EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 14 January 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 14 January 2025.

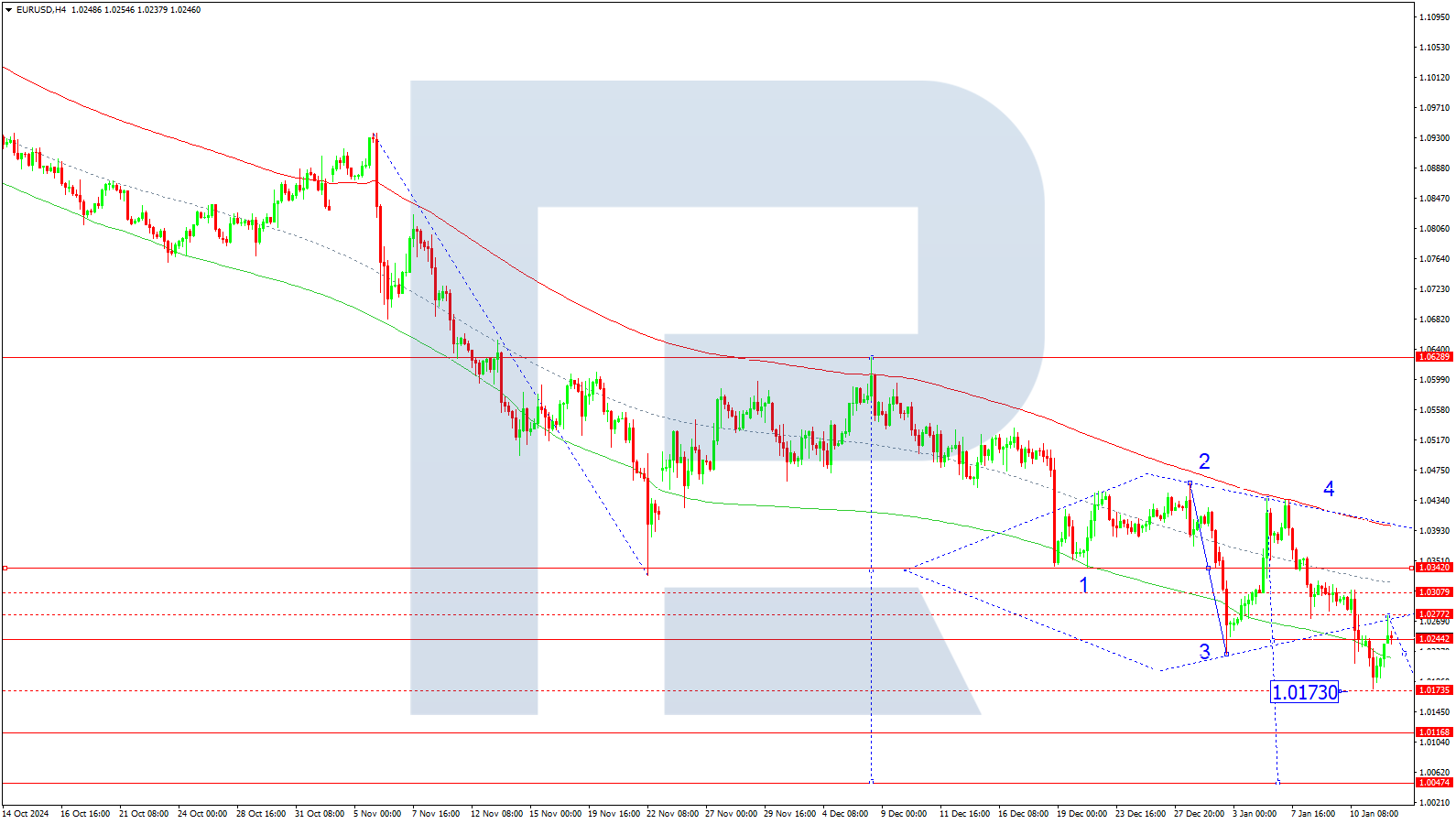

EURUSD forecast

On the H4 chart, EURUSD completed a downward wave to 1.0176 and executed a correction to 1.0276. Today, 14 January 2025, the price should decline to 1.0220. The market will likely consolidate around this level and may expand downward to 1.0173 as the first target. Afterwards, the price will likely rise to 1.0300 before forming a downward wave to 1.0168 as a local target.

