Japanese Candlesticks Analysis 24.07.2020 (USDCAD, AUDUSD, USDCHF)

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, after re-testing the descending channel’s downside border and forming a Harami pattern, USDCAD has started reversing. Considering the current downtrend, one may assume that the asset may correct towards 1.3475 and then continue falling. In this case, the downside target is at 1.3333. Still, an opposite scenario suggests that the instrument may continue growing to return to the resistance area at 1.3550.

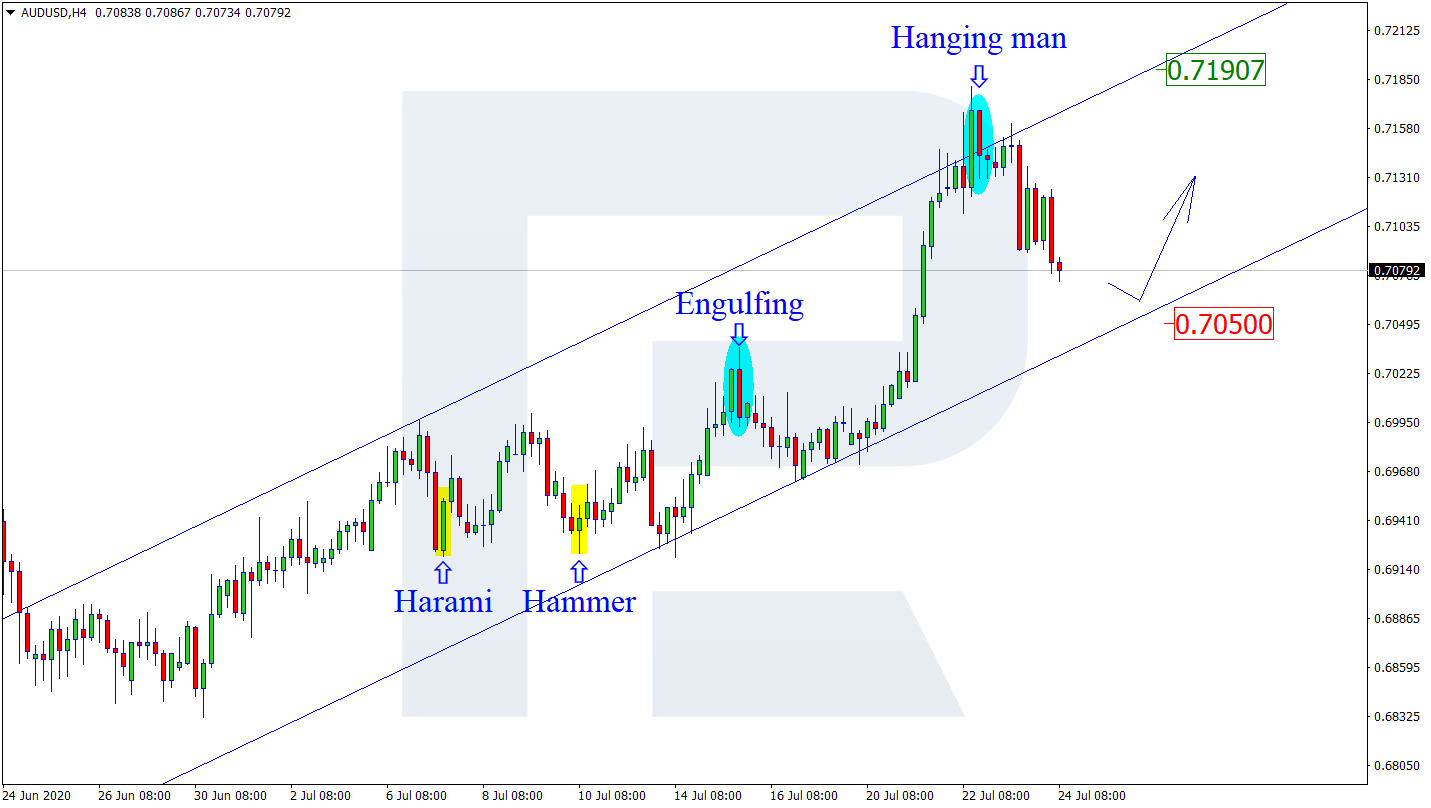

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the uptrend continues. By now, AUDUSD has formed a Hanging Man pattern not far from the resistance area; at the moment, the pair is reversing. The downside target may be the rising channel’s downside border at 0.7050. Later, the price may rebound from the support level and resume the rising tendency. In this case, the upside target will be at 0.7190. At the same time, one shouldn’t exclude another scenario, which implies that the instrument may continue falling and return to 0.7000.

