USDJPY: risks of further upward trend development persist

The USDJPY currency pair has risen steadily after breaking out of a descending channel, signalling the potential for continued upward momentum. In this analysis for 24 September 2024, we delve into the key market drivers, technical outlook, and signals influencing USDJPY forecasts for traders.

USDJPY forecast: key trading points

- Traders focus on the upcoming PCE report and Fed speeches

- Kazuo Ueda confirmed that Japan’s economy is moving towards a moderate recovery

- Japan’s manufacturing activity remains weak due to low external demand, particularly from China

- USDJPY forecast for 24 September 2024: 145.77 and 146.66

Fundamental analysis

USDJPY is slightly higher on Tuesday, with buyers trying to consolidate above the resistance level of 144.45. At the same time, the probability of the Fed cutting the interest rate by 50 basis points at the upcoming meeting on 7 November 2024 is 52.9%, while the likelihood of a 25-point is 47.1%. Traders are focusing on the forthcoming PCE index report and speeches by Fed officials to gauge the regulator’s next moves.

Bank of Japan Governor Kazuo Ueda reiterated the outlook for the economy to move towards a moderate recovery, emphasising that the BoJ will adjust the level of monetary policy easing if economic and price expectations are met.

Japan’s manufacturing business continued to contract in September 2024, with au Jibun Bank’s Japan Manufacturing PMI remaining below 50.0 points for the third consecutive month. At the same time, the services sector showed strong growth, with au Jibun Bank’s Japan Services PMI rising to 53.9, the highest level in 5 months. Despite the positive trends in the services sector, sentiment in the manufacturing sector remains negative due to low external demand, particularly from China. Within the USDJPY forecast for today, such signals may put pressure on the Yen.

USDJPY technical analysis

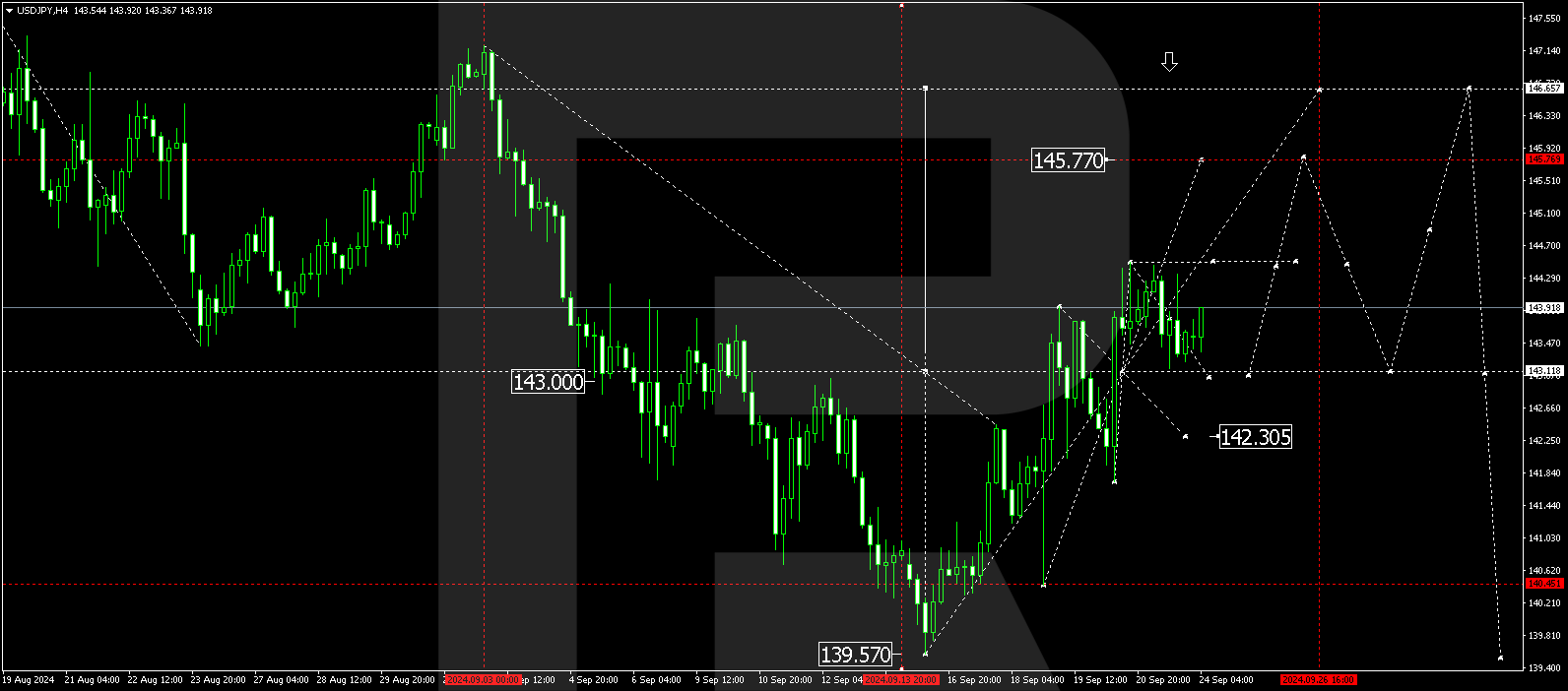

Regarding technical analysis, the USDJPY H4 chart shows a consolidation range developing around 143.00, with extensions down to 141.73 and upwards to 144.44. On 24 September 2024, the USDJPY rate will likely test the 143.00 level from above, followed by expected growth towards 144.50.

A breakout above 144.50 could trigger further upward movement, targeting 145.77, with the potential for the wave to extend toward 146.66. If the pair breaks below the consolidation range, however, downside targets could open around 142.30. The broader trend suggests a continued upward signal in either scenario, with technical indicators aligning with the bullish USDJPY forecast.

Summary

Despite challenges in Japan’s manufacturing sector, weak external demand from China, and broader economic uncertainty, USDJPY signals point to further potential gains. The pair is trading near key resistance levels, with today’s USDJPY prediction focusing on a move towards 145.77 and 146.66. Traders should monitor upcoming fundamental news, such as the PCE index report and Fed speeches, as these events may impact the USDJPY forecast.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.