USDJPY: the pair continues its ascent, reaching daily highs

The USDJPY rate is rising, surpassing a local high of 154.70. Find out more in our analysis for 13 November 2024.

USDJPY forecast: key trading points

- The USDJPY pair is trading in an uptrend

- The Bank of Japan is in no rush to raise rates

- Inflation in the country is rising moderately

- USDJPY forecast for 13 November 2024: 156.15

Fundamental analysis

Japan’s inflation statistics released today, notably the Producer Price Index (PPI), showed a moderate increase in inflation, which rose 3.4% year-on-year and 0.2% month-on-month, slightly exceeding expectations. This could give the Bank of Japan more reasons to raise the interest rate next year.

US inflation statistics, including the Consumer Price Index (CPI), are scheduled for release during today’s American session. The indicator is anticipated to increase by 2.6% year-on-year and 0.2% month-on-month. Weaker-than-forecasted statistics will exert pressure on the USDJPY rate. Conversely, stronger-than-expected growth would bolster the US dollar and could drive the pair further upwards.

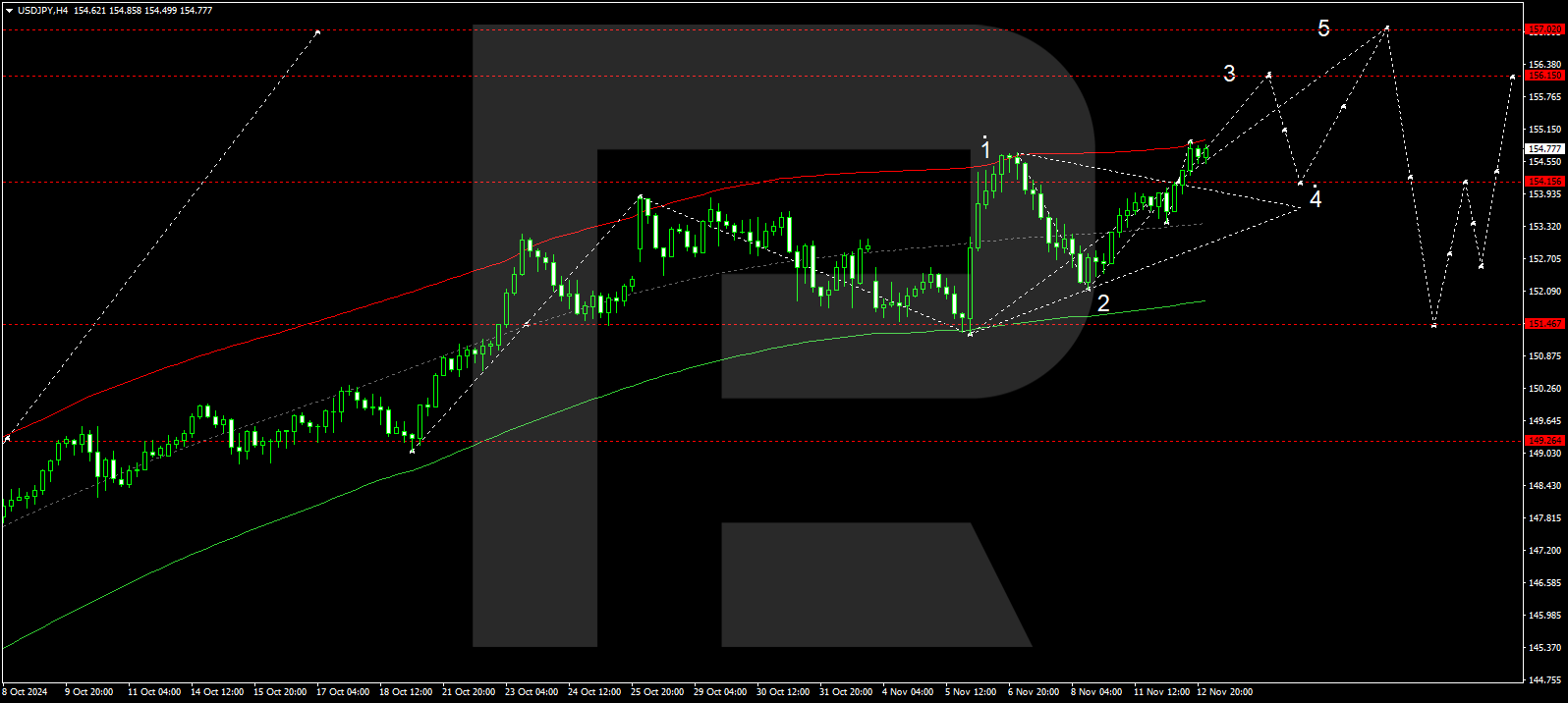

USDJPY technical analysis

The USDJPY H4 chart shows that the market has breached the 154.15 level and continues its upward trajectory to 156.15. The price might decline to 154.15 today, 13 November 2024. After reaching this level, it could rise to the local target of 156.15. Once the quotes hit this target, a more substantial correction is expected to begin, testing 154.15 from above). An onward growth wave towards 157.00 is worth considering.

The Elliott Wave structure and growth wave matrix, with a pivot point at 154.15, technically confirm this scenario for the USDJPY rate. The market is currently at the upper boundary of a price envelope, with the growth wave expected to end at 156.15. If the price rebounds from the envelope’s upper boundary, a corrective matrix could develop, aiming for its lower boundary at 154.15. Subsequently, a growth wave is expected to start, targeting the envelope’s upper boundary at 157.00.

Summary

The USDJPY pair is rising moderately, with market participants awaiting today’s US inflation statistics. Technical indicators for today’s USDJPY forecast suggest that the growth wave may extend to the 156.15 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.