Gold (XAUUSD) continues its upward rally, rising above 2,600 USD

The XAUUSD price reached another all-time high at 2,630 USD at the beginning of the week. The gold trend is upward, but a downward correction is possible – read about it in our XAUUSD analysis for today, 23 September 2024.

XAUUSD forecast: key trading points

- Market focus: Gold is growing steadily on the back of the US Fed rate cut

- Current trend: a strong uptrend is underway

- XAUUSD forecast for 23 September 2024: 2,640 and 2,600

Fundamental analysis

XAUUSD quotes are rising steadily above 2,600 USD after the US Fed cut the interest rate by 0.50% last week. At the subsequent press conference, the regulator’s head, Jerome Powell, expressed his intention to implement two more 0.25% cuts before the end of the year.

Today, the composite Purchasing Managers Index (PMI) statistics published during the American trading session could drive volatility in precious metal prices. A decrease in the index would put pressure on the US dollar and would contribute to further growth of XAUUSD, while its increase could, on the contrary, lead to a decline in the pair’s quotes.

XAUUSD technical analysis

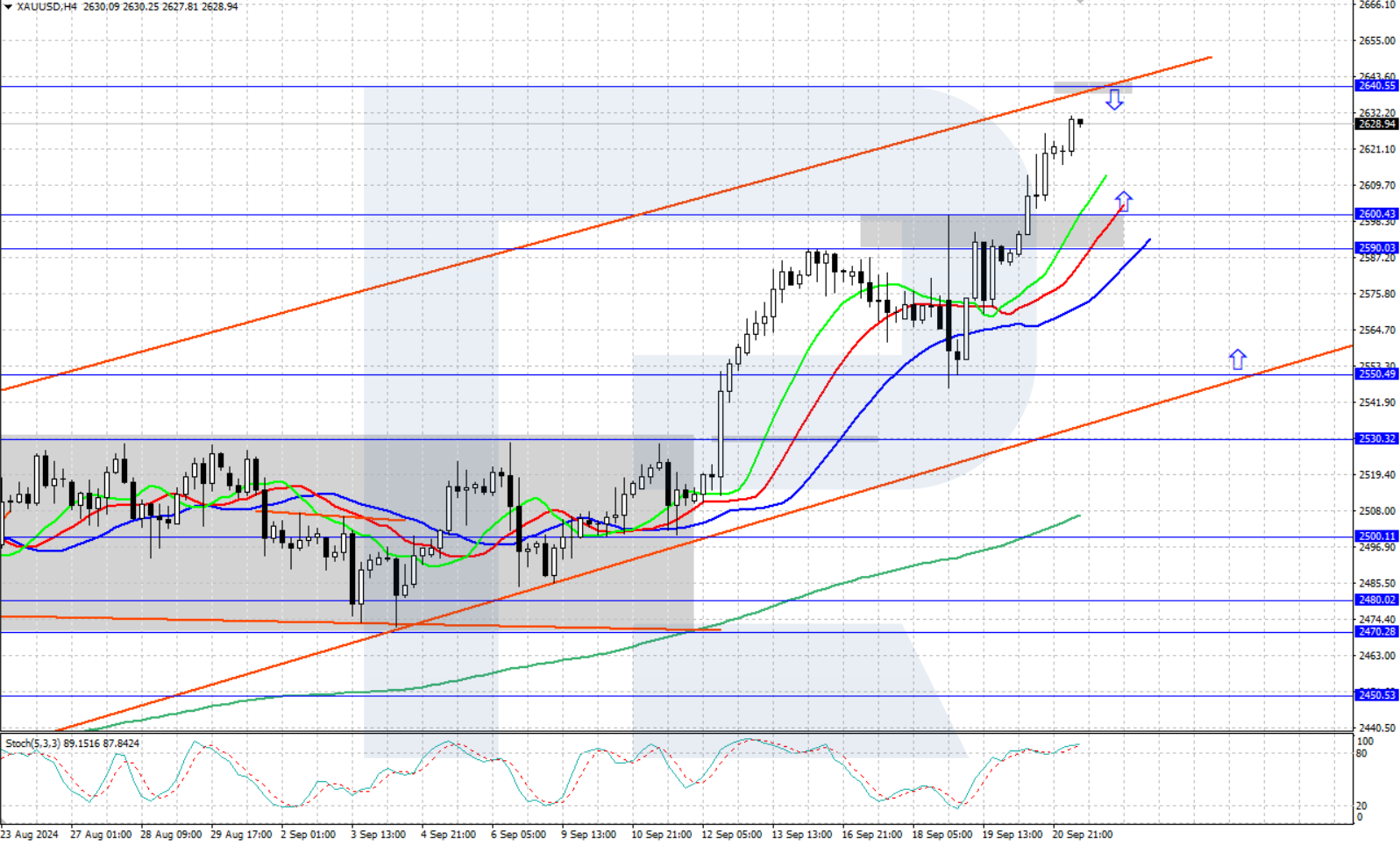

On the daily chart, XAUUSD is trading within a strong uptrend at the upper boundary of the price channel – the 2,630 USD mark. The price area between 2,630 and 2,640 USD may serve as significant resistance, from which the bears will try to push the quotes down into a local downward correction.

In the short-term XAUUSD price forecast, we can assume that if the bulls continue their upward movement and consolidate above 2,640 USD, further growth towards 2,700 USD could follow. If the bears manage to seize the initiative and trigger a local reversal in the resistance area of 2,630-2,640 USD, a downward correction towards the support levels of 2,600 and 2,550 USD may follow.

Summary

The gold price shows a strong upward rally, having confidently consolidated above 2,600 USD. The precious metal prices are supported by demand from global central banks and the US Federal Reserve’s decisive course towards reducing its key interest rate. Keep an eye on XAUUSD signals for potential shifts in market sentiment as new data and news emerge.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.