This scenario aligns with the Elliott wave structure and the matrix for the fifth downward wave, centred at 1.0244. This level plays a key role in the current movement of EURUSD. The market continues forming a downward wave towards the lower boundary of the price Envelope at 1.0173. After reaching this target, it should correct to the central line at 1.0300.

Technical indicators for today’s EURUSD forecast suggest a potential decline to 1.0173.

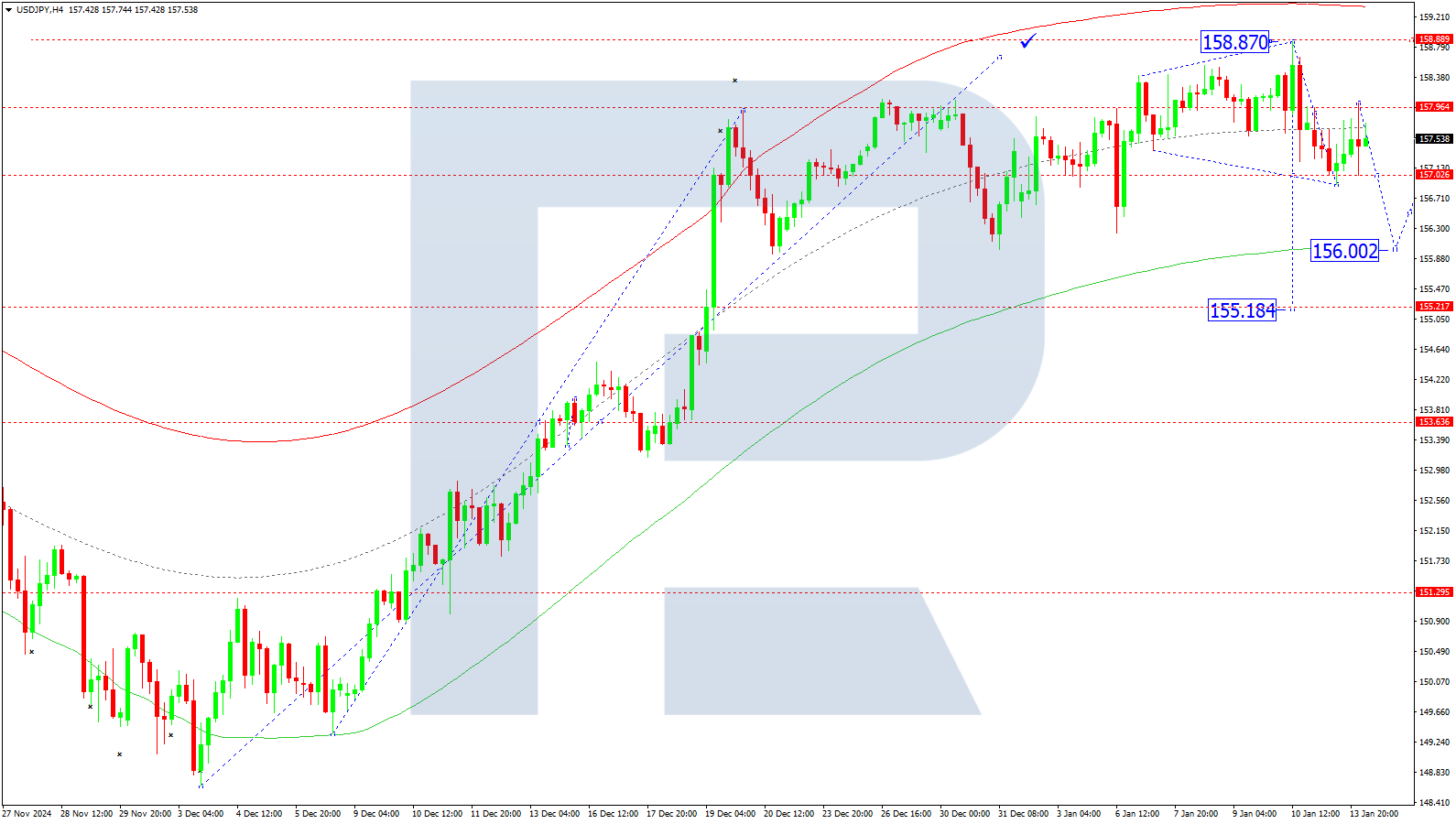

USDJPY forecast

On the H4 chart, USDJPY completed a downward impulse to 156.90 and a correction to 158.00. Today, 14 January 2025, the price has formed a consolidation range above 156.90. If the market breaks below this level, it will likely correct to 156.00. After this correction, the price should rise to 156.90 (testing from below) and then decline to 155.84. Once the market reaches 155.84, it is expected to form a wave of growth to 156.90.

This forecast aligns with the Elliott wave structure and the correction matrix, centred at 156.90. The market is currently trading near the central line of the price Envelope. The price is expected to move downwards to the lower boundary at 156.00, followed by a rise to the central line at 156.90.

Technical indicators for today’s USDJPY forecast suggest the possibility of a correction to 156.00.

