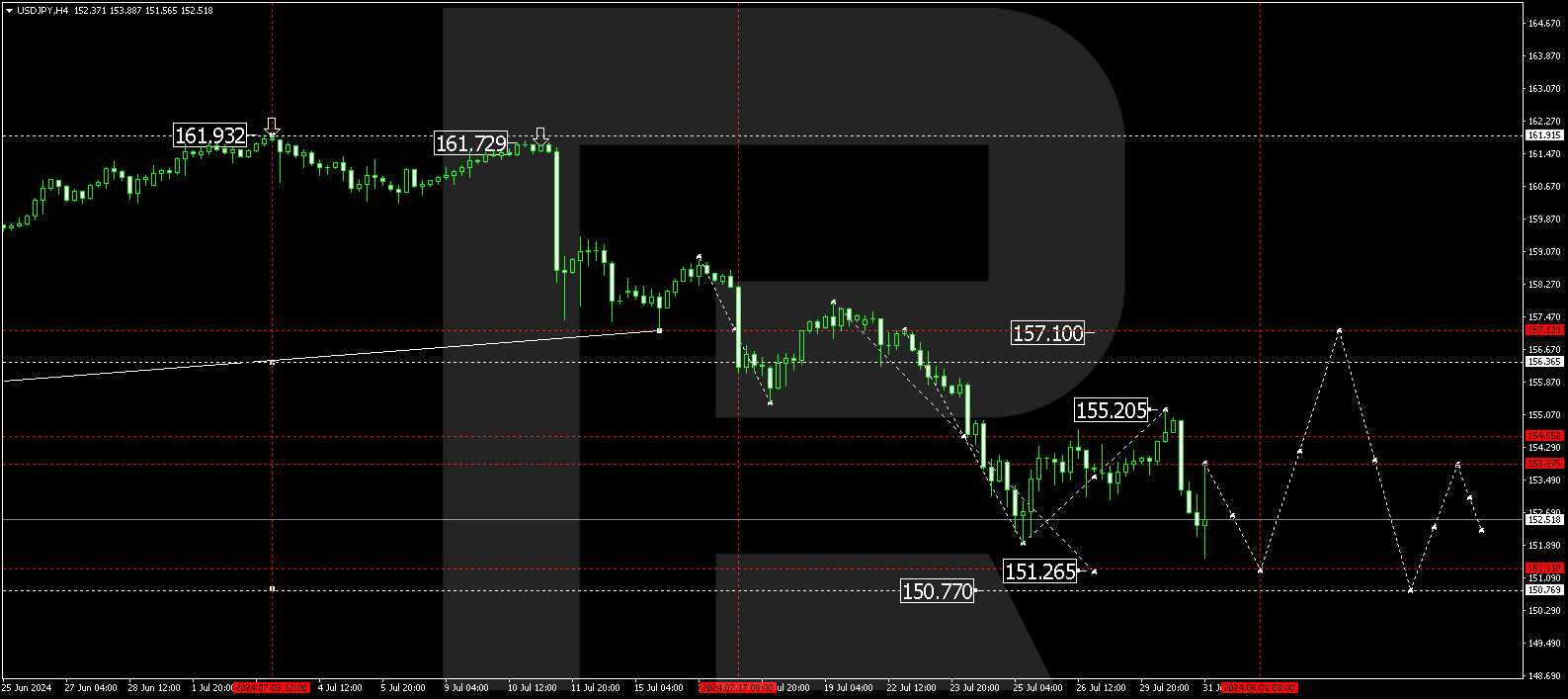

- USDJPY forecast for 31 July 2024: 151.26 and 150.77

Fundamental analysis

The Japanese yen maintains its upward trajectory, which began a little earlier. The market had anticipated the outcome of the Bank of Japan’s meeting. The USDJPY rate is declining.

Japan’s interest rate increased by 25 basis points to 0.25% per annum, up from 0%. Additionally, the BoJ announced plans to reduce bond purchases in the second half of the year. This was the most anticipated outcome of the meeting.

In its comments, the Bank of Japan noted that inflation risks for this year and the next have increased. Consumption in the economy is considered stable despite rising prices, and wage growth is accelerating. This is a significant achievement for the Bank of Japan, as wages have been relatively stagnant for a long time.

Japan’s GDP is expected to increase by 0.6% in 2024, with the economy expanding by 1.0% in 2025. Core inflation is projected to be 2.5% in 2024 and 2.1% in 2025.

USDJPY technical analysis

On the USDJPY H4 chart, a consolidation range is forming around 153.87. The price rose to 155.20 before declining to 151.91. Today, 31 July 2024, the price broke below the consolidation range, opening the potential for a decline wave towards 151.26, potentially extending to 150.77. After reaching this level, the USDJPY rate could rebound to 157.10, which would be considered a correction of the previous decline. Subsequently, the USDJPY rate is expected to fall to 146.56.

Summary

The USDJPY rate quickly reacts to the Bank of Japan’s decision. Technical indicators for today’s USDJPY forecast suggest a decline towards the 151.26 and 150.77 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.