Gold (XAUUSD) has reversed upwards from 2,600 USD

XAUUSD prices continue a moderate correction following last week’s surge. The quotes are now attempting to reverse upwards and continue their ascent. More details in our XAUUSD analysis for today, 27 November 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting the US Q3 GDP data today

- Current trend: moving upwards

- XAUUSD forecast for 27 November 2024: 2,600 and 2,720

Fundamental analysis

The Federal Reserve’s latest meeting minutes, released yesterday, highlighted the need for a more cautious approach to interest rate cuts, indicating that the process may be slower than expected. The cautiousness stems from persistent inflation and uncertainty regarding an appropriate rate level.

The US Q3 GDP statistics are due today, with growth expected by 2.8%. Weaker-than-forecast data could exert pressure on the US dollar and support XAUUSD. Conversely, stronger figures may prompt a correction in the pair.

XAUUSD technical analysis

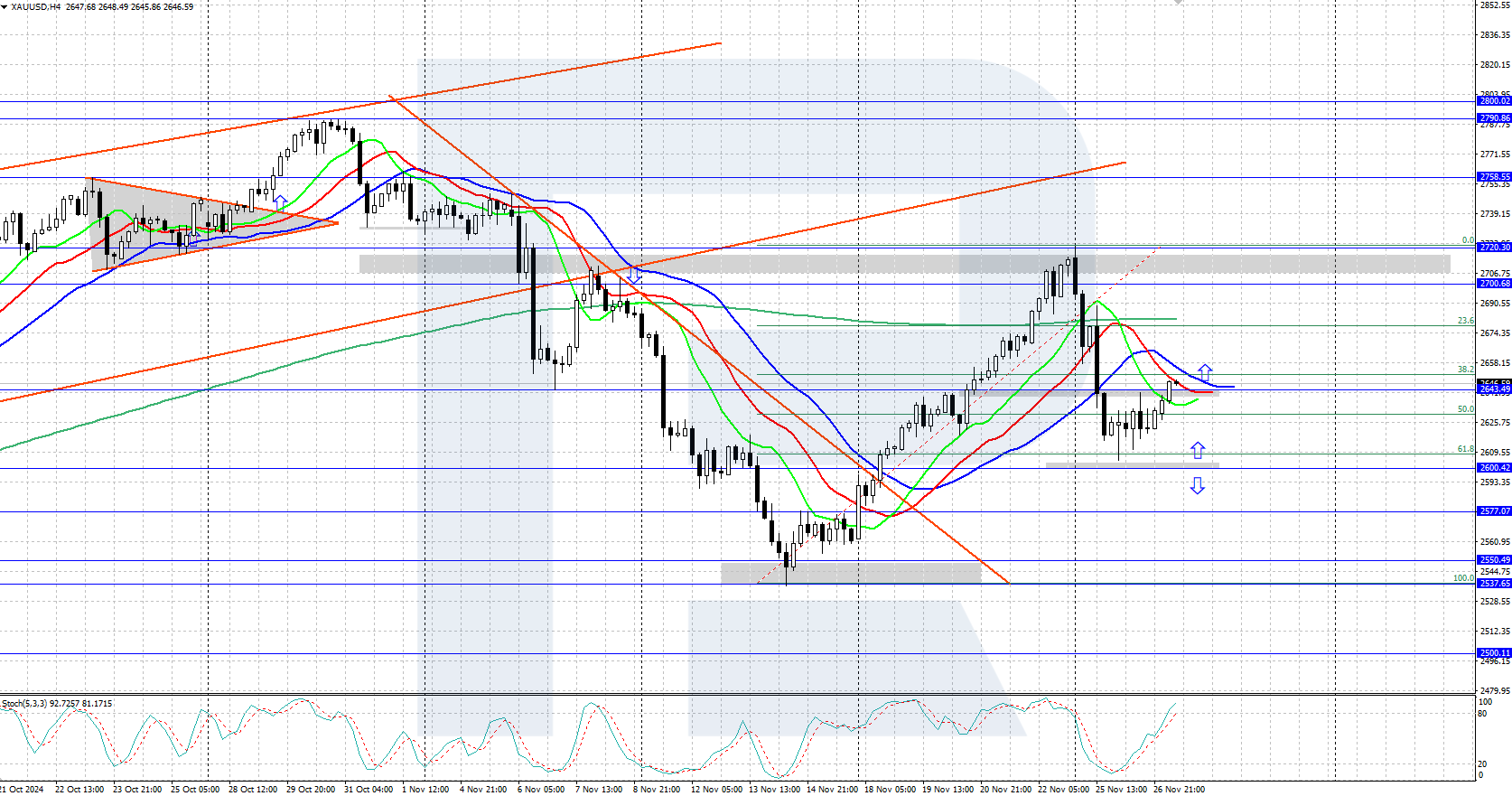

On the H4 chart, the XAUUSD pair has corrected downwards from the 2,700-2,720 USD resistance area following last week’s steady upward movement. Yesterday, the quotes approached a strong support near the 2,600 USD level and rebounded upwards. This development suggests the correction may be complete, and further growth towards the all-time high of 2,790 USD may follow.

The short-term XAUUSD price forecast indicates that prices could continue to rise after an upward reversal from 2,600 USD and a consolidation above 2,643 USD. However, if bears take control and firmly establish themselves below 2,600 USD, it could signal the end of the upward scenario.

Summary

XAUUSD quotes completed a downward correction and reversed upwards from 2,600 USD. Today, market participants will focus on the US Q3 GDP data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.