EURUSD: the resilience of the US economy supports the US dollar

The EURUSD rate declines after rebounding from the 1.0870 resistance level. Find out more in our analysis for 21 October 2024.

EURUSD forecast: key trading points

- The US dollar has strengthened for the third consecutive week amid expectations of a softer Federal Reserve rate cut

- Markets estimate the likelihood of a 25-basis-point Fed rate cut in November at 90.9%

- This week, investors are focusing on corporate reports and risks related to the US election

- EURUSD forecast for 21 October 2024: 1.0820 and 1.077

Fundamental analysis

The EURUSD rate is undergoing a correction after Friday’s rise, remaining below the EMA-200 level, indicating persistent pressure from sellers. The US dollar has strengthened for three consecutive weeks amid expectations of a softer Fed rate-cutting cycle and higher chances of Donald Trump’s victory in the upcoming elections.

Analysts note that the current US interest rate helps strengthen the US currency. At the same time, rate cuts in other countries only add to the USD’s appeal. Experts believe this trend may persist until the election, and if Donald Trump wins, it will likely continue. The markets currently estimate the likelihood of a 25-basis-point Federal Reserve rate cut in November at 90.9%.

Investors are now awaiting the release of data on new home sales and durable goods orders in the US. The markets will primarily focus on corporate reports and risks related to the upcoming election. Retail sales data and the previously released robust statistics on the labour market and inflation show that consumer spending is stable. This reflects the resilience of the US economy, which is still far from a recession. According to today’s EURUSD forecast, this may support the US dollar.

EURUSD technical analysis

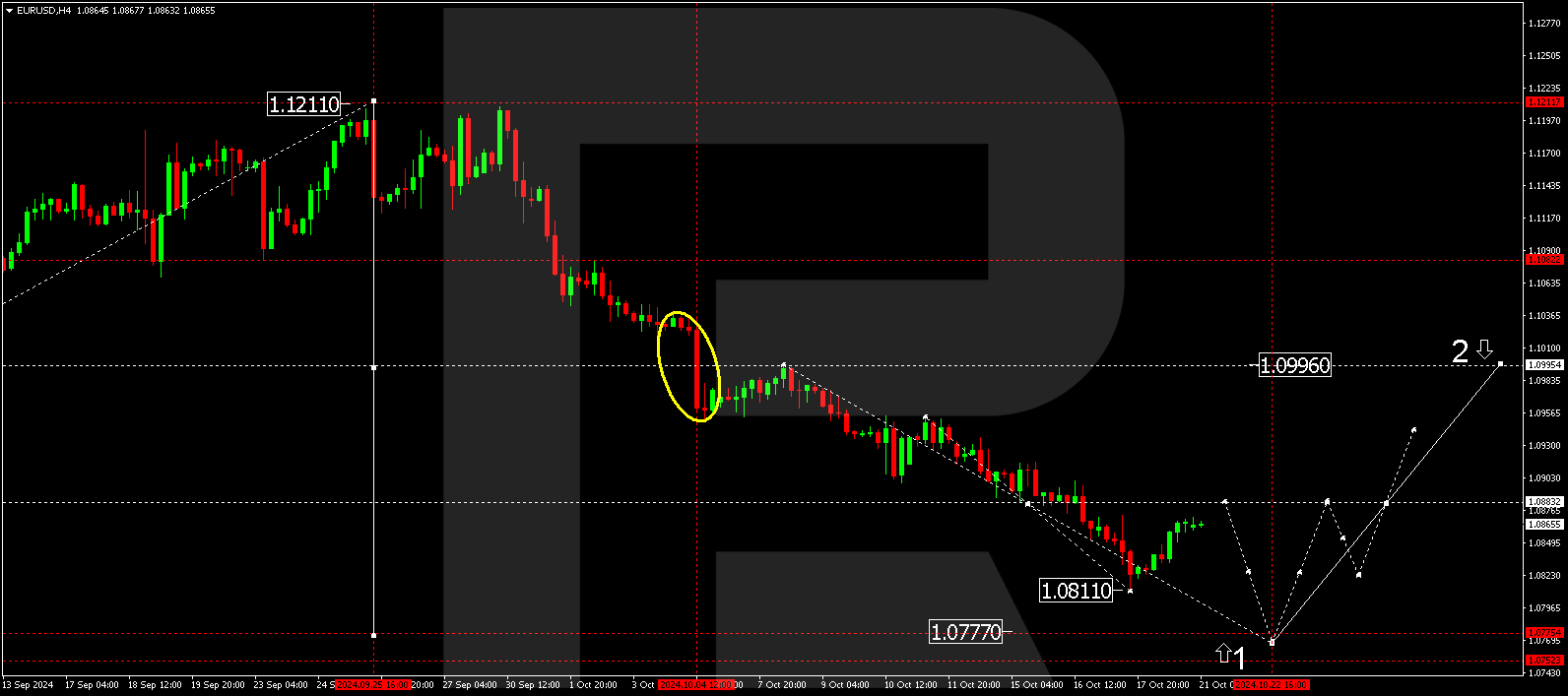

The EURUSD H4 chart shows that the market has completed a corrective wave, reaching 1.0871. Another rise to 1.0883 (testing from below) is possible as part of the correction. After reaching this level, the price is expected to decline to 1.0820, potentially continuing the trend to 1.0777, the first target. Subsequently, a more substantial correction could start to form, aiming for 1.0996, with the first target for this correction at 1.0888.

Summary

The EURUSD rate remains under bearish pressure due to the strengthening US dollar amid expectations of a softer Federal Reserve rate cut. The resilience of the US economy, supported by retail sales and labour market data, also helps support the US dollar in the short term. Technical indicators in today’s EURUSD forecast suggest the correction may be complete, with a new downward wave likely beginning towards the 1.0820 and 1.0777 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.