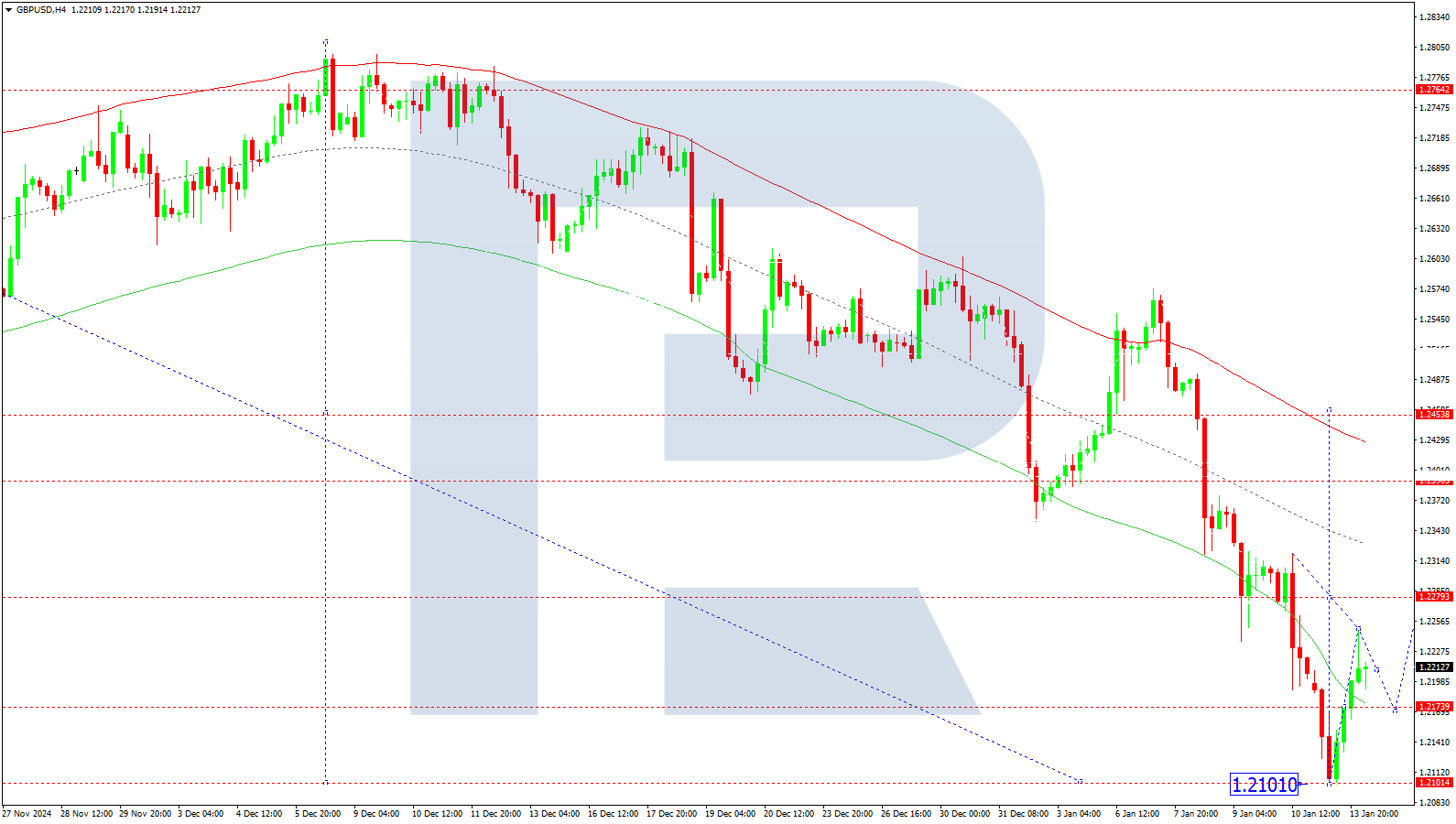

GBPUSD forecast

On the H4 chart, GBPUSD completed a downward wave to 1.2101 and is now rising impulsively towards 1.2249. Today, 14 January 2025, the price will likely decline to 1.2173. The market should consolidate around this level. If the market breaks downwards, the price will likely drop to 1.2080. Conversely, if it breaks upwards, the price should correct to 1.2390.

This scenario corresponds with the Elliott wave structure and the downward wave matrix, centred at 1.2333. The market is consolidating near the lower boundary of the price Envelope. The price is expected to rise to the central line at 1.2273, potentially advancing to the upper boundary at 1.2390.

Technical indicators for today’s GBPUSD forecast suggest a correction towards 1.2390.

