Brent price begins to rise, surpassing 80.00 USD

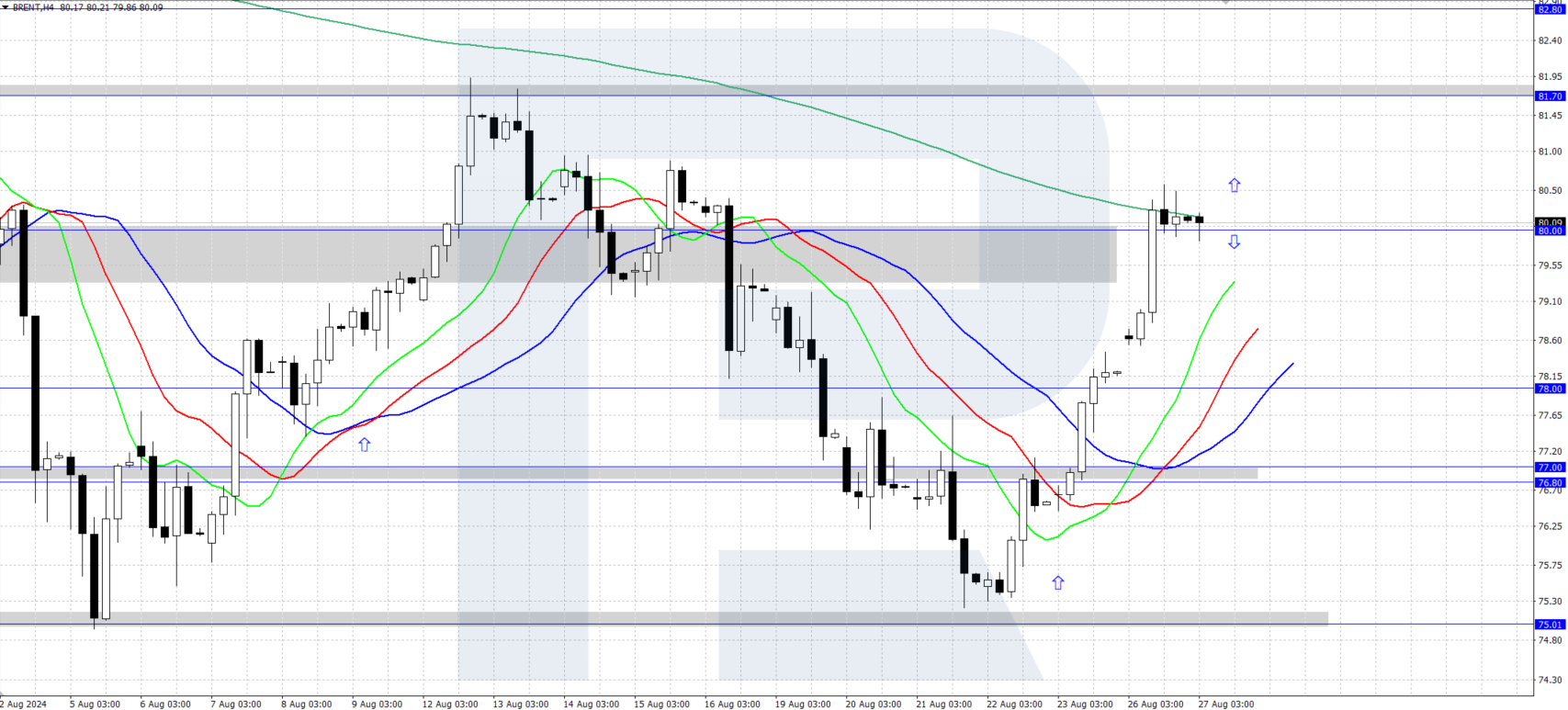

Brent price is experiencing steady growth, surpassing 80.00 USD per barrel; today, the focus is on the API oil stock data. Find out more in our Brent analysis for today, 27 August 2024.

Brent forecast: key trading points

- US data: the market awaits the API US oil inventory statistics today

- Brent forecast for 27 August 2024: 78.00 and 81.70

Fundamental analysis

Brent quotes have halted their decline and reversed upwards, finding support at a local daily low of 75.00 USD. Oil prices are being supported by a rise in stock markets, driven by the US Federal Reserve’s intention to start a monetary policy easing cycle, with the first rate cut in September.

Brent price will depend on US oil stock data from the American Petroleum Institute (API) during today’s American session. At the same time, the Energy Information Administration (EIA) will provide market participants with oil inventory statistics tomorrow. After the release of these figures, volatility in oil prices may increase.

Brent technical analysis

Although Brent has halted its decline on the daily chart and reversed upwards, it is still trading within a downtrend. The quotes hover just above the 80.00 mark, with a crucial resistance level of 81.70. If bulls surpass this level, this could signal an upward reversal of a daily trend.

The short-term Brent price forecast suggests that if bears push the quotes below 80.00, this could open the way for a decline to the 78.00 USD support level. If bulls maintain their positions above 80.00, the price is expected to rise to the 81.70 resistance level.

Summary

This week, Brent prices stopped declining after encountering strong demand near the 75.00 level. Further oil price movements will depend on the API and EIA oil stock statistics.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.