DE 40 analysis: the index is trading within a sideways channel with the potential for further decline

The DЕ 40 stock index remains in a sideways channel between current resistance and support levels. The DЕ 40 price forecast suggests a further decline.

DE 40 trading key points

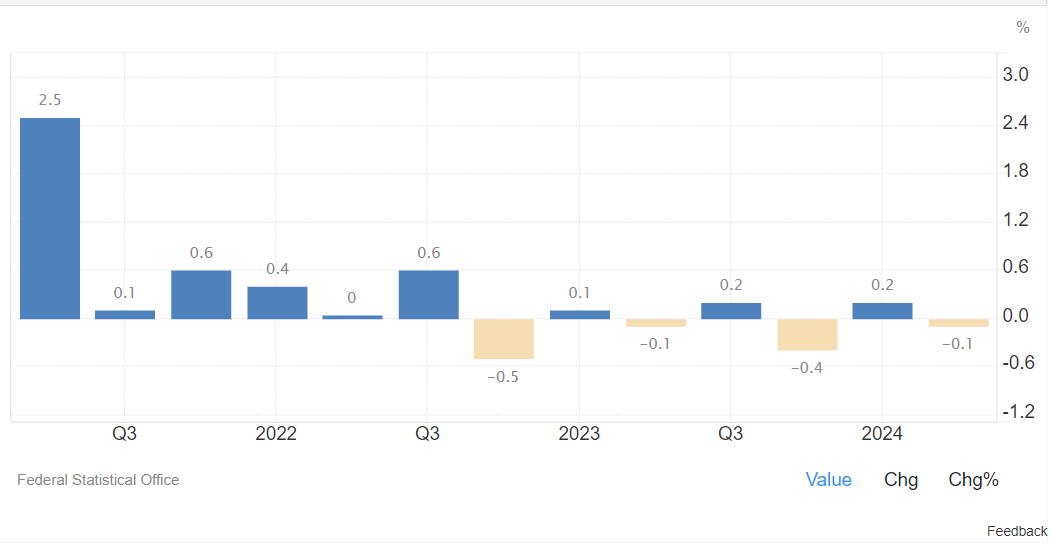

- Recent data: Germany’s GDP in Q2 2024 decreased by 0.1% year-over-year

- Economic indicators: Germany is the only developed country experiencing an economic downturn, which indicates a stagnant corporate sector

- Market impact: both foreign and domestic traders are hesitant to invest in assets from a country approaching recession

