GBPUSD is under pressure due to a potential Bank of England rate cut

The GBPUSD rate is approaching a crucial support level of 1.3035. Read more in our analysis for 7 October 2024.

GBPUSD forecast: key trading points

- Bank of England Governor Andrew Bailey announced a potential rapid interest rate cut if inflation slows

- Strong US labour market data reduced expectations of a significant Federal Reserve interest rate cut

- In September, the UK construction sector demonstrated the highest growth rates in two years

- GBPUSD forecast for 7 October 2024: 1.3033

Fundamental analysis

The GBPUSD rate has been falling for the fifth consecutive trading session amid expectations of a decisive Bank of England interest rate cut in November. The regulator’s chief, Andrew Bailey, indicated a potential transition to a more aggressive easing policy, hinting that a rate cut may occur earlier if inflation continues to slow.

At the same time, the strong US labour market data reduced expectations of a significant Federal Reserve interest rate cut, putting pressure on the pound and supporting the current downtrend as part of today’s GBPUSD forecast.

Meanwhile, despite high interest rates in September, the UK construction sector showed the highest growth rates over the past two years. According to Halifax, the House Price Index rose by 4.7% year-over-year, marking the highest reading since November 2022.

The improvement in mortgage loan affordability is due to a significant wage increase and a gradual decrease in interest rates, which have reinforced buyer confidence. The number of mortgage loans granted increased by more than 40% over the past year, reaching a record level since July 2022.

GBPUSD technical analysis

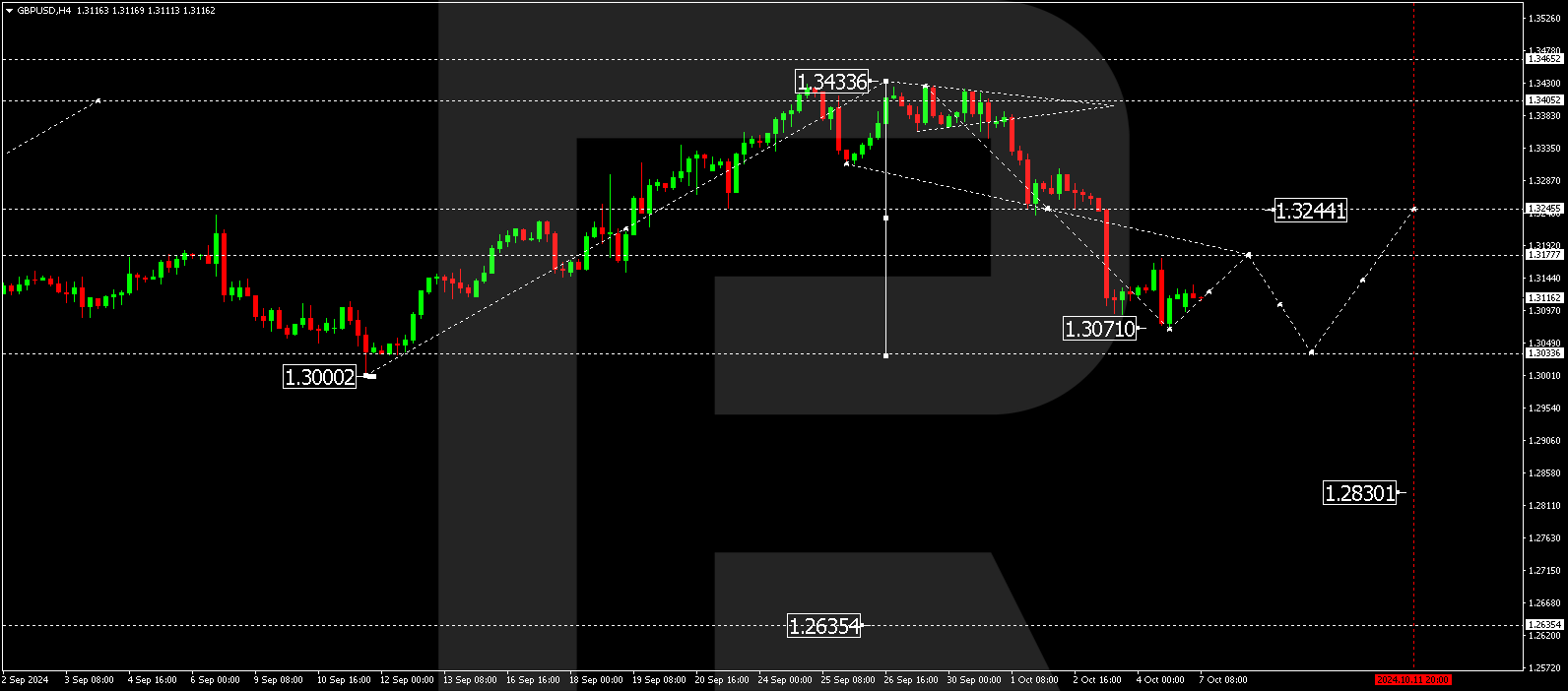

The GBPUSD H4 chart shows that the market has breached the 1.3244 level and reached the downward wave’s local target of 1.3070. A correction towards 1.3177 is possible today, 7 October 2024. Once the correction is complete, the price is expected to decline to 1.3033, the first target. Subsequently, it could rise to 1.3244 (testing from below). After the price reaches this level, another downward wave in the GBPUSD rate could develop, aiming for 1.2830 as the local target.

Summary

The GBPUSD rate remains under pressure due to expectations of aggressive Bank of England interest rate cuts and strong US labour market data, which reduce the chances of a Federal Reserve policy easing. Technical indicators in today’s GBPUSD forecast suggest a potential decline to the 1.3033 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.