EURUSD falls ahead of a historic ECB rate cut

The EURUSD rate has been declining for the fourth consecutive trading session. Find out more in our analysis for 17 October 2024.

EURUSD forecast: key trading points

- Traders expect dovish comments from the ECB, which may increase pressure on the euro

- The average 30-year mortgage rate in the US rose to 6.52%

- Mortgage applications in the US fell by 17%

- EURUSD forecast for 17 October 2024: 1.0820 and 1.0777

Fundamental analysis

The EURUSD rate is approaching the next crucial support level at 1.0775. Today, traders expect the ECB to decide on two consecutive interest rate cuts for the first time in 13 years. Analysts note that the current cut has most probably been factored into the pair’s price, so the main focus will be on the regulator’s press conference, where its monetary policy outlook will be presented. Forecasts suggest dovish comments from the ECB, which may exert additional pressure on the euro as part of today’s EURUSD forecast.

Meanwhile, the average 30-year mortgage rate in the US rose by 16 basis points over the week ending 11 October, reaching 6.52%. This increase was driven by unexpectedly high inflation data and strong labour market indicators, which may prompt the Federal Reserve to lower interest rates more cautiously and gradually.

In addition, mortgage applications in the US fell sharply by 17% over the past week, marking a record decline since the COVID-19 pandemic. Applications for home purchases sank by 7%, while mortgage refinance requests plummeted by 26%.

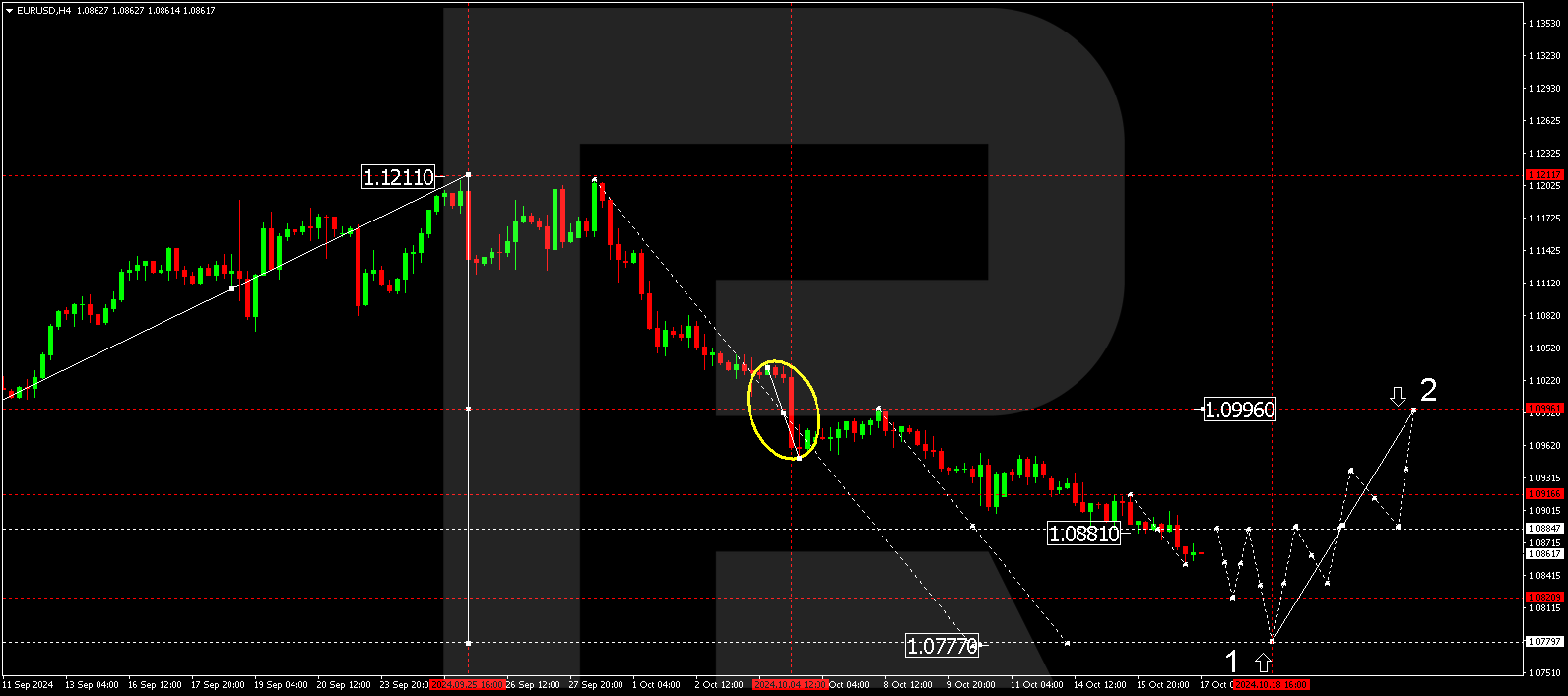

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a downward wave towards 1.0852, extending the boundaries of a consolidation range around 1.0881. The price could rise to 1.0881 (testing from below) today, 17 October 2024. After hitting this level, the EURUSD rate is expected to decline to 1.0820. A breakout below this level will open the potential for continuing the trend towards 1.0777, the first target. Subsequently, a correction could begin, aiming for 1.0966.

Summary

The ECB will likely ease its monetary policy, putting more pressure on the euro. At the same time, increasing mortgage rates and decreasing loan applications in the US may slow the pace of Federal Reserve key rate cuts, potentially sending the EURUSD rate even lower. Technical indicators in today’s EURUSD forecast suggest a potential fall to the 1.0820 and 1.0777 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.