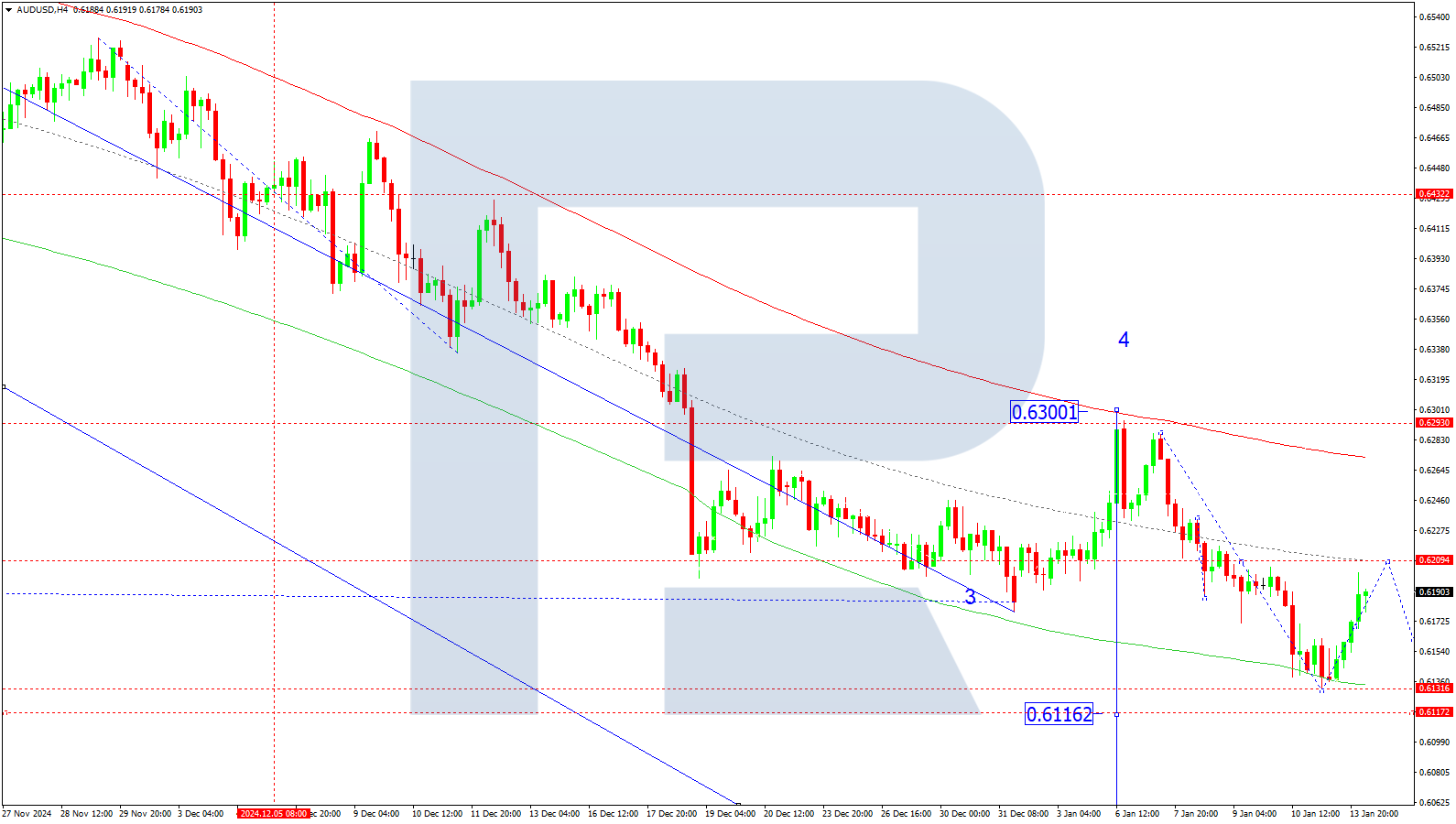

AUDUSD forecast

On the H4 chart, AUDUSD broke below 0.6185 and completed a downward wave to 0.6132 as a local target. Today, 14 January 2025, the price should undergo a correction to 0.6209, after which the market will likely form a new downward wave to 0.6116 as the first target.

This scenario aligns with the Elliott wave structure and the matrix for a downward wave centred at 0.6209. The market achieved its local target at the lower boundary of the price Envelope at 0.6132. The price could undergo a correction to the central line at 0.6209 before moving further downwards to the lower boundary at 0.6116.

Technical indicators for today’s AUDUSD forecast suggest the likelihood of a decline to 0.6116.

