DE 40 analysis: the index gradually declines, retracing to 19,000.0

The DE 40 stock index has fallen slightly this week, approaching the 19,000.0 mark. The DE 40 forecast for next week remains negative.

DE 40 forecast: key trading points

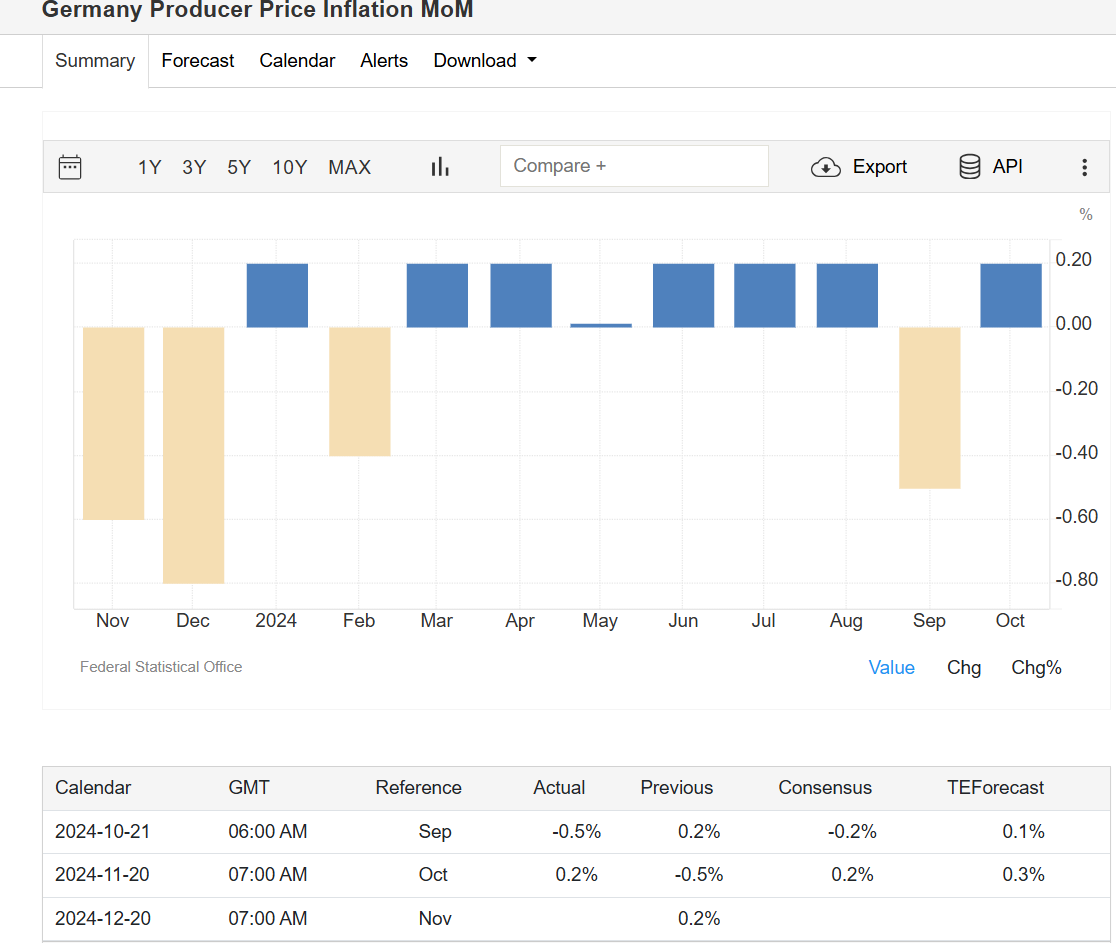

- Recent data: Germany’s Producer Price Index (PPI) rose by 0.2% compared to the previous month

- Economic indicators: the PPI is used to gauge the country’s inflation rate

- Market impact: the indicator met forecasts, resulting in no significant market reaction

- Resistance: 19,570.0, Support: 18,837.0

- DE 40 price forecast: 18,837.0

Fundamental analysis

According to this week’s data, Germany’s PPI increased by 0.2% from the previous month, in line with analysts’ expectations. In September, the index had decreased by 0.5%.

Source: https://tradingeconomics.com/germany/producer-price-inflation-mom

European stock markets have shown a gradual decline on Wednesday and Thursday amid a further escalation of the Russia-Ukraine conflict. Investors are selling off risky assets due to concerns about the current conflict’s potential expansion, with the possible involvement of NATO countries.

Germany’s automotive industry recorded the most considerable losses on Wednesday, with Mercedes-Benz, Volkswagen, and Porsche stocks falling by 1.40-3.00%. The healthcare sector also faced pressure, with Bayer and Fresenius declining by 2.00%. Germany’s 10-year bond yield rose above 2.35% on Wednesday.

DE 40 technical analysis

The DE 40 index is edging down this week, retracing to the 19,000.0 level. There is no clear trend now, with the index trading within a broad price range from 18,837.0 to 19,570.0. The price’s direction outside the range will determine the index’s prospects.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price secures below the 18,837.0 level, the index could decline to 18,500.0

- Optimistic DE 40 forecast: if the price surpasses the 19,570.0 resistance level, it could reach a new high of 19,677.0, opening the potential for growth towards 20,000.0

Summary

The DE 40 stock index is declining this week, retracing to the 19,000.0 level. Investors are concerned that the current conflict between Russia and Ukraine may escalate, potentially involving NATO countries.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.