GBPUSD: inflation data supports the US dollar

The GBPUSD rate is rising after three consecutive trading sessions of decline. Find out more in our analysis dated 2 September 2024.

GBPUSD forecast: key trading points

- The US Consumer Price Index rose by 0.2% in July

- Investors have revised their expectations regarding a Federal Reserve interest rate cut amid the latest inflation data

- The market focus now shifts to the upcoming US employment report

- GBPUSD forecast for 2 September 2024: 1.3097, 1.3040 and 1.2900

Fundamental analysis

The GBPUSD rate corrected following Friday’s decline as investors adjusted their expectations of an aggressive interest rate cut by the US Federal Reserve amid the latest inflation data.

The Consumer Price Index (CPI), excluding food and energy, rose by 0.2% in July from the previous month and 2.6% year-on-year.

The CPI is a key indicator the Federal Reserve uses to assess inflation risks. The latest data shows that US core prices increased steadily in July. As part of today’s GBPUSD forecast, this development has reduced expectations of a significant 50-basis-point interest rate cut in September, supporting the US dollar.

Market participants are now focusing on the upcoming August employment report, as the Federal Reserve closely monitors employment market conditions.

GBPUSD technical analysis

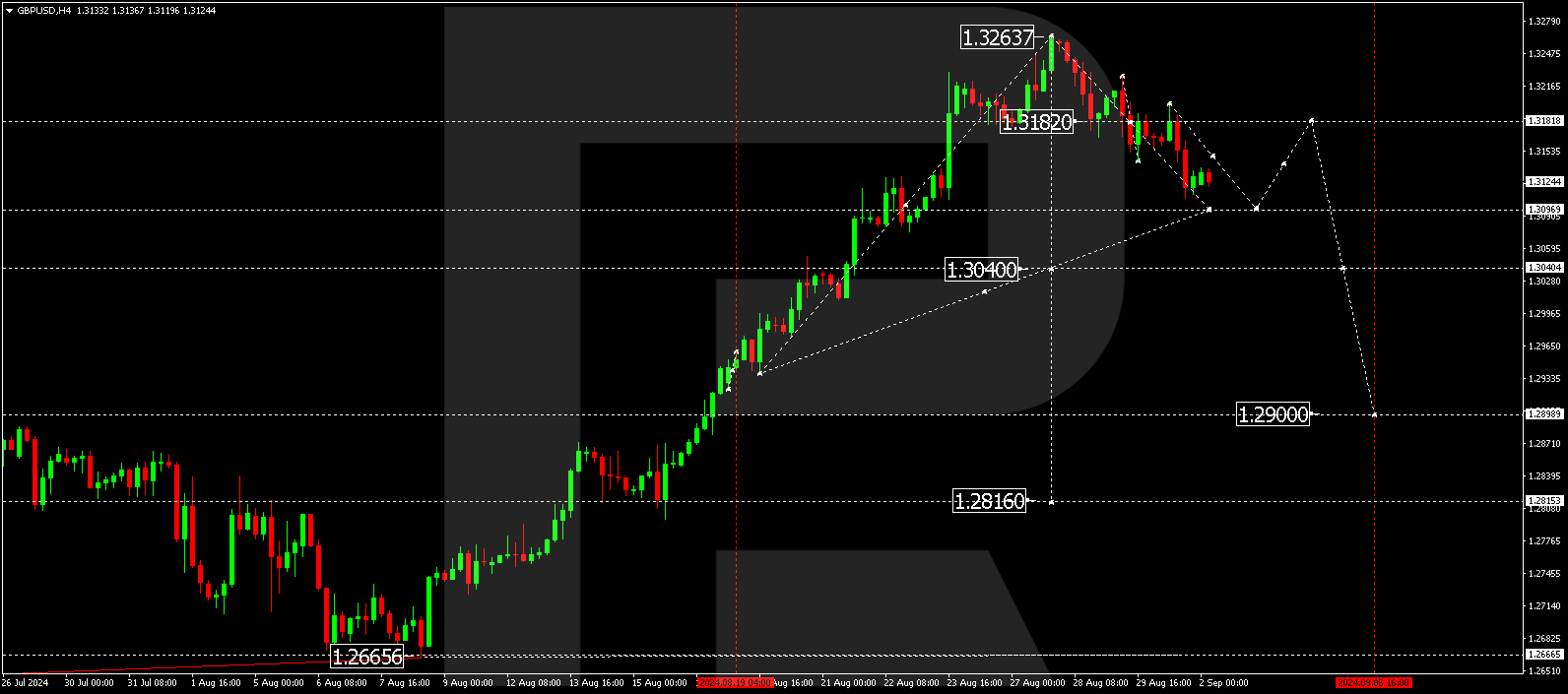

On the GBPUSD H4 chart, the market has formed a consolidation range around 1.3182 and, after breaking below it, continues the downward momentum towards 1.3097, the first target. The price is expected to reach this level and start correcting towards the second target of 1.3182 today, 2 September 2024. Once the correction is complete, another downward wave might begin, aiming for 1.3097. A breakout below this level could signal a continuation of the trend towards the local targets of 1.3040 and 1.2900.

Summary

Amid persistent inflation, the prospects of a significant Federal Reserve interest rate cut are becoming increasingly unlikely. While this may support the decline in the GBPUSD rate, further movements in the currency pair will depend on the upcoming employment data. Technical indicators suggest a potential decrease in the GBPUSD rate to the 1.3097, 1.3040, and 1.2900 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.