Brent crude oil is trading below 76.00 USD; the decline persists

Brent price has fallen for the fourth consecutive trading session, driven by weakening economic activity in China and negotiations in the Middle East. Find out more in our Brent analysis for today, 22 August 2024.

Brent forecast: key trading points

- US statistics: EIA reports a 4.65-million-barrel drop in inventories

- Market focus: market participants are awaiting Federal Reserve’s Chair Jerome Powell’s speech at the Jackson Hole Symposium

- Brent forecast for 22 August 2024: 72.20 and 76.80

Fundamental analysis

Brent quotes have continued their decline as part of a downtrend, falling below 76.00 USD. Despite a reported decrease of 4.65 million barrels in US crude oil inventories from the Energy Information Administration (EIA), this data has not supported the price.

Oil prices are under pressure due to slowing economic growth in China and prospects of peace talks in the Middle East. Today and tomorrow, market participants await comments from Federal Reserve Chair Jerome Powell on monetary policy at the Jackson Hole Symposium.

Brent technical analysis

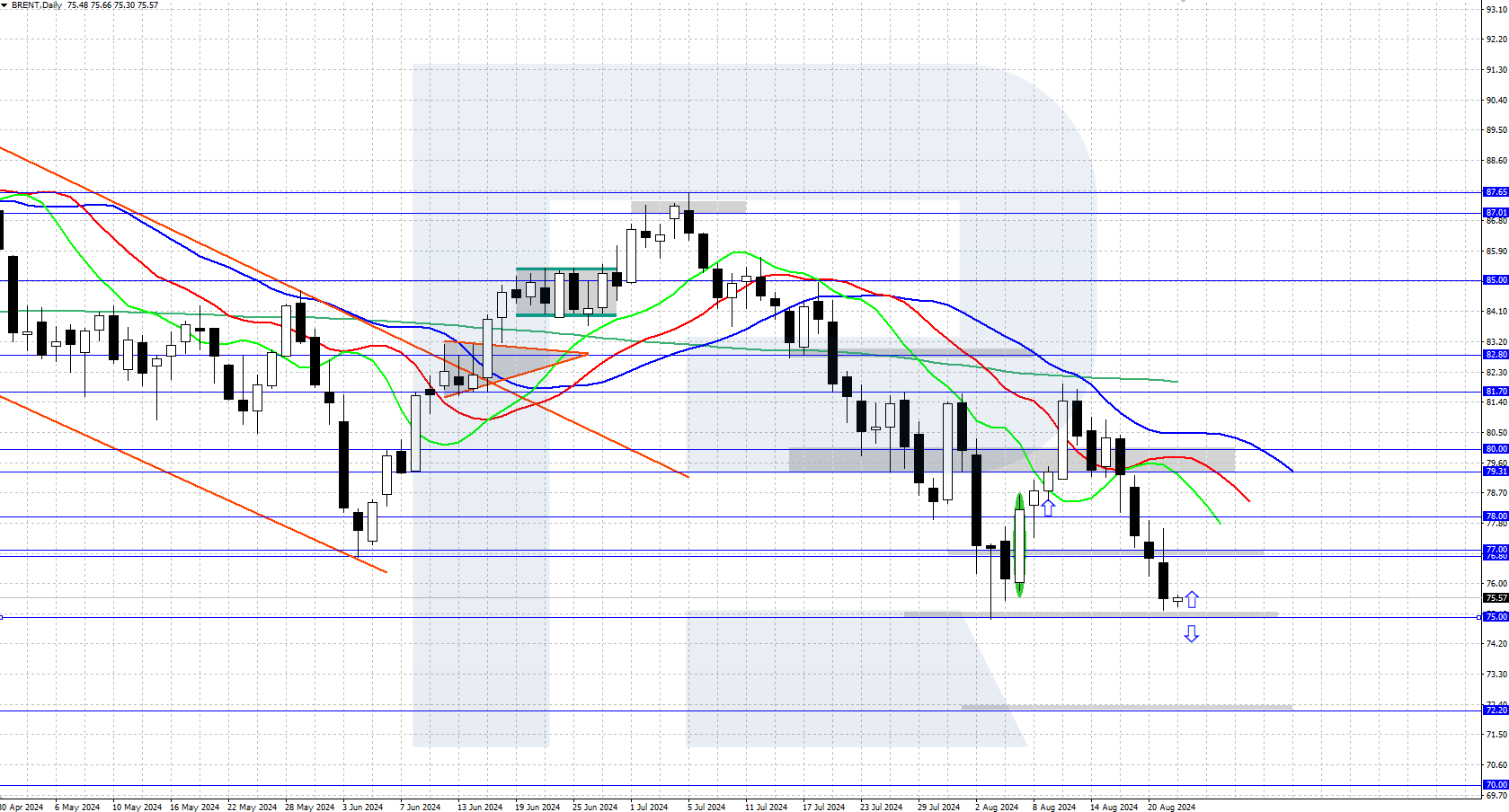

Brent prices currently continue to decline as part of a daily downtrend, approaching the critical support level at 75.00 USD, which can halt the decline. The daily chart indicates a solid downward momentum, with bulls unable to reverse the trend yet.

The short-term Brent price forecast suggests that if bulls halt the decline at 75.00, prices might recover to 76.80 and potentially higher. Conversely, if bears continue to control the situation and push prices below 75.00, a decline to 72.20 could follow.

Summary

Brent quotes dipped below the 76.00 USD level, continuing their decline for the fourth consecutive trading session. The pressure on oil prices is attributed to reduced economic growth in China and easing tensions in the Middle East.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.