USTECH analysis: tech index poised to reach new all-time high following correction

The USTECH stock index is poised to hit a new all-time high following a 3.05% correction.

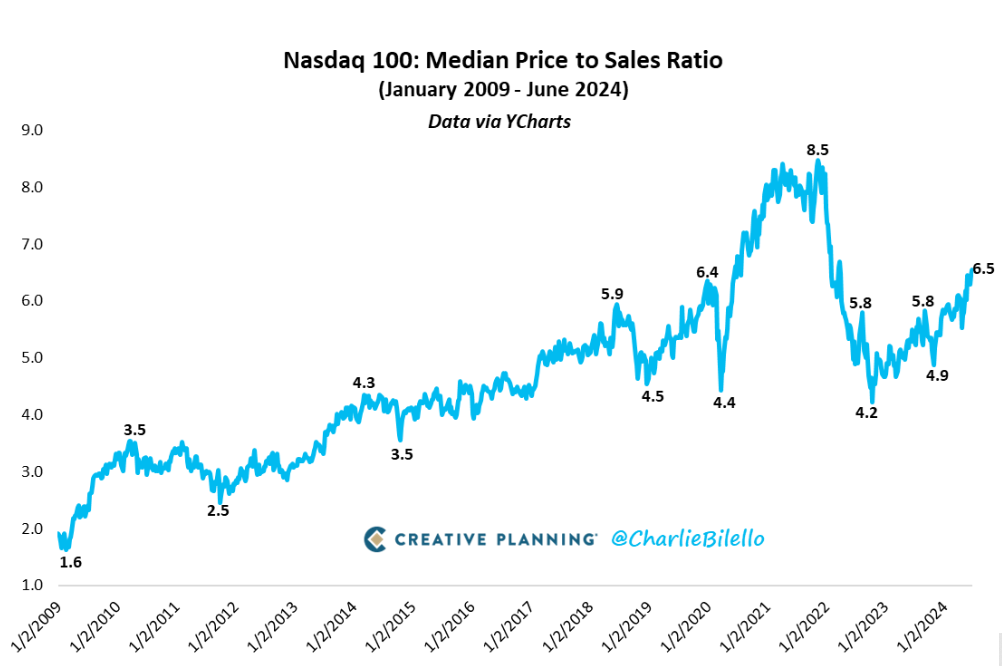

The median price-to-sales ratio in USTECH is approaching March 2022 levels, with growth prospects intact

A surge in the artificial intelligence sector is driving growth in the USTECH index. The median price-to-sales ratio in USTECH has approached March 2022 levels, reaching 6.5, although the 2009 record is 8.5.

Median P/S ratio in the USTECH index 26.06.2024

Source: https://bilello.blog/2024/the-week-in-charts-6-23-24

Thus, the potential for further growth remains. Consequently, the stock index could achieve a new historical peak this week or early next week. However, future levels will likely become increasingly challenging to achieve due to the anticipated decline in demand for these assets.

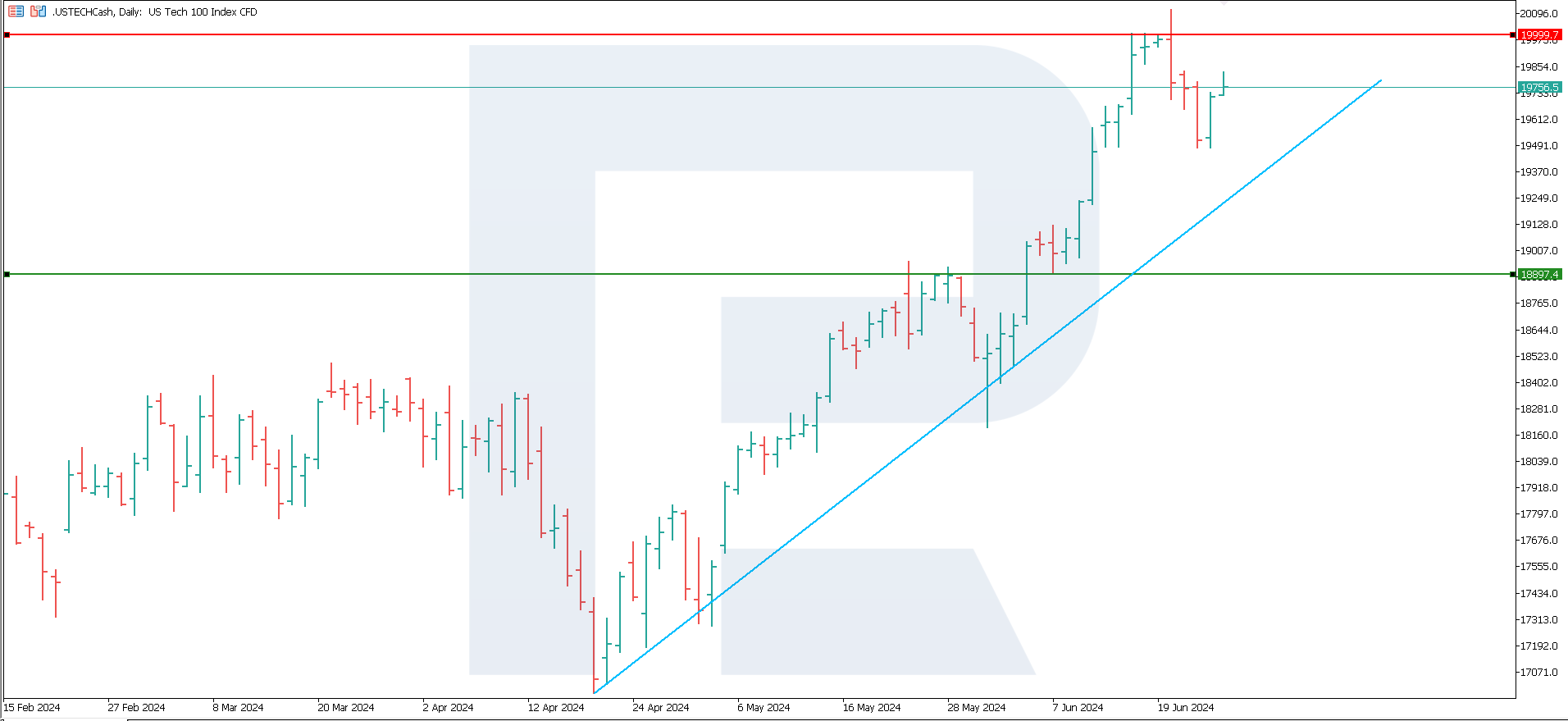

USTECH technical analysis

The USTECH stock index fell by 3.05% but has resumed growth since the beginning of the week. There is a steady uptrend – the support line remains unbroken. The quotes are poised to reach a new all-time high in the near term, possibly more than once.

The USTECH index chart, D1 26.06.2024

A resistance level formed at 19999.7, with support at 18897.5, creating a relatively wide channel. The resistance level is likely to be breached towards the target of 20100.0. Otherwise, quotes may decline to 18500.0.

Summary

The average price-to-sales ratio in USTECH stands at March 2022 levels, approaching 6.5. The stock index is poised to reach a new all-time high this week or early next week. The resistance level is likely to be breached, with quotes targeting 20100.0. Otherwise, they may fall to 18500.0.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.