USDJPY under pressure: the Japanese economy is recovering

The USDJPY rate has been falling for the fourth consecutive trading session. Traders are awaiting the US employment report. Find out more in our analysis for 6 September 2024.

USDJPY forecast: key trading points

- Today, the focus is on the US employment report for August, which may heighten expectations of a significant 50-basis-point Federal Reserve interest rate cut

- The US private sector added 99,000 jobs in August, marking the lowest reading since January 2021

- Japan’s reserve assets increased to 1.24 trillion USD in August 2024, reaching a four-month high

- Japan’s household spending increased by 0.1% year-over-year in July 2024

- USDJPY forecast for 6 September 2024: 139.70

Fundamental analysis

The USDJPY rate is approaching a monthly low as the US dollar remains under pressure amid weak economic data, raising recession concerns. These threats force traders to consider the possibility of a more aggressive Federal Reserve interest rate cut. Today, all eyes are on the US employment report for August, which may heighten expectations of a 50-basis-point Federal Reserve interest rate cut this month.

In August, the US private sector added 99,000 jobs, marking the lowest reading since January 2021. This data shows that the employment market has been cooling for the fifth consecutive month despite steady wage growth. Wage growth remains at the same year-over-year level of 4.8% for employees who kept their jobs and 7.3% for those who changed jobs. As part of today’s USDJPY forecast, these data have increased the likelihood of a 50-basis-point Federal Reserve interest rate cut to 40%.

Meanwhile, Japan’s reserve assets increased to 1.24 trillion USD in August 2024 from 1.22 trillion in July, reaching a four-month high. At the same time, household spending in Japan rose by 0.1% year-over-year in July. Although the reading is below market expectations of a 1.2% increase, this is still an improvement from a 1.4% decline a month ago, marking the first positive change since April.

USDJPY technical analysis

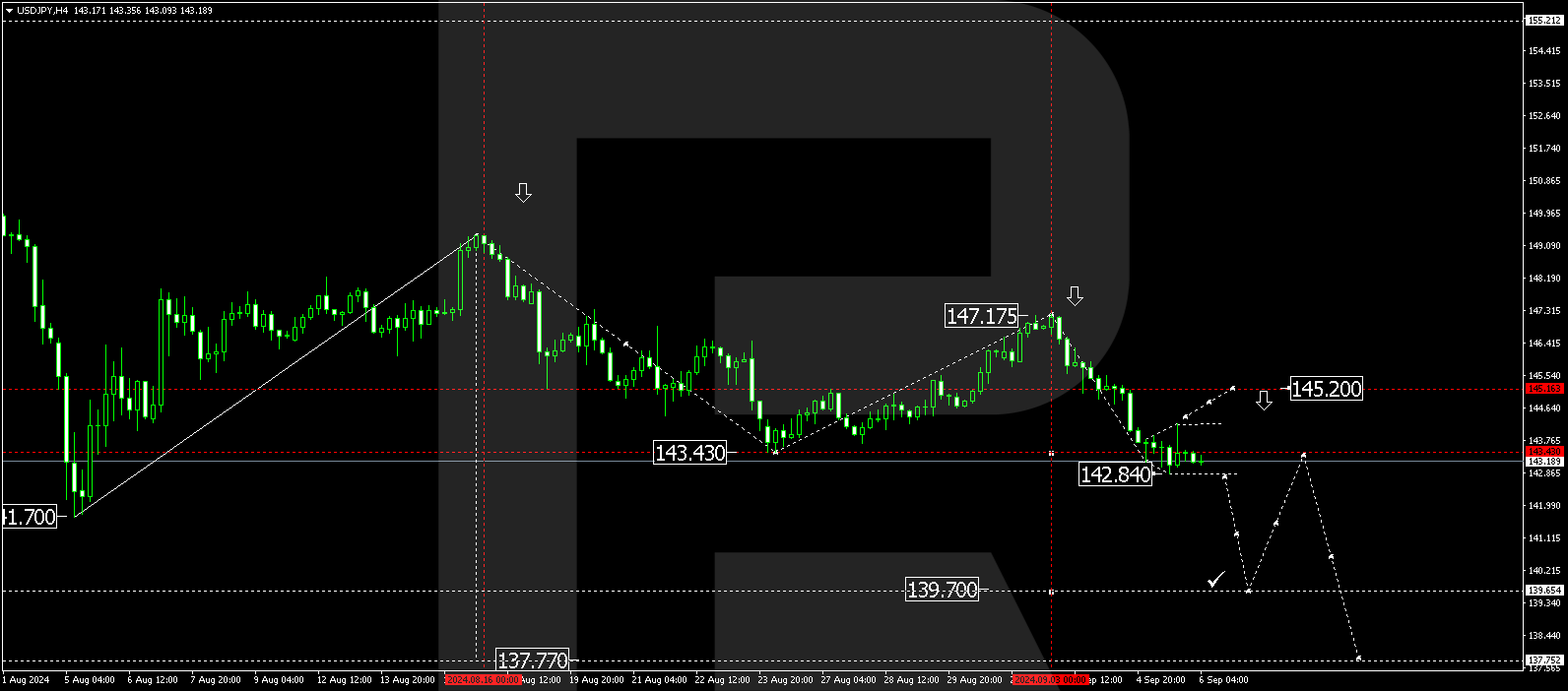

The USDJPY H4 chart shows that the market is forming a new consolidation range around 143.43, extending it to 144.22 and down to 142.84. The price could break below the lower boundary of the range today, 6 September 2024. A breakout below the 142.80 level may signal a further decline in the USDJPY rate towards the local target of 139.70. After the price reaches this level, a correction might start, aiming for 143.43 (testing from below).

Summary

Weak US economic data continue to pressure the USDJPY rate, increasing the likelihood of a more aggressive Federal Reserve interest rate cut as early as this month. At the same time, Japanese indicators are showing signs of recovery despite more moderate growth in consumer spending, which supports the yen. Technical indicators in today’s USDJPY forecast suggest a potential decline to 1139.70.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.