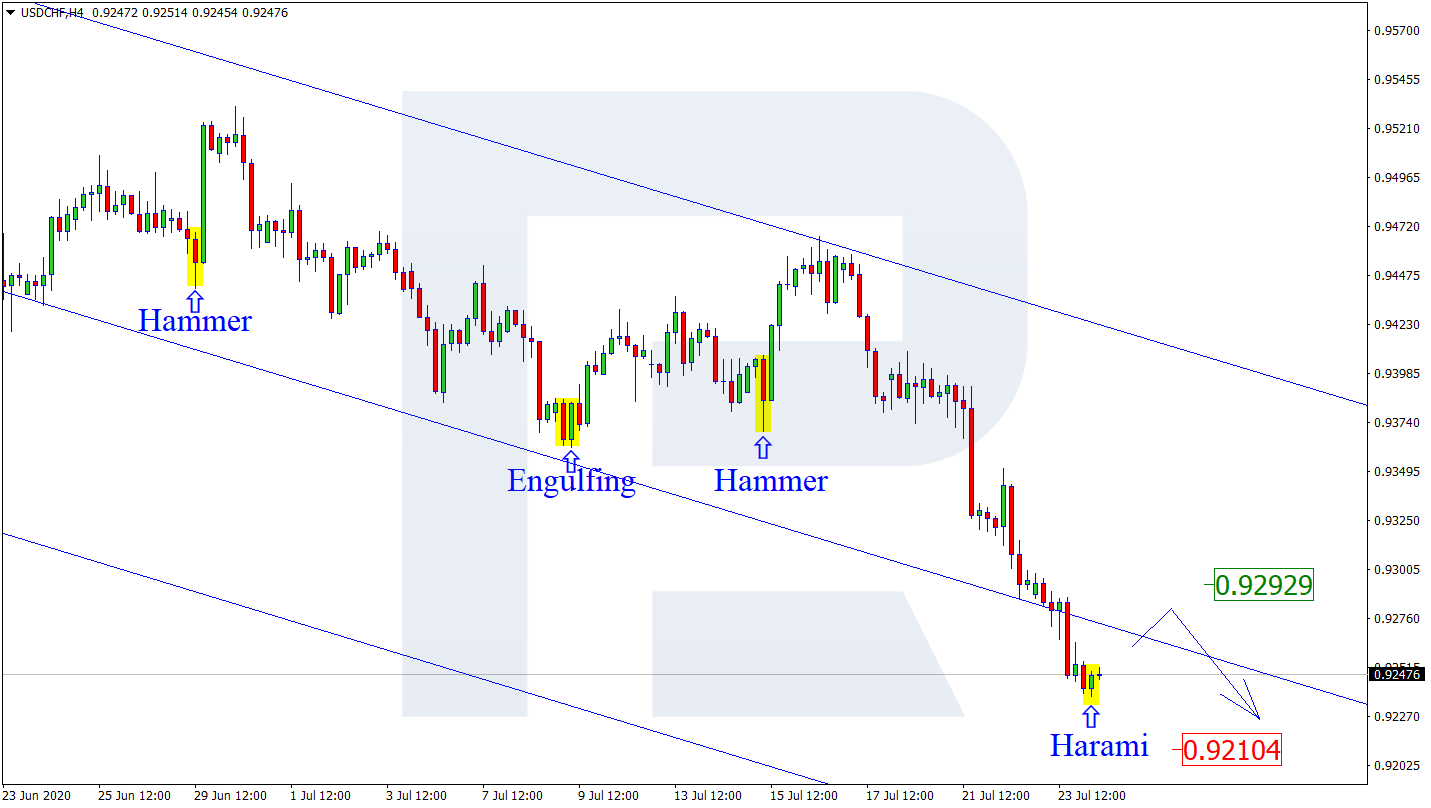

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after breaking the channel’s downside border and forming a Harami pattern not far from the support area, USDCHF is reversing. The correctional target is at 0.9292. After completing the pullback, the pair may resume trading downwards to reach the next downside target at 0.9210. Later, the market may update its lows and continue falling.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.