NZDUSD forecast: the New Zealand dollar continues to lose ground against the US dollar

Rising PCE and Michelle Bowman’s speech could support the US dollar - read more in our analysis for 27 September 2024.

NZDUSD forecast: key trading points

- US Core PCE (YoY): Previously 2.6%, Forecasted 2.7%

- Speech by Michelle Bowman, member of the US Federal Open Market Committee (FOMC)

- CFTC NZD Net Speculative Positions: Previously -1.9K

- NZDUSD forecast for 27 September 2024: 0.6222 and 0.6140

Fundamental analysis

The Core Personal Consumption Expenditures Price Index (Core PCE) is an economic indicator measuring changes in the cost of goods and services consumed by US households (excluding food and energy prices due to their high volatility). The index is one of the most important inflation indicators in the US, which the Federal Reserve System uses to assess economic conditions and make decisions on monetary policy.

The previous value was 2.6% on an annualised basis. The forecast for 27 September 2024 suggests it may increase by 0.1% to 2.7%. Such expectations boost optimism among market participants, although the data may differ significantly. If the published statistics exceed forecasts, it will provide additional support to the US dollar and cause a decline in the NZDUSD exchange rate.

Michelle Bowman, a member of the US Federal Open Market Committee (FOMC) and the Fed’s Board of Governors, is scheduled to deliver a speech. Her report may contain data on future US monetary policy.

The Commodity Futures Trading Commission’s (CFTC) weekly report analyses the volume of speculative positions held by non-commercial traders in US futures markets. It reflects the difference between traders’ long and short NZD positions on the Chicago and New York trading floors. The CFTC report is published every Friday and covers data from as of Tuesday of the current week.

The fundamental analysis for 27 September 2024 shows a notable decrease in positions in the last reporting period, indicating the likelihood of a trend reversal. However, the forecast remains uncertain until the actual data is published.

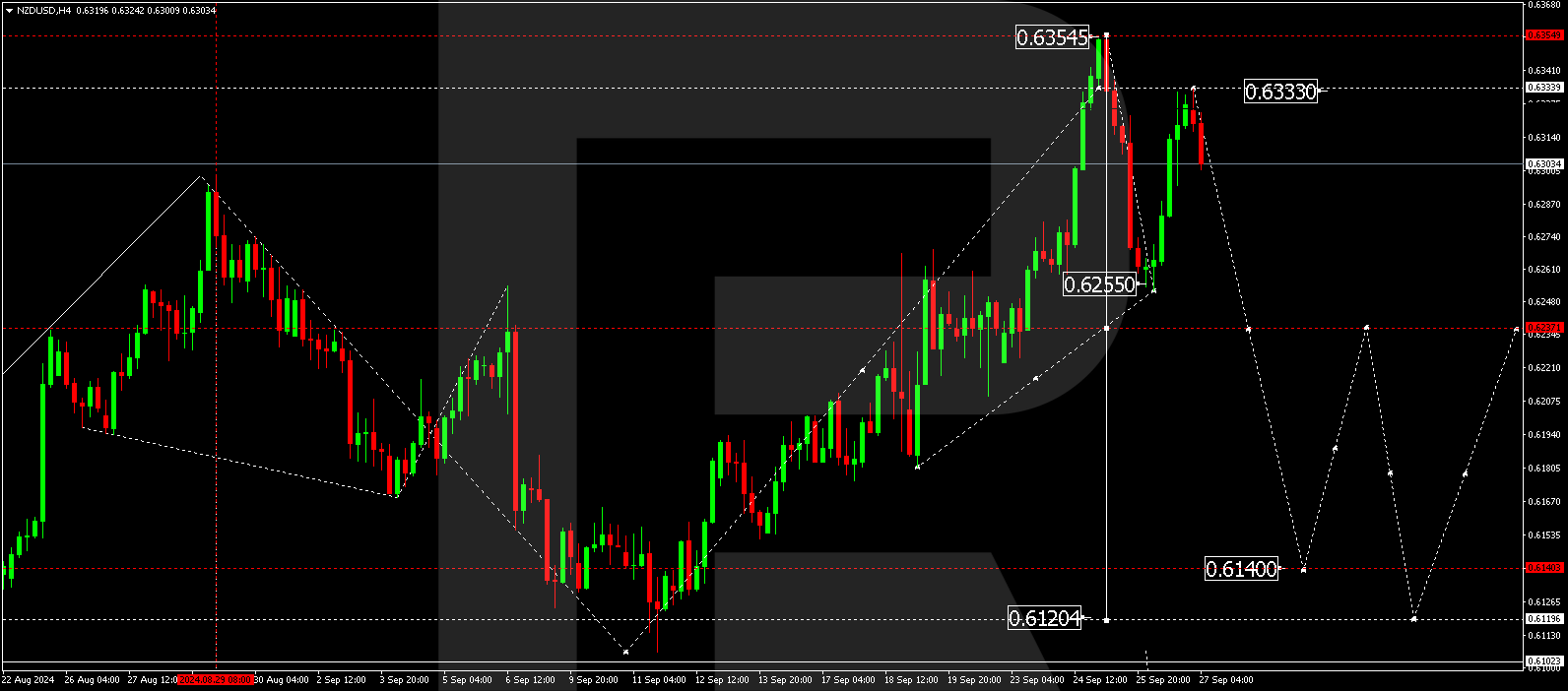

NZDUSD technical analysis

On the H4 chart of the NZDUSD currency pair, the market declined to 0.6255. This development was followed by a correction to 0.6333. The market has practically outlined the limits of the consolidation range. Today, 27 September 2024, we anticipate a potential decline to the lower boundary of this range. A break below the 0.6255 level would open the potential for a further decline to 0.6222. Subsequently, we expect the formation of a narrow consolidation range around this level. A downward break from this consolidation could signal a continuation of the decline towards 0.6140. This is the local target.

Summary

Michelle Bowman’s speech, the rise in indices, and the technical analysis of NZDUSD suggest a probability in today’s NZDUSD forecast of the trend continuing downward to the levels of 0.6222 and 0.6140.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.