JP 225 rises, but its trend potential is limited

The JP 225 stock index is in an uptrend, but its growth potential is limited. The JP 225 forecast for next week is negative.

JP 225 forecast: key trading points

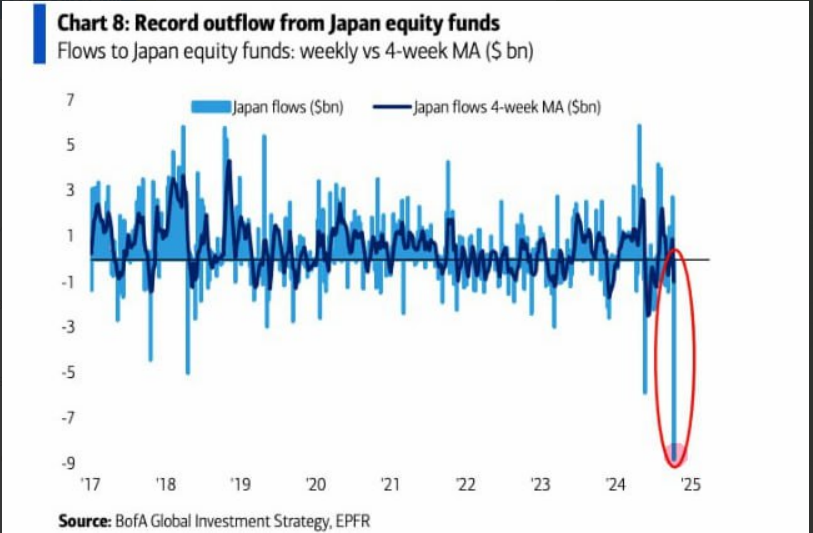

- Recent data: foreign investors withdrew 9 billion USD from the Japanese stock market

- Economic indicators: demand from foreigners indicates how attractive the country’s stock assets are on the global stage

- Market impact: falling demand from non-residents may push down stock prices and create an unfavourable trend in the long term

- Resistance: 40,155.0, Support: 38,850.0

- JP 225 price forecast: 37,230.0

Fundamental analysis

According to Barclays, the 9 billion USD outflow from Japanese shares is a significant development for the Japanese stock market. This is the most significant weekly decline over the past 20 years, indicating that investors are losing confidence in the Japanese economy and capital markets.

Massive capital outflows usually lead to a decline in stock prices as investors sell off shares. In the short term, this may trigger a further decline in indices. Amid outflows and uncertainty, the Japanese stock market may face increased volatility. Investors become more cautious, which makes long-term investment decisions more complex and may boost speculation.

Japan’s Producer Price Index increased 2.8% from September last year, above the previous 2.6%. Rising producer prices may signal increased inflationary pressures on the economy. If inflation continues to grow, this may lead to higher borrowing costs, increased company costs, and lower earnings, which will also exert pressure on the stock market. The JP 225 index forecast is pessimistic.

JP 225 technical analysis

The JP 225 stock index is in an uptrend after exiting the sideways channel. However, the growth potential is limited and is not long-term. A correction and a trend reversal are highly likely to occur. According to the JP 225 technical analysis, a breakout below the 38,850.0 support level may signal the beginning of the downtrend, with the target at 37,230.0.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 38,850.0 support level could cause the index to decline to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 40,155.0 resistance level could drive the index to 41,550.0

Summary

As reported by Barclays, the 9 billion USD outflow from Japanese shares marks a 20-year record. Japan’s Producer Price Index showed a 2.8% increase from September last year, above the previous 2.6%. Capital outflows combined with the increased Producer Price Index may pressure the Japanese stock market in the short term. Rising producer prices and potential monetary policy changes may increase uncertainty, lowering investor confidence and rising market volatility.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.