Gold failed to gain a foothold at highs

Gold failed to remain at the area of 2368 and started to correct amid stronger-than-expected US data.

Gold is experiencing another downward correction but growth prospects persist

June’s S&P Global PMI data released on Friday was better than forecasted, with the manufacturing purchasing managers’ index coming in at 51.7 (forecast of 51.0) and the services purchasing managers’ index at 55.1 (forecast of 53.7).

Gold responded to the released US data by declining against the US dollar and returning to the area below 2340 USD per troy ounce. Nevertheless, global fundamental factors such as geopolitical tensions and expectations of an upcoming interest rate cut from the Federal Reserve continue to support gold prices in the long run.

XAUUSD technical analysis

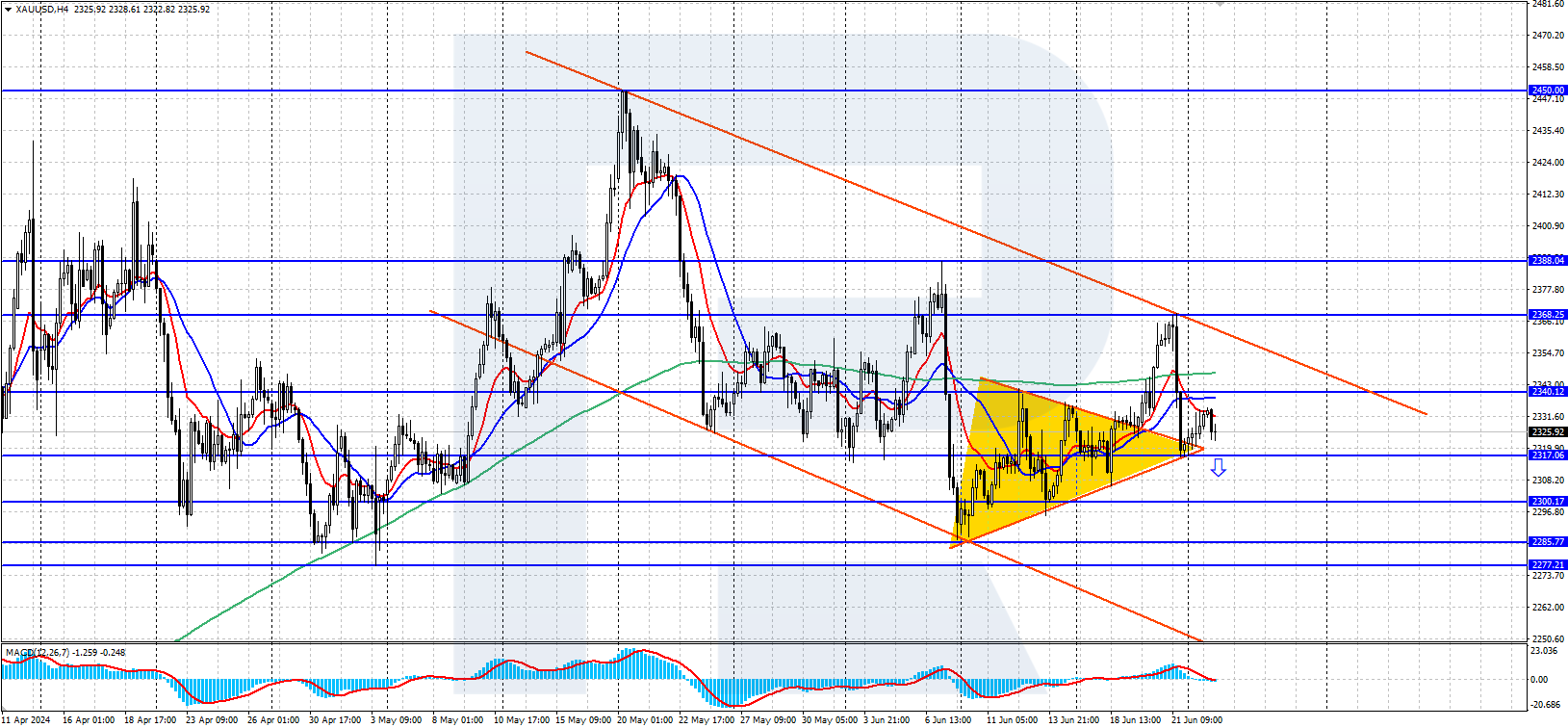

On the XAUUSD H4 chart, after reaching a local high of 2368, Gold quotes are experiencing another downward correction, forming a new upper boundary of the descending price channel. The price is currently hovering near the 2325 mark, retracing to the boundaries of the previously formed Triangle pattern.

XAUUSD technical analysis 25.06.2024

The forecast suggests the correction may continue as the descending H4 channel remains in force. The 2317 level serves as the nearest local support. A breakout of this level will open the potential for a movement to 2300. The downward scenario could be invalidated by a price rise above the daily resistance level of 2368.

Summary

Gold continues to trade within a downward correction after rebounding from the 2368 resistance level. The precious metal came under pressure from stronger-than-expected US PMI data. Fundamentally, Gold has good reasons to resume growth following the current correction.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.