Gold rises amid weak US statistics

Gold prices reversed upwards amid weak US data release on Thursday

According to the released housing market data, Building Permits decreased by 3.8% in May, and Housing Starts by 5.5%. The Philadelphia Fed Survey's Manufacturing Sector Index fell to 1.3 from 4.5 last month. As a result of Thursday's developments, gold strengthened against the US dollar.

The rise in XAUUSD is driven by fundamental factors, with the asset experiencing increased demand from central banks and other market participants. Geopolitical tensions and expectations of lower yields on US government bonds amid the anticipated easing of the Federal Reserve's credit and monetary policy also contribute to the increased interest. According to forecasts from various experts, the global upward trend in gold is expected to continue in the next five years.

XAUUSD technical analysis

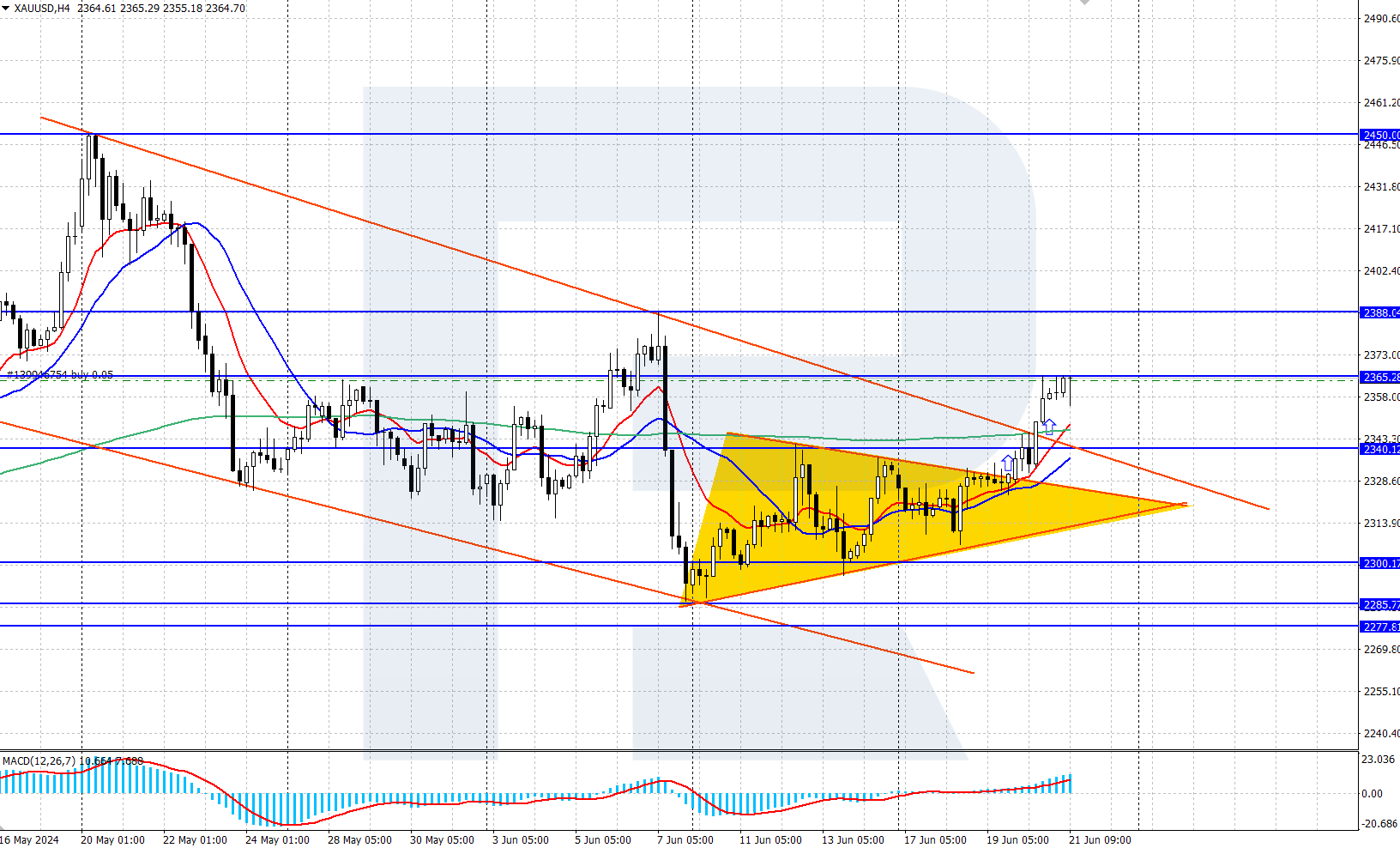

On the H4 chart, Gold quotes are experiencing an upward reversal, securing above the resistance line of a descending price channel. A Triangle pattern formed this week. The price has broken above it and is currently moving along the pattern with an estimated growth target at 2385.

XAUUSD technical analysis 21.06.2024

As part of a short-term forecast, the price may be expected to continue developing the Triangle pattern, with XAUUSD quotes continuing their ascent to the daily resistance area at 2388 after a slight correction. The scenario suggesting Gold strengthening could be invalidated if the price retraces to the previously breached descending channel and secures below the 2340 support level.

Summary

Amid the weak US economic data release, Gold quotes are experiencing steady upward momentum on the H4 chart, breaking above the upper boundary of the descending price channel. This indicates a potential completion of the downward correction, opening the potential for further growth to an annual high of 2450.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.