DE analysis: the uptrend will highly likely shift to a sideways range

The DE 40 stock index is entering a sideways channel amid disappointing statistics and pessimistic expectations for the German economy. The DE 40 forecast for next week is negative.

DE 40 forecast: key trading points

- Recent data: the German government revised the 2024 GDP forecast downwards by 0.2%

- Economic indicators: GDP reflects the growth dynamics of the country’s entire economy

- Market impact: due to the government’s pessimistic outlook, domestic and foreign investors are reducing their investments in the stock market as they do not expect the issuer’s profit to grow

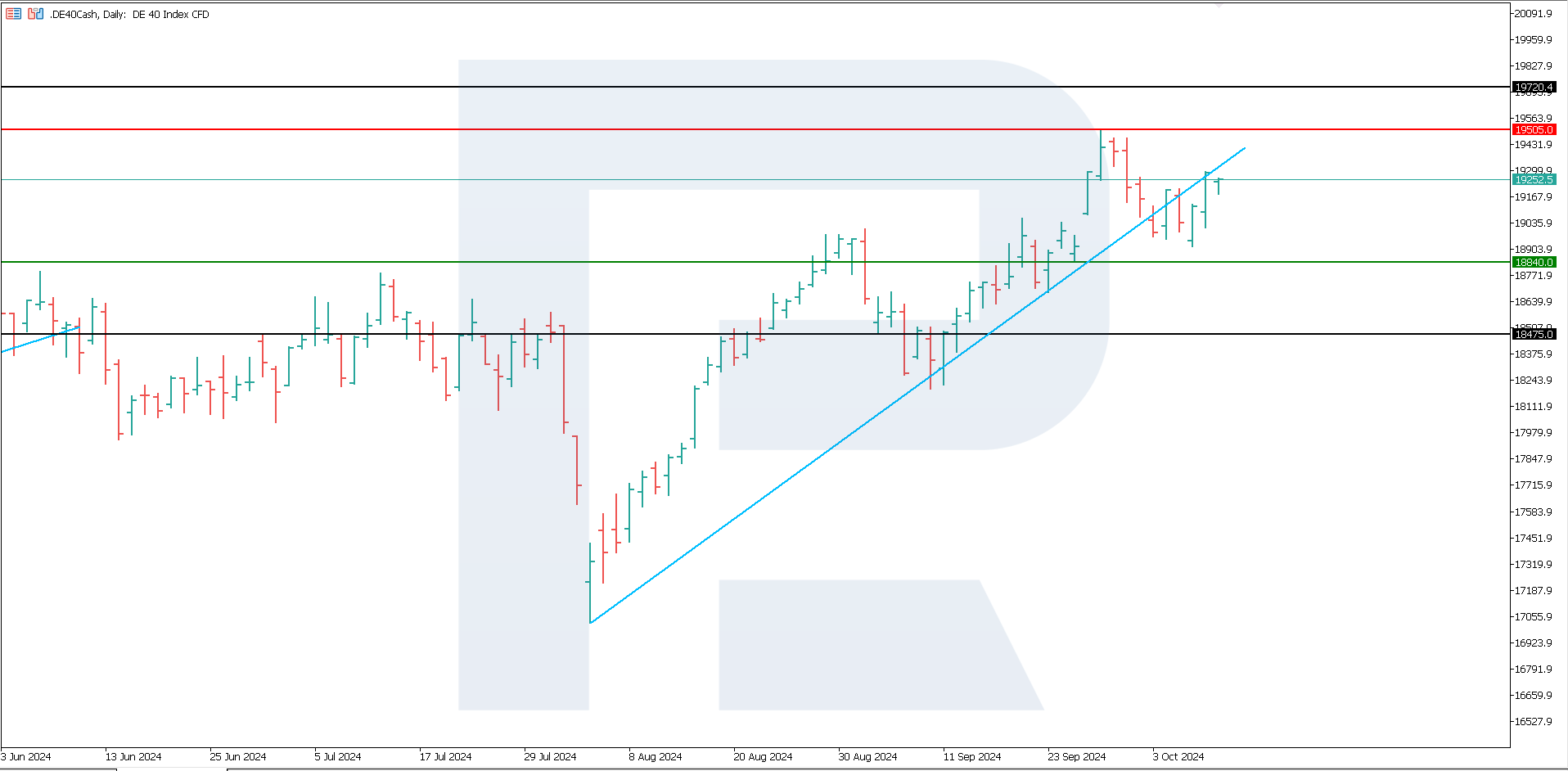

- Resistance: 19,505.0, Support: 18,840.0

- Resistance: 19,505.0, Support: 18,840.0

- DE 40 price forecast: 18,475.0

Fundamental analysis

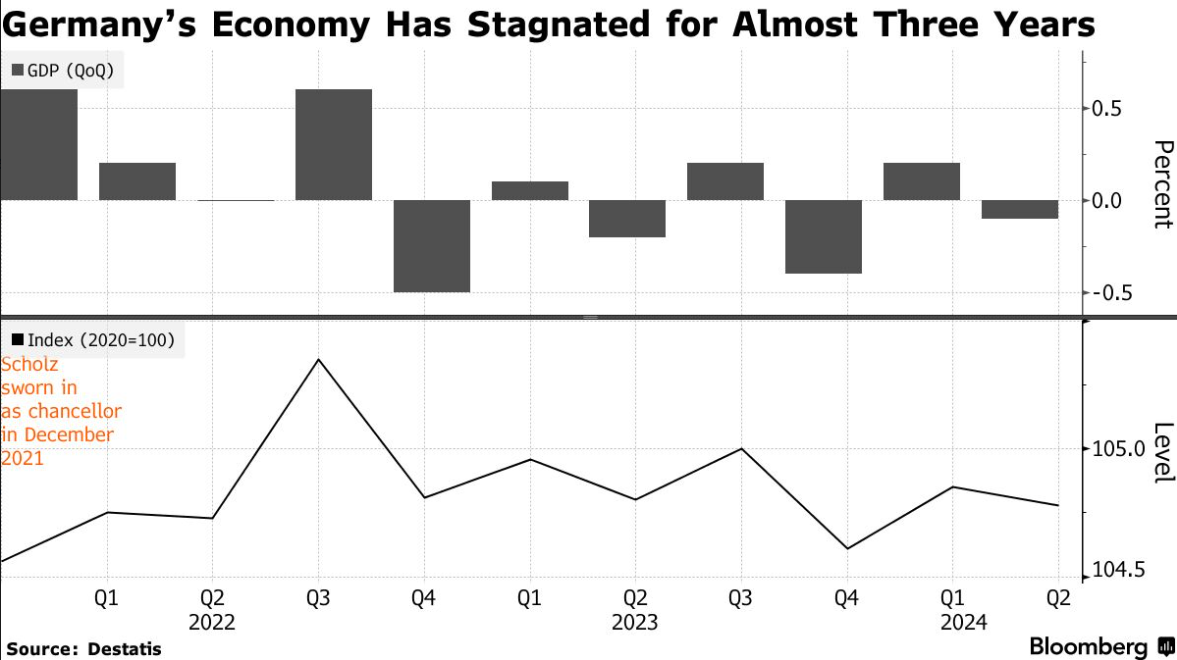

The German government downgraded this year’s gross domestic product (GDP) forecast by 0.2%. This is the latest signal that Europe’s largest economy continues to struggle, unable to emerge from prolonged stagnation.

A decline in production in 2024 (following a 0.3% decrease last year) will be only the second consecutive GDP contraction since the reunification of West and East Germany in 1990. Economy Minister Robert Habeck had predicted a 0.3% growth in his six-month forecast released in late April.

If Germany’s GDP shrinks for a second consecutive year, this could significantly impact the stock market, especially for companies focused on domestic demand. Given the inflation indicators, an ECB interest rate cut may help stimulate economic growth. However, the effect of such measures may not be seen until next year. The short-term DE 40 index forecast remains negative.

DE 40 technical analysis

The DE 40 stock index is entering a sideways channel between the current resistance and support levels. It is likely to remain in this range in the medium term. According to the DE 40 technical analysis, the price will most likely break below the 18,840.0 support level and decline to 18,475.0, forming a downtrend.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 18,840.0 support level could send the index down to 18,475.0

- Optimistic DE 40 forecast: a breakout above the 19,505.0 resistance level may drive the price up to 19,720.0

Summary

The German government revised this year’s gross domestic product (GDP) forecast downwards by 0.2%. This would mark the second consecutive GDP contraction since the reunification of West and East Germany in 1990. In such conditions, the stock market growth is not expected. The DE 40 index will likely remain in a downtrend in the medium term.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.