USDJPY analysis: the yen continues to strengthen against the US dollar

Rising retail sales offset falling industrial production, which supported the yen. Read more in our detailed USDJPY analysis for today, 30 September 2024.

USDJPY forecast: key trading points

- Industrial production in Japan (August 2024): previously 3.1%, actual -3.3%

- Japan retail sales (August 2024): previously 2.7%, actual 2.8%

- Fed Chair Jerome Powell’s speech: expected to impact the USD

- USDJPY forecast for 30 September 2024: 140.88 and 137.77

Fundamental analysis

Industrial Production for August fell by -3.3%, contrary to forecasts predicting a decline to -0.5%. Last month, Japan showed a 3.3% increase in industrial production. Given that Japan’s economy depends heavily on industrial production (including mines, factories, and utilities), a drop into negative territory does not bode well. However, as the analysis for 30 September 2024 shows, the yen continues to strengthen against the US dollar.

Retail Sales in Japan show the amount of goods sold by all retailers. The sample includes retail shops of various sizes and types in Japan. The indicator for August remained almost unchanged, showing a slight increase of 0.1%. These data likely counterbalanced the decline in industrial production and helped the USDJPY rate continue its decline.

Today, 30 September 2024, at the end of the US trading session, Fed Chair Powell will give a speech. This will have a strong impact on the US dollar exchange rate. Investors are awaiting information about the future direction of US monetary policy. The USDJPY forecast for today does not favour the US dollar, which will likely lose ground against other currencies, including the Japanese yen.

USDJPY technical analysis

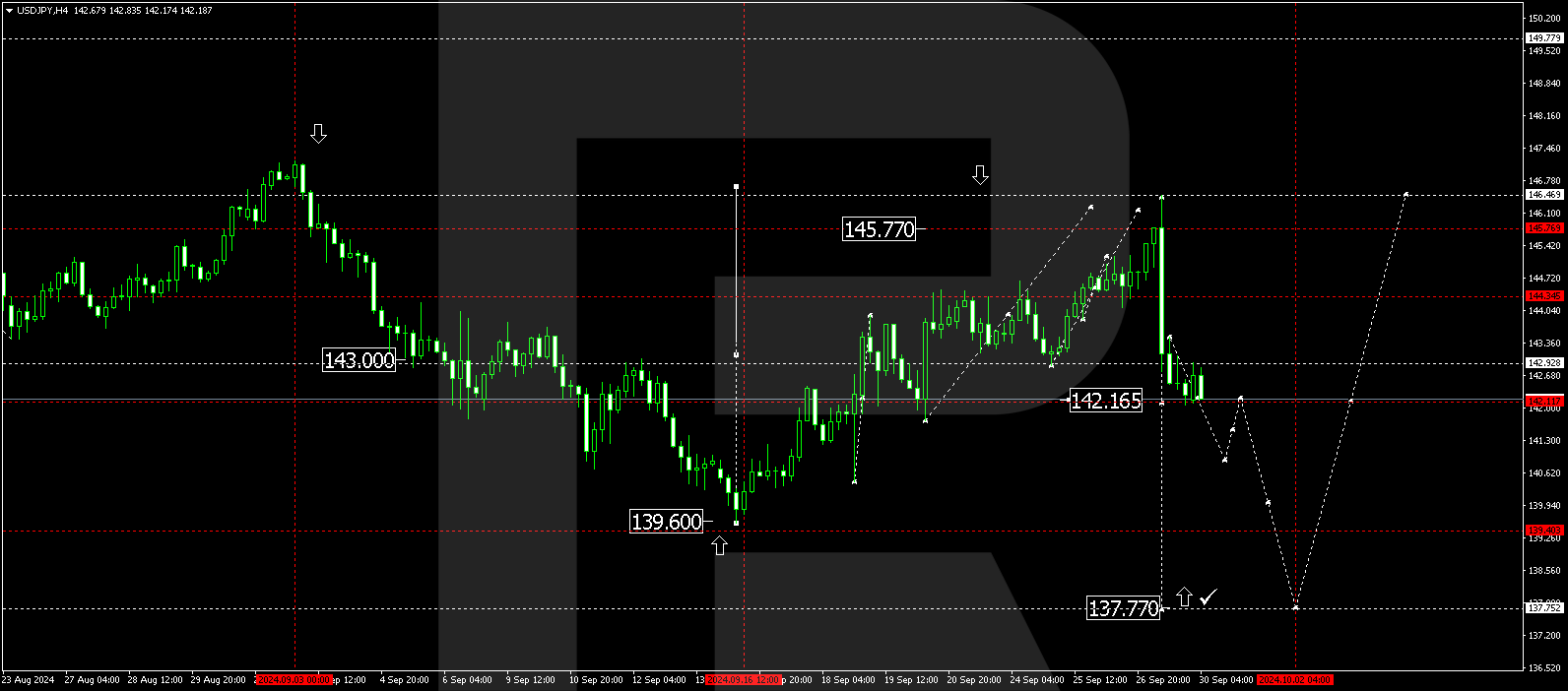

On the H4 USDJPY chart, the market has formed a growth wave to the level of 146.48 and a downward impulse to the level of 142.77. Today, 30 September 2024, USDJPY continues to be under downward pressure. At the moment, a consolidation range has formed at around 142.16. We expect a downward breakout from it. The target is at 140.88. After reaching this level, a growth link to 142.77 (test from below) is not excluded.

Breaking through 140.80 would serve as a strong signal for trend continuation, with the next primary target at 137.77. This level is a critical marker for the downside trend.

Summary

Positive developments from Japan’s economic indicators and the upcoming speech from Fed Chair Powell align with today’s USDJPY forecast. The fundamental and technical analysis suggests that USDJPY will likely continue its downward movement, with key targets set at 140.88 and 137.77. Traders should closely watch these levels as they represent significant turning points for the currency pair.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.