EURUSD halted its decline: correction is complete; the market awaits news

The EURUSD pair has halted its decline. The market is awaiting greater clarity on Trump’s policy. Find out more in our analysis for 21 November 2024.

EURUSD forecast: key trading points

- The EURUSD pair is no longer in a downward trend

- The market is analysing what to expect from the new US White House administration

- EURUSD forecast for 21 November 2024: 1.0464

Fundamental analysis

The EURUSD rate is consolidating around 1.0552 on Thursday, following yesterday’s decline.

Investors are exercising caution as they await further data on the future actions of US President-elect Donald Trump. Additionally, forecasts of a less aggressive Federal Reserve interest rate cut have already been priced into the primary currency pair.

The market needs to interpret what exactly Trump’s campaign promises mean not only for the US but also for the rest of the world.

The US dollar has strengthened by over 2% since the US presidential election.

The EURUSD forecast for today remains neutral.

EURUSD technical analysis

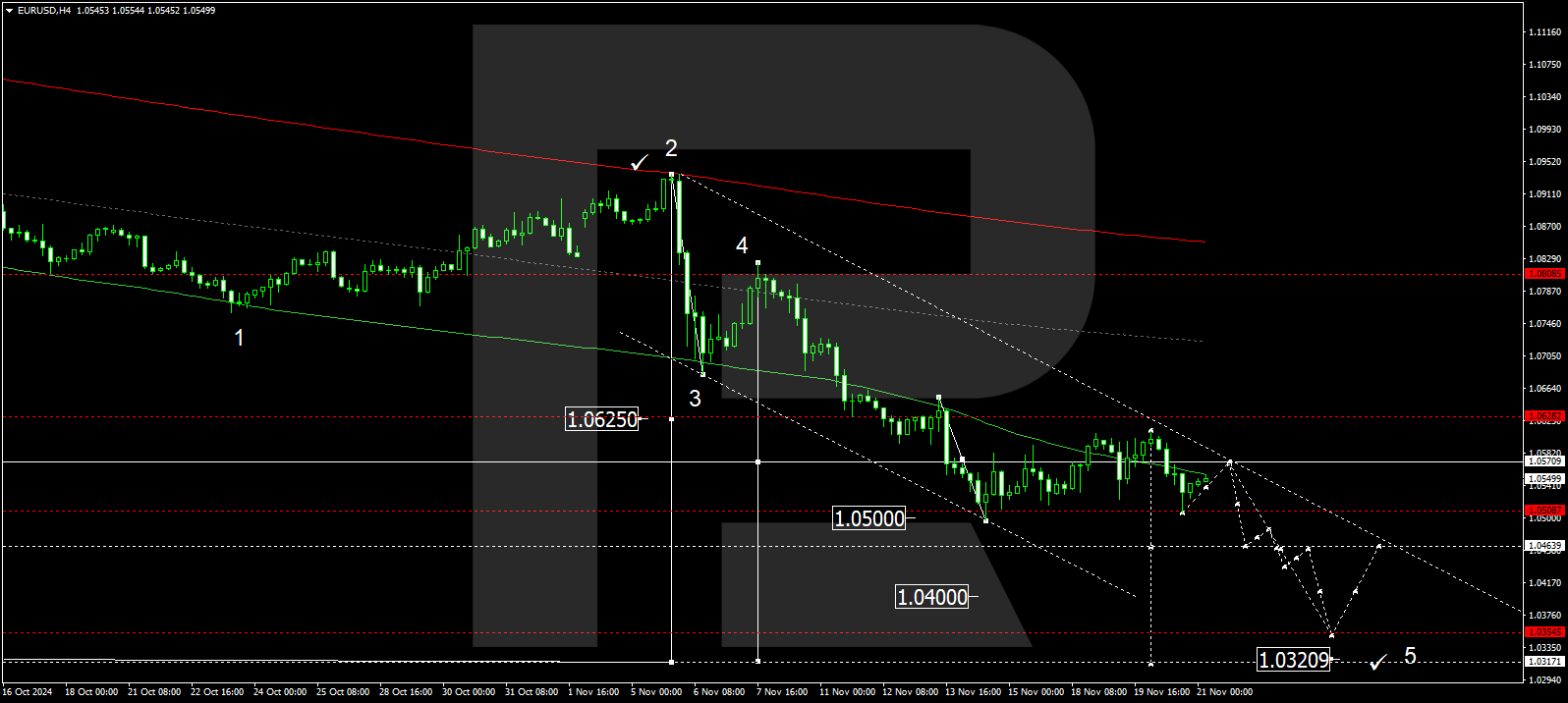

The EURUSD H4 chart shows that the market has completed another leg of its downward wave, reaching 1.0506. A correction is anticipated today, 21 November 2024, towards 1.0570 (testing from below), with a consolidation range forming around this level. A breakout below the range could trigger a downward wave towards 1.0464, potentially extending further to 1.0400, the local target. Conversely, an upward breakout could drive a growth wave towards 1.0628, after which a new downward wave may begin, targeting 1.0320.

The Elliott Wave structure and matrix for the second half of the downward wave, with a pivot point at 1.0570, technically support this scenario. This level is crucial for continuing the downward wave in the EURUSD rate. The market is forming a correction around the lower boundary of a price envelope, which is expected to conclude at 1.0570. Subsequently, the wave could extend to the envelope’s lower boundary at 1.0320.

Summary

The EURUSD pair was trending downward yesterday but has now paused and entered a consolidation phase. Technical analysis for today’s EURUSD forecast suggests that the corrective wave could extend to the 1.0570 level. A downward wave will likely begin once the correction is complete, targeting 1.0464.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.