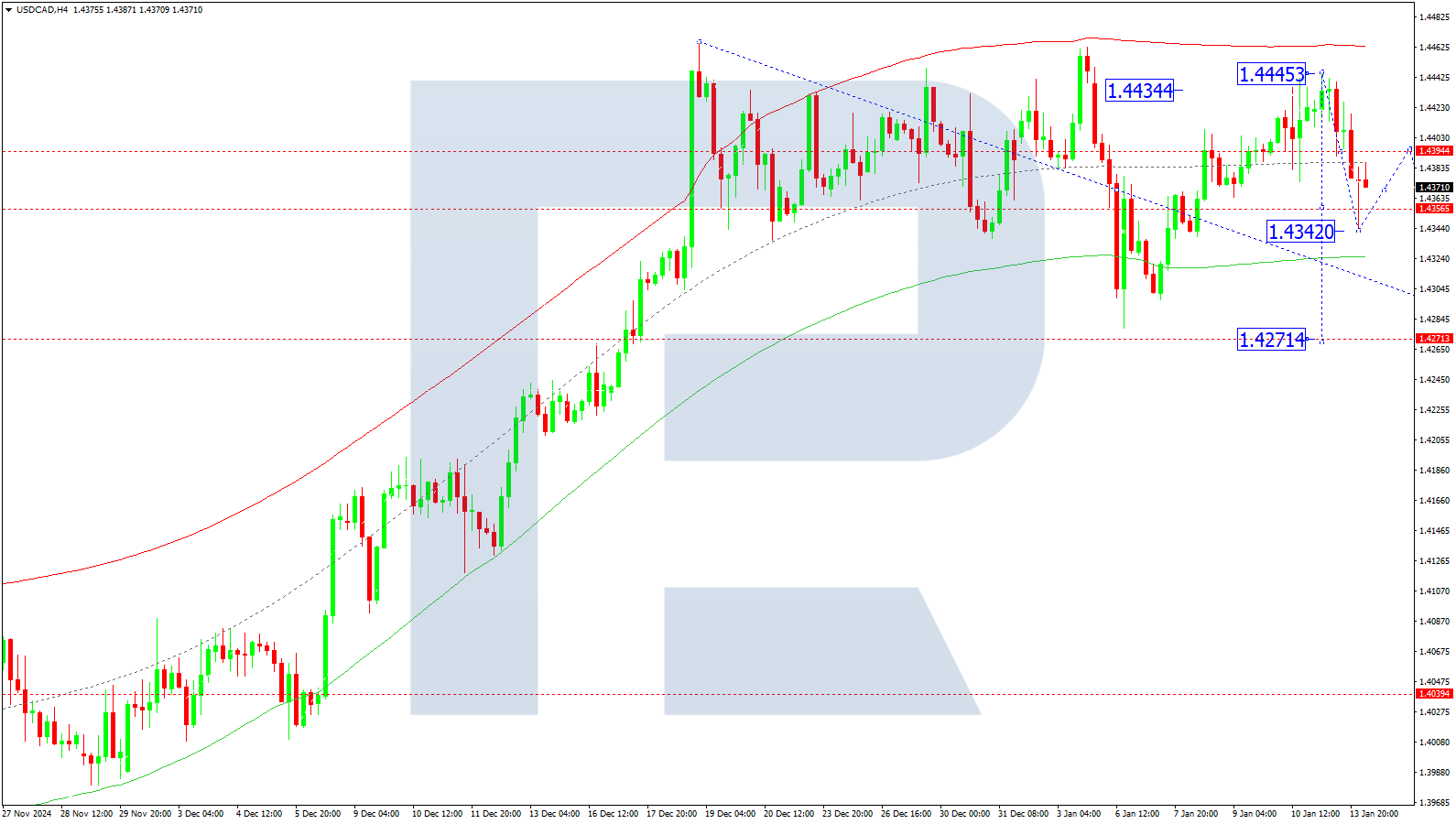

USDCAD forecast

On the H4 chart, USDCAD moved downwards to 1.4342. Today, 14 January 2025, the price is expected to undergo a correction to 1.4394. Subsequently, the market could form a new downward structure towards 1.4317, potentially continuing the movement to 1.4271.

The Elliott wave structure and the correction matrix, pivoting at 1.4375, validate this scenario. This level is considered crucial for this wave in the USDCAD rate. The price continues to move towards the lower boundary of the price Envelope at 1.4317. After reaching this boundary, the price may reverse and move towards the central line of the Envelope at 1.4355.

Technical indicators for today’s USDCAD forecast suggest the market could extend the downward wave to 1.4317.

