NZDUSD hit new annual lows: all sympathies are with the US dollar

The New Zealand dollar fell to an annual low, with investors siding with the USD. Find out more in our analysis for 22 November 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair reached a new annual trough

- The RBNZ is expected to lower the interest rate by 50 basis points in one move next week

- NZDUSD forecast for 22 November 2024: 0.5810

Fundamental analysis

The NZDUSD rate plummeted to 0.5837 on Friday.

The New Zealand dollar has experienced significant weakening for three consecutive sessions. The market is confident that the Reserve Bank of New Zealand will continue to ease monetary policy, prompting forecasts to remain unfavourable for the NZD.

The likelihood of a 50-basis-point RBNZ rate cut to 4.25% per annum at next week’s meeting is already fully reflected in the quotes. This aligns with October’s financial regulation easing pace and general market expectations.

Externally, the NZD faces persistent pressure from the US dollar.

The NZDUSD forecast remains negative.

NZDUSD technical analysis

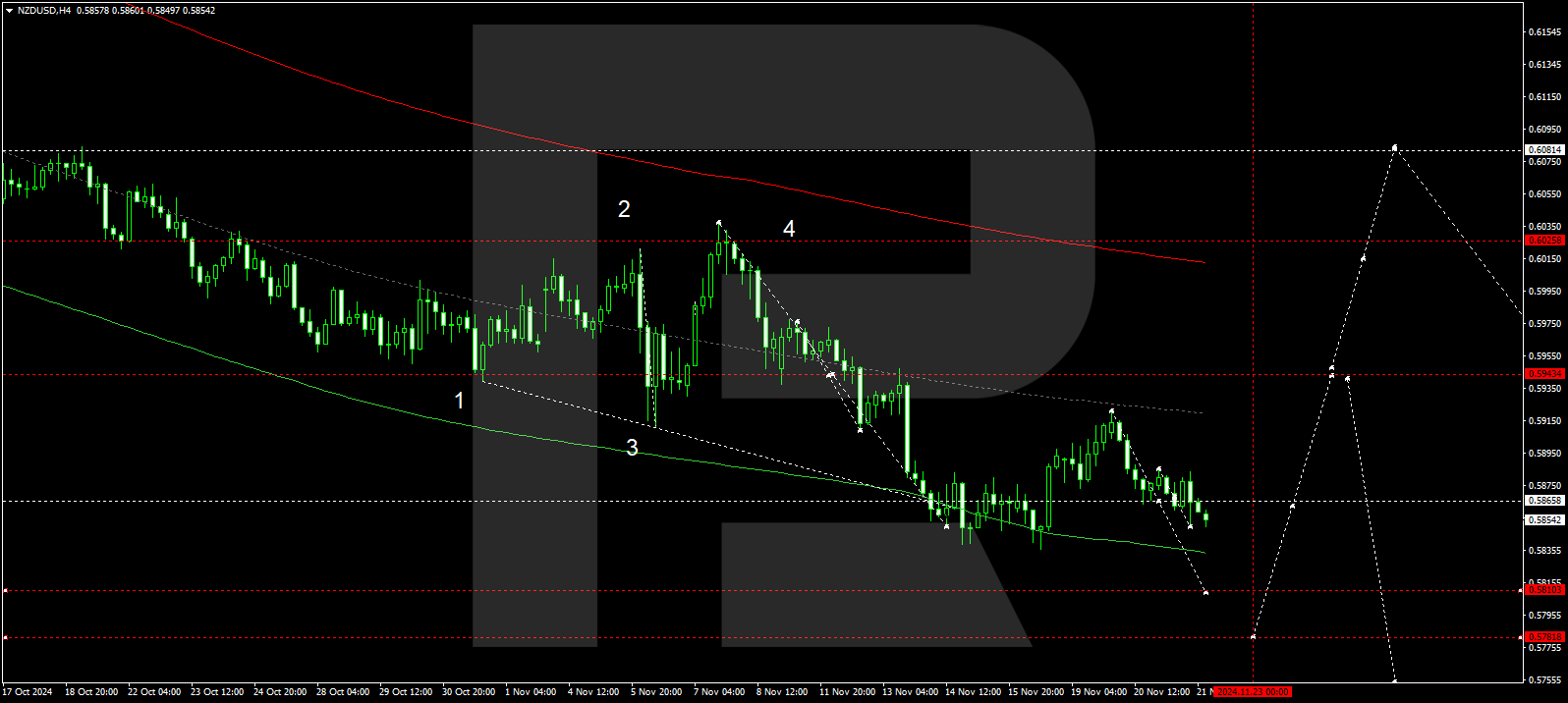

The NZDUSD H4 chart shows that the market is forming a narrow consolidation range around 0.5865 without a clear trend. The price could break below the range today, 22 November 2024, with the downside target set at 0.5810. Alternatively, an upward breakout could trigger a corrective wave towards 0.5940, followed by a new downward wave, aiming for 0.5780 as the first target.

The Elliott Wave structure and wave matrix for the NZDUSD rate, with a pivot point at 0.5865, technically confirm this scenario. The market is currently forming a consolidation range around this level. The price is expected to break below the range to the lower boundary of a price envelope at 0.5810. Subsequently, a correction move could aim for its central line at 0.5944. Afterwards, another downward wave might develop, targeting the envelope’s lower boundary at 0.5777.

Summary

The NZDUSD pair remains under pressure from sell-offs and now appears very weak. Technical indicators for today’s NZDUSD forecast suggest that a downward wave could continue to the 0.5810 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.