EURUSD: the US dollar awaits the Fed interest rate decision

The Federal Reserve interest rate decision dominates the news. Find out more in our analysis for 18 September 2024.

EURUSD forecast: key trading points

- The eurozone’s Consumer Price Index (CPI) in August (y/y): previously at 2.6%, projected at 2.2%

- The US Federal Reserve interest rate decision: previously at 5.50%, projected at 5.25%

- US Federal Reserve FOMC press conference

- EURUSD forecast for 18 September 2024: 1.1100 and 1.1026

Fundamental analysis

The Consumer Price Index reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A weaker-than-forecasted reading typically has a negative effect on the national currency. The forecast for 18 September 2024 suggests a 0.4% decline in the CPI to 2.2%, indicating a reduction in the volume of purchases by end consumers.

The US Federal Reserve will announce its interest rate decision today. Market participants disagree on the exact rate value, which heats up the situation. According to forecasts, the interest rate may be lowered by 0.25%. However, a 0.5% rate cut should not be ruled out. The release of the interest rate decision is a serious challenge for investors, with the market likely to see increased volatility and unpredictable movements in the EURUSD rate.

Following the announcement of the Federal Reserve rate decision, the FOMC will hold a press conference, where it will likely explain the reason for the interest rate change. Fundamental analysis for 18 September 2024 shows that the market will experience increased volatility, with a trend reversal in the EURUSD pair being possible.

EURUSD technical analysis

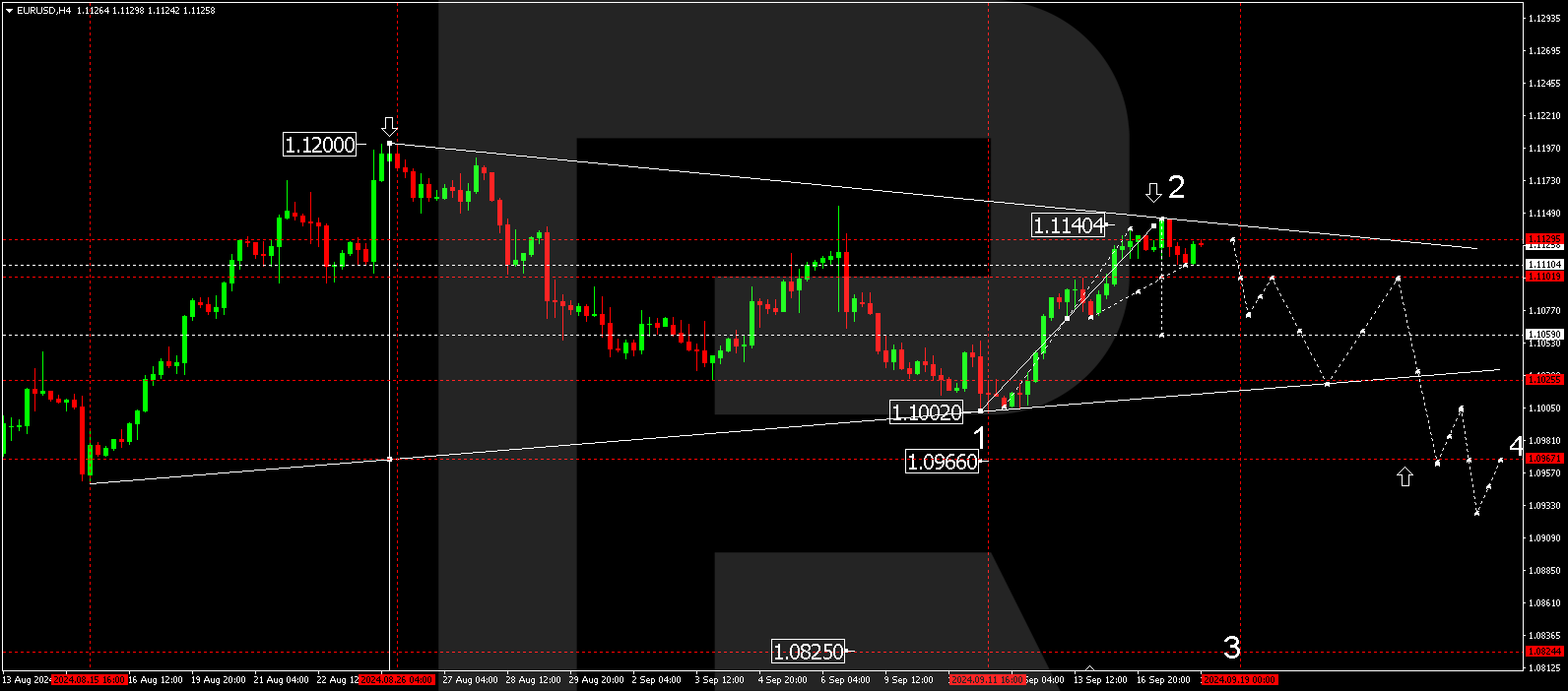

The EURUSD H4 chart shows that the market has declined to 1.1110 and corrected towards 1.1129. A new downward wave could develop today, 18 September 2024, aiming for 1.1100. It will be relevant to consider a possible breakout below this level. This will open the potential for a downward wave towards the lower boundary of the triangle pattern at 1.1026. After reaching this level, the price is expected to rise to 1.1100. Alternatively, given the fundamental background, the EURUSD rate could break above the current highs and rise to 1.1155 for a short period. Subsequently, a downward wave could start, aiming for 1.1000.

Summary

Following the Federal Reserve interest rate change, the market situation may be at odds with the EURUSD technical analysis for today’s EURUSD forecast, which suggests a potential downward movement towards the 1.1100 and 1.1026 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.