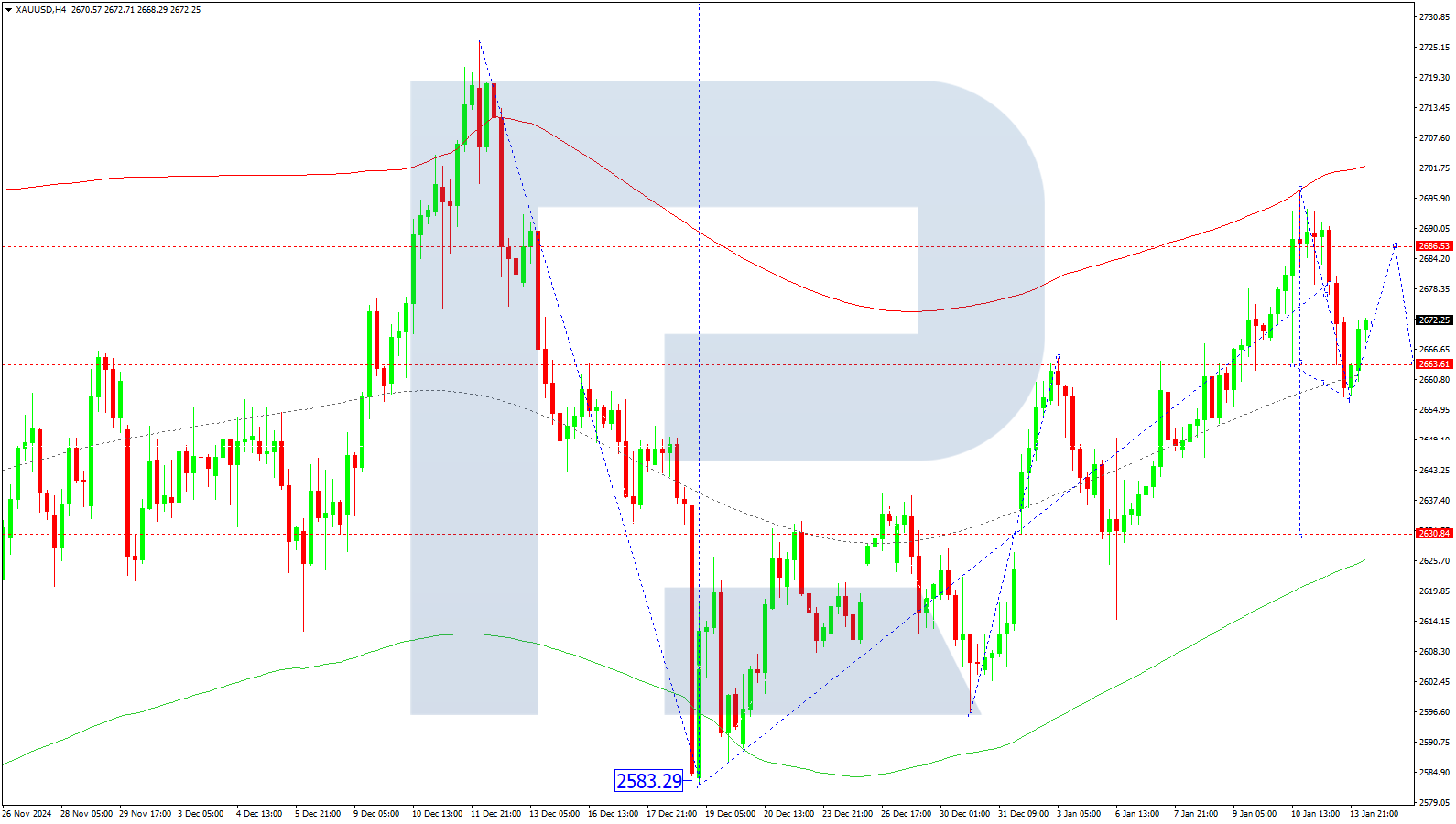

XAUUSD forecast

On the H4 chart, XAUUSD broke below 2,676 and moved downwards to 2,656. Today, 14 January 2025, the price is expected to rise to 2,686 before declining towards 2,641, the local target. Subsequently, the price may increase to 2,663 before falling further to 2,630.

The Elliott wave structure and the matrix for the upward wave, pivoting at 2,630, support this scenario. This level is considered crucial for the growth wave in the XAUUSD rate. The price is moving towards the lower boundary of the price Envelope at 2,630. Upon reaching this level, the price could reverse and move towards the central line of the Envelope at 2,663.

Technical indicators for today’s XAUUSD forecast suggest the price may decline to 2,630.