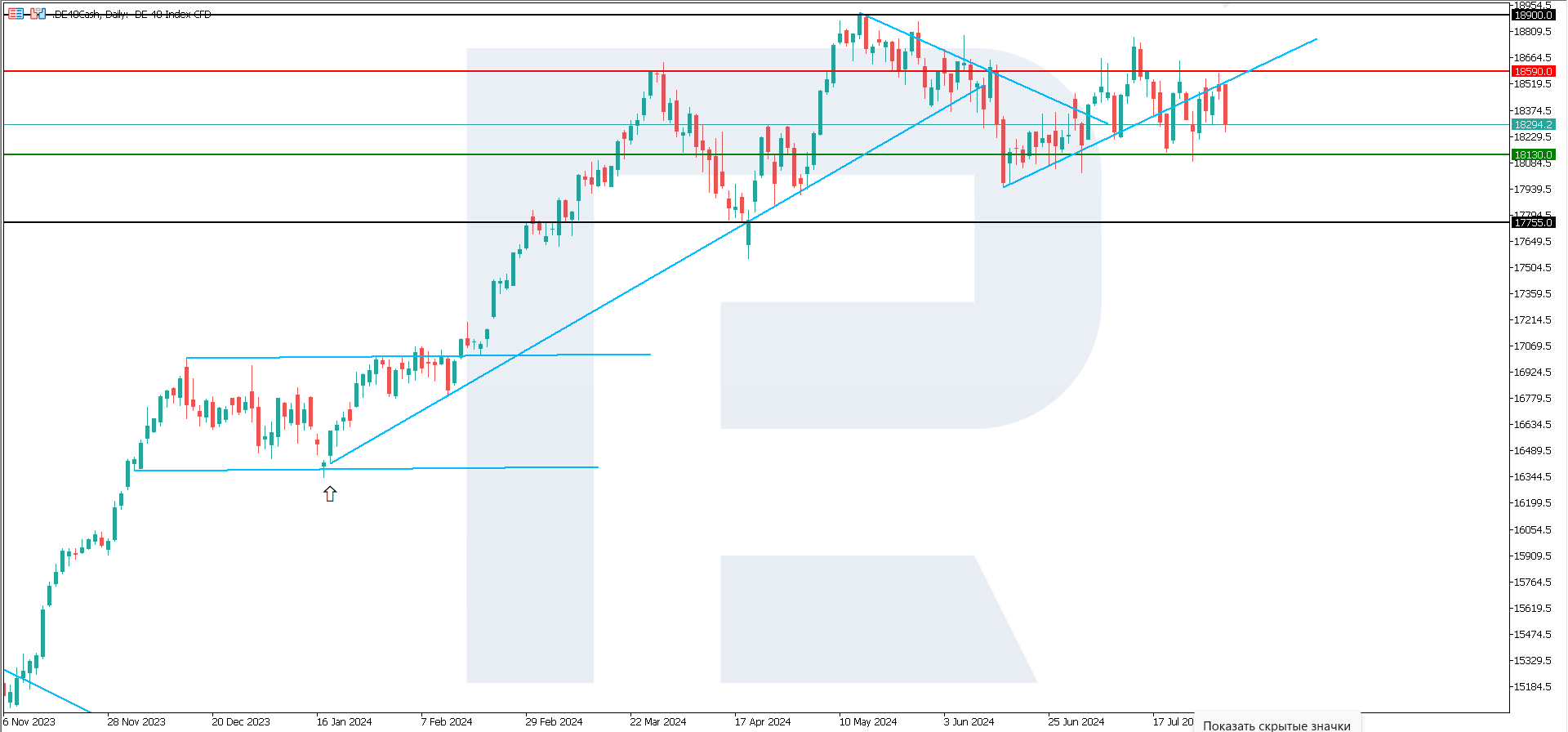

- Resistance: 18,590.0, Support: 18,130.0

- DE 40 price forecast: 17,755.0

Fundamental analysis

Germany’s economic weakness is rooted in its once-strong production sector, which has historically supported export-oriented growth. However, German automakers, which were the central pillar to the country’s success, are also struggling to catch up as they face Chinese competition in the electric vehicle market.

Source: https://tradingeconomics.com/germany/gdp-growth

The latest financial results from Germany’s largest manufacturing companies reflect similar challenges. BASF’s profit decreased following price declines across its chemicals business, while the Mercedes-Benz Group lowered its key margin forecast amid a subdued outlook and fierce competition from China. Volkswagen, which has already adjusted its projections downward, will release its earnings report today, 1 August 2024.

Economic problems in Germany extend beyond cyclical fluctuations. According to Bloomberg Economics estimates, half of the 7% estimated industrial decline is structural. Factors such as reduced inflation outside the energy sector and continued wage growth might offer some support. Additionally, the 2025 budget plan the current government approved last month following challenging negotiations could influence sentiment positively. However, the prevailing news landscape suggests a negative DE 40 forecast for next week.

DE 40 technical analysis

From the technical analysis perspective, the DE 40 index forecast suggests a decline. The quotes are in a sideways channel that formed over the past week. Given the intense selling pressure, the price will likely breach the lower boundary of the channel at 18,130.0.

Key levels in the DE 40 analysis to watch include:

- Resistance level: 18,590.0 – if the price breaks above this level, it could target 18,900.0

- Support level: 18,130.0 – if the price breaks below this support, it could aim for 17,755.0

Summary

The DE 40 stock index is trading within a sideways channel amid negative GDP statistics and weak corporate reports from Germany. A further price decline is likely, with a potential decline target at the 17,755.0 level. A mid-term downtrend will form in such a scenario.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.