BoJ’s soft monetary policy favours USDJPY strength

USDJPY is rising for the third consecutive trading session. Read more in our analysis for today - 27 September 2024.

USDJPY forecast: key trading points

- Core inflation in Tokyo declined to 2.0% in September from 2.4% in August

- Japan’s index of leading economic indicators was revised downwards to 109.3 in July

- Japan’s unemployment rate rose to 2.7%, which may increase pressure on the yen and support further USD appreciation

- USDJPY forecast for 27 September 2024: 145.77 and 146.66

Fundamental analysis

The USDJPY rate continues to strengthen, with buyers confidently overcoming the 144.75 resistance level and heading towards 147.45. The yen’s fall was triggered by the latest Tokyo inflation data, which is a key indicator of the nationwide price trends.

According to the report, Japan’s core inflation slowed to 2.0% in September from 2.4% in the previous month, matching analysts’ forecasts and confirming the BoJ’s restrained approach to interest rate hikes. Bank of Japan Governor Kazuo Ueda said earlier that the regulator has room to wait and assess economic conditions before making further monetary policy decisions. This indicates that there is no urgency regarding interest rate changes.

The revised data for Japan’s index of leading economic indicators showed a decline to 109.3 in July from the initial estimate of 109.5. This figure was attributed to the expansion of the service sector and the rise in consumer confidence, which reached a 3-month high. However, unemployment increased to 2.7%, the highest since August 2023. This may support the current USDJPY growth within the forecast for today.

USDJPY technical analysis

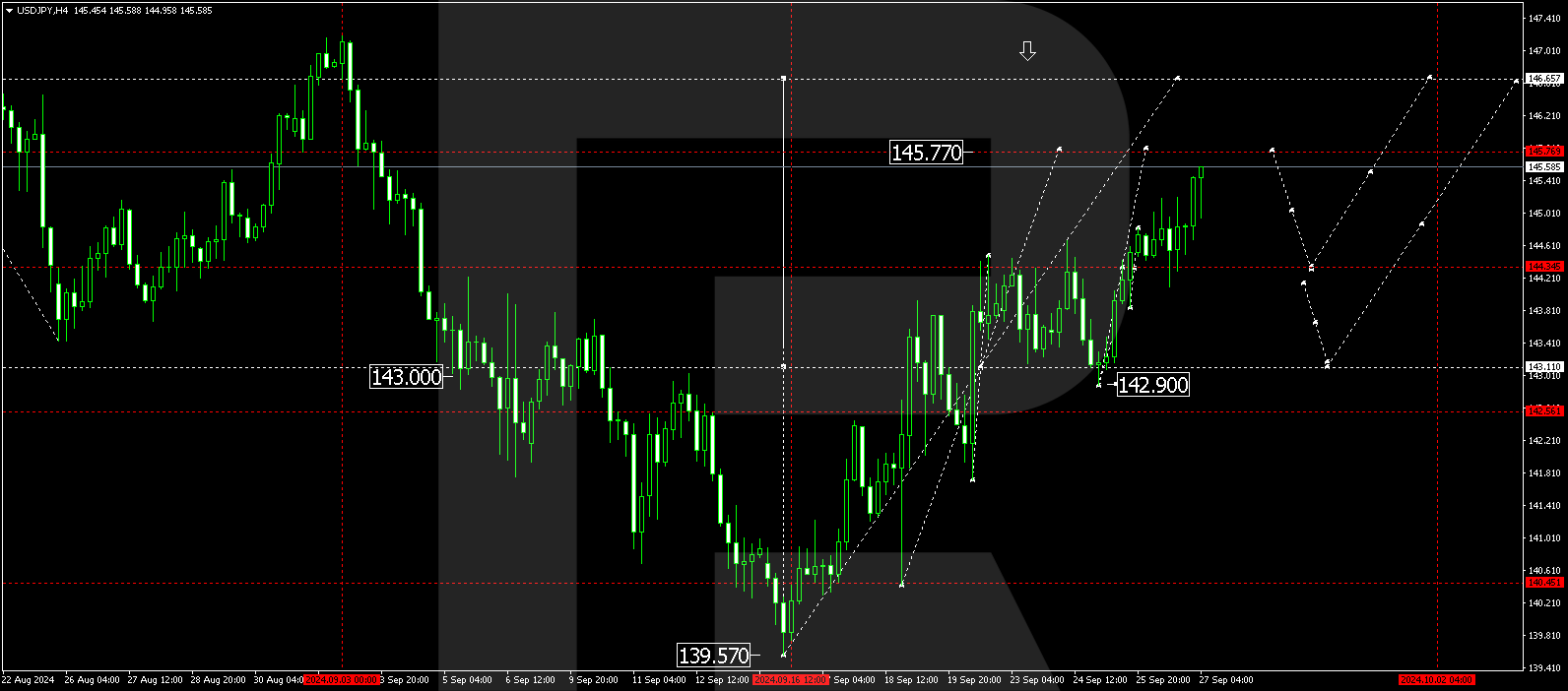

On the USDJPY H4 chart, the market has formed a narrow consolidation range around the 144.34 level and continues to develop an upward wave towards the 145.77 level.

For today’s USDJPY forecast, we expect this level to be tested. A potential USDJPY correction to the 142.90 level is possible shortly, but we anticipate further upward movement towards the 146.66 level after the correction. This target is the primary objective for this wave of growth, which is part of a broader correction from the previous decline at 139.60.

Summary

USDJPY is strengthening amid slowing Tokyo inflation and the BoJ’s restrained approach to rate hikes. Despite the rise in consumer confidence, a higher unemployment rate and revised economic indicators suggest that economic risks remain and are likely to continue to weigh on the JPY. Technical indicators for today’s USDJPY outlook suggest the likelihood of the upside wave continuing towards the 145.77 and 146.66 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.