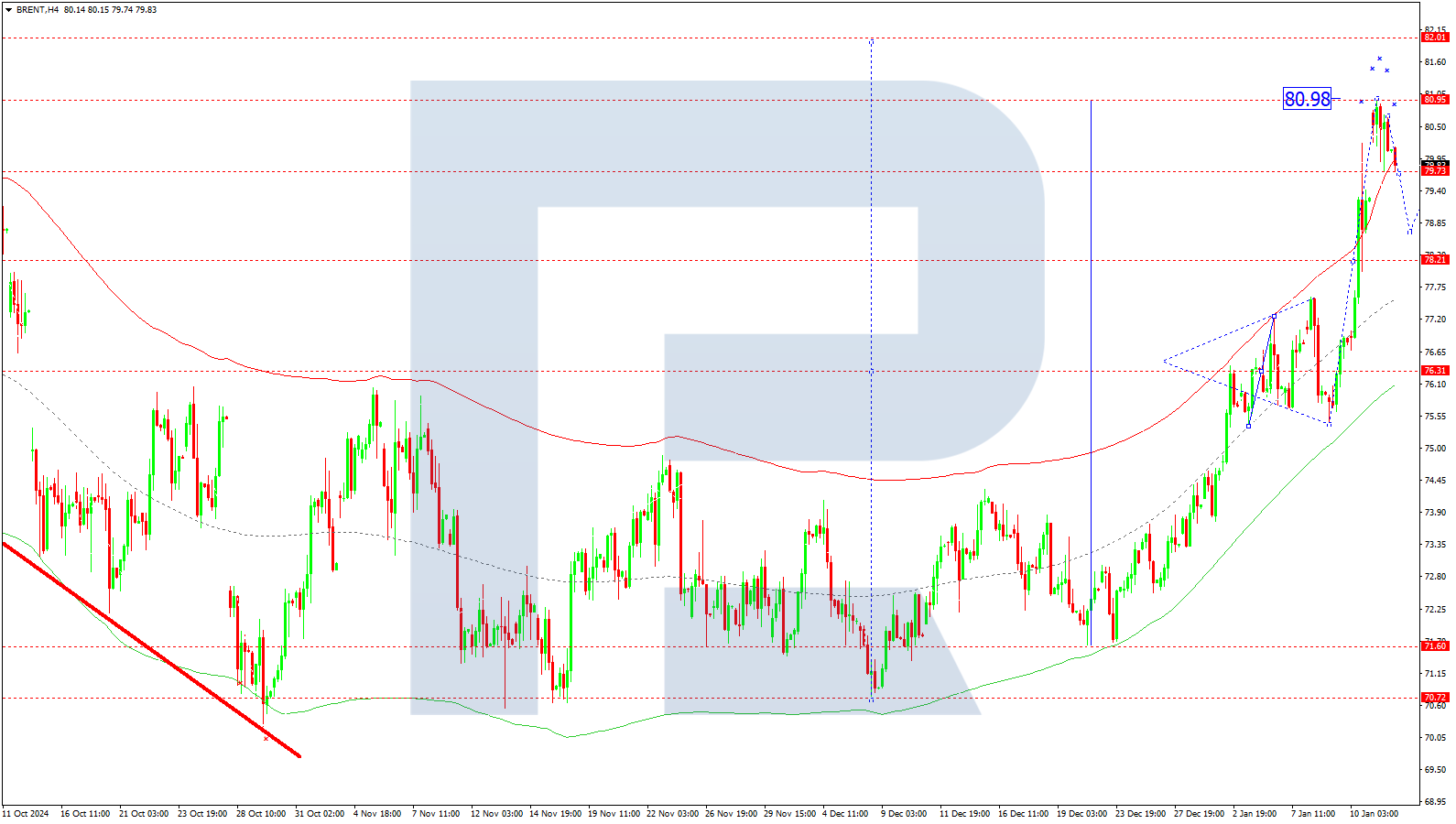

Brent forecast

On the H4 chart, Brent crude moved upwards to 80.98. Today, 14 January 2025, the market could consolidate below this level. A downward breakout below 79.79 might lead to a correction towards 76.30 (testing from above), after which the market may initiate a new upward wave towards 82.00.

The Elliott wave structure and the upward wave matrix, pivoting at 76.30, support this scenario. This level, around the central line of the price Envelope, is considered crucial for the Brent rate. The market reached the upper boundary of the price Envelope at 80.98. A correction to its lower boundary at 76.30 is possible today.

Technical indicators for today’s Brent forecast suggest the market may initiate a correction to 76.30.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.