EURUSD: the euro attempts to regain ground on US Labor Day

The eurozone’s PMI and the US holiday may not weaken the US dollar. Find out more in our analysis dated 2 September 2024.

EURUSD forecast: key trading points

- Today is US Labor Day

- The eurozone’s manufacturing PMI for August: previously at 45.6, projected at 45.6

- EURUSD forecast for 2 September 2024: 1.1005 and 1.1096

Fundamental analysis

Today is a holiday in the US due to Labor Day, which may give the euro a chance to strengthen against the US dollar, as many US traders are unlikely to participate in trading.

The PMI index evaluates the activity of purchasing managers in the industrial sector. This index reflects the state of the industry and the dynamics of industrial processes in the eurozone. Traders closely follow this data as purchasing managers are the first to receive information about their companies’ operations, making the PMI a crucial measure of the general economic situation. Readings above 50.0 points indicate industrial growth, while values below 50.0 points suggest a downturn.

Analysis for 2 September 2024 shows that the PMI index may remain flat at 45.6, indicating some stability in the industrial sector. However, as it is still below 50.0 points, it is unlikely to impact the EURUSD rate positively.

Investors await a decision on the Federal Reserve interest rates, due on 18 September 2024. US inflation data remains stable; analysts suggest a 50-basis-point change is unlikely at this stage.

EURUSD technical analysis

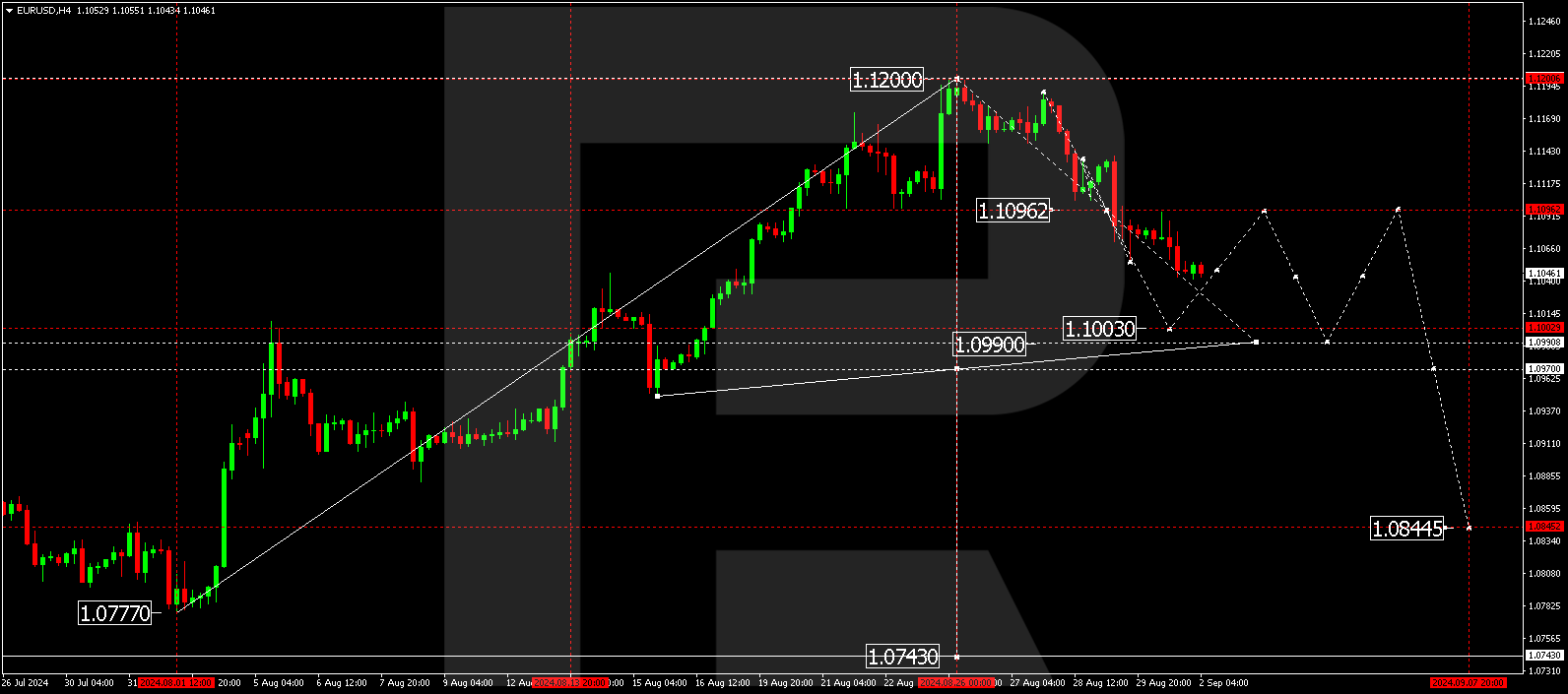

On the EURUSD H4 chart, the market has completed a downward wave, reaching 1.1050. A consolidation range is forming around this level, with the price expected to break below this range and extend the downward wave towards 1.1005 today, 2 September 2024. A breakout below the 1.1040 level may signal a continuation of the trend towards 1.1005, the local estimated target. Once the EURUSD rate reaches this level, a correction could follow, targeting 1.1096 (testing from below). Subsequently, another downward wave might start, aiming for 1.0990 as the first target.

Summary

Despite the US holiday and a stable forecast for the eurozone’s PMI, the EURUSD technical analysis in today’s EURUSD forecast suggests a potential decline to 1.1005, followed by a correction towards 1.1096.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.