Gold (XAUUSD) is rising amid demand: the market needs safe-haven assets

Gold prices start the week at around 2,690 USD. Rising global risks are prompting investors to seek protection. Find out more in our analysis for 13 January 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) is in positive territory

- The market’s demand for safe-haven assets supports Gold prices, even amid the ongoing rally in the US dollar

- XAUUSD forecast for 13 January 2025: 2,693, 2,700, and 2,710

Fundamental analysis

Gold (XAUUSD) troy ounce prices hover around 2,690 USD on Monday. As risk aversion becomes increasingly apparent in the market, Gold is poised to breach the 2,700 USD mark. Against this backdrop, buyers appear willing to disregard the impact of a strong US dollar, which traditionally weighs on Gold prices.

The key factor driving uncertainty is the future policy of the US White House. President-elect Donald Trump will take office on 20 January. His proposed trade tariffs could trigger global confrontation and higher inflation, thereby creating favourable conditions for Gold, which acts as a hedge against inflation.

Investors will monitor the release of the US Consumer Price Index this week, which will provide additional insight into the Federal Reserve’s monetary policy outlook.

The Gold (XAUUSD) forecast appears positive.

