Brent awakens: oil prices rise amid new sanctions

Brent crude oil prices are once again recovering and trading near 64.20 USD per barrel. Find more details in our analysis for 23 October 2025.

Brent forecast: key trading points

- OPEC+ maintains an optimistic outlook

- Brent is on the rise again

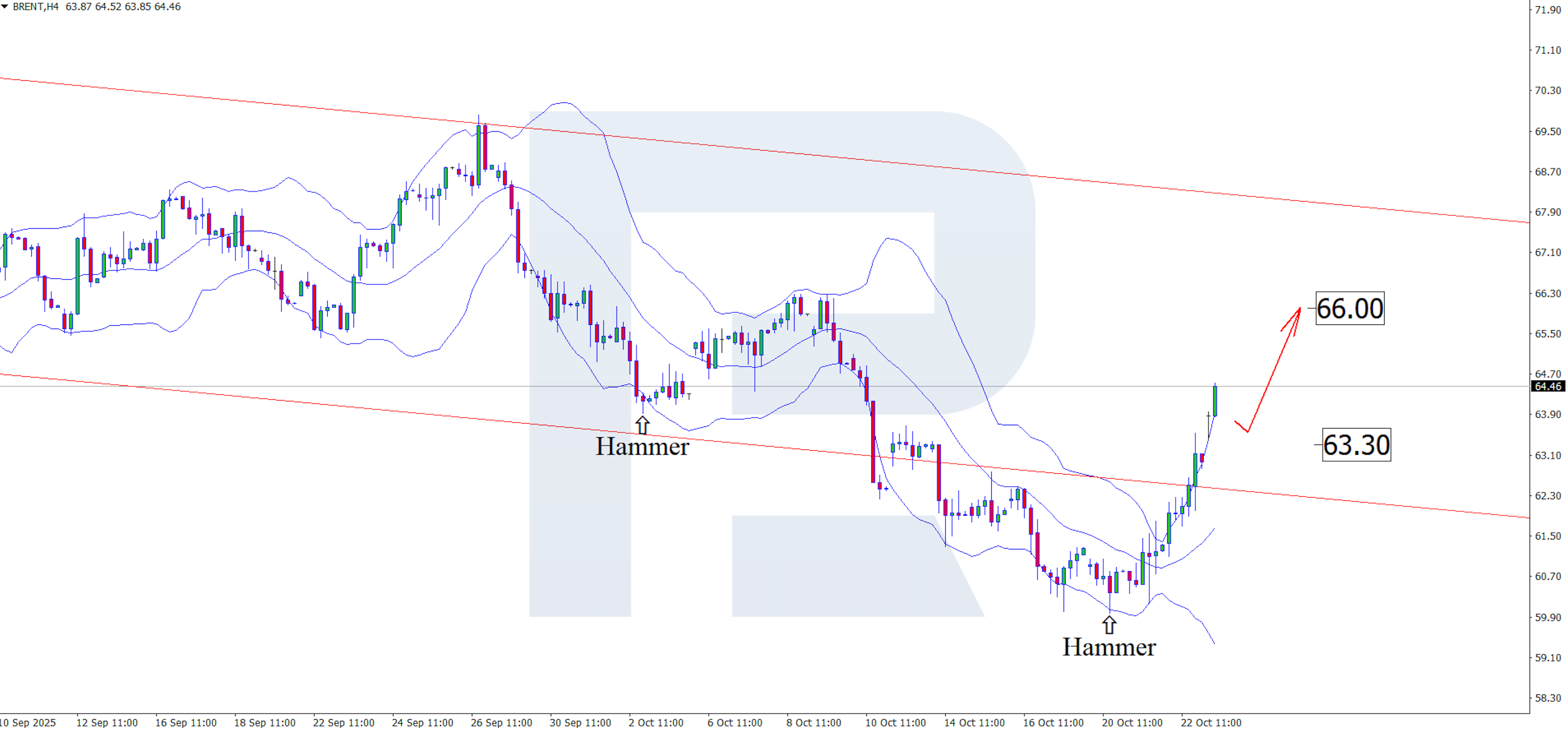

- Brent forecast for 23 October 2025: 66.00 or 63.30

Fundamental analysis

The Brent fundamental analysis for today, 23 October 2025, indicates that after a decline, Brent prices are now forming a new upward wave and trading around 64.20 USD per barrel.

OPEC+ remains optimistic, projecting higher demand for oil, particularly in Asian markets. The group acknowledges the growth in global output but emphasises the need to maintain the balance between supply and demand. An oversupply could still pressure prices, but for now, the market is showing signs of recovery.

Key factors supporting the current growth include:

- New US sanctions

- India’s search for new suppliers

- Potential US export cuts or strategic reserve operations aimed at influencing global oil flows

Overall, the Brent forecast for 23 October 2025 appears cautiously bullish. Despite the broader downtrend, prices have returned to the channel boundaries and are forming a recovery wave.

Brent technical analysis

On the H4 chart, Brent quotes tested the lower Bollinger Band and formed a Hammer reversal pattern. They are currently following the signal in the form of an upward wave.

An upside target in today’s Brent forecast is the 66.00 USD level. A breakout above the resistance level could trigger stronger bullish momentum.

However, an alternative scenario suggests that a short-term correction towards 63.30 USD could occur before the uptrend resumes.

Summary

Despite ongoing risks of global oversupply, Brent crude shows signs of recovery. Today’s technical analysis indicates that prices may continue to rise towards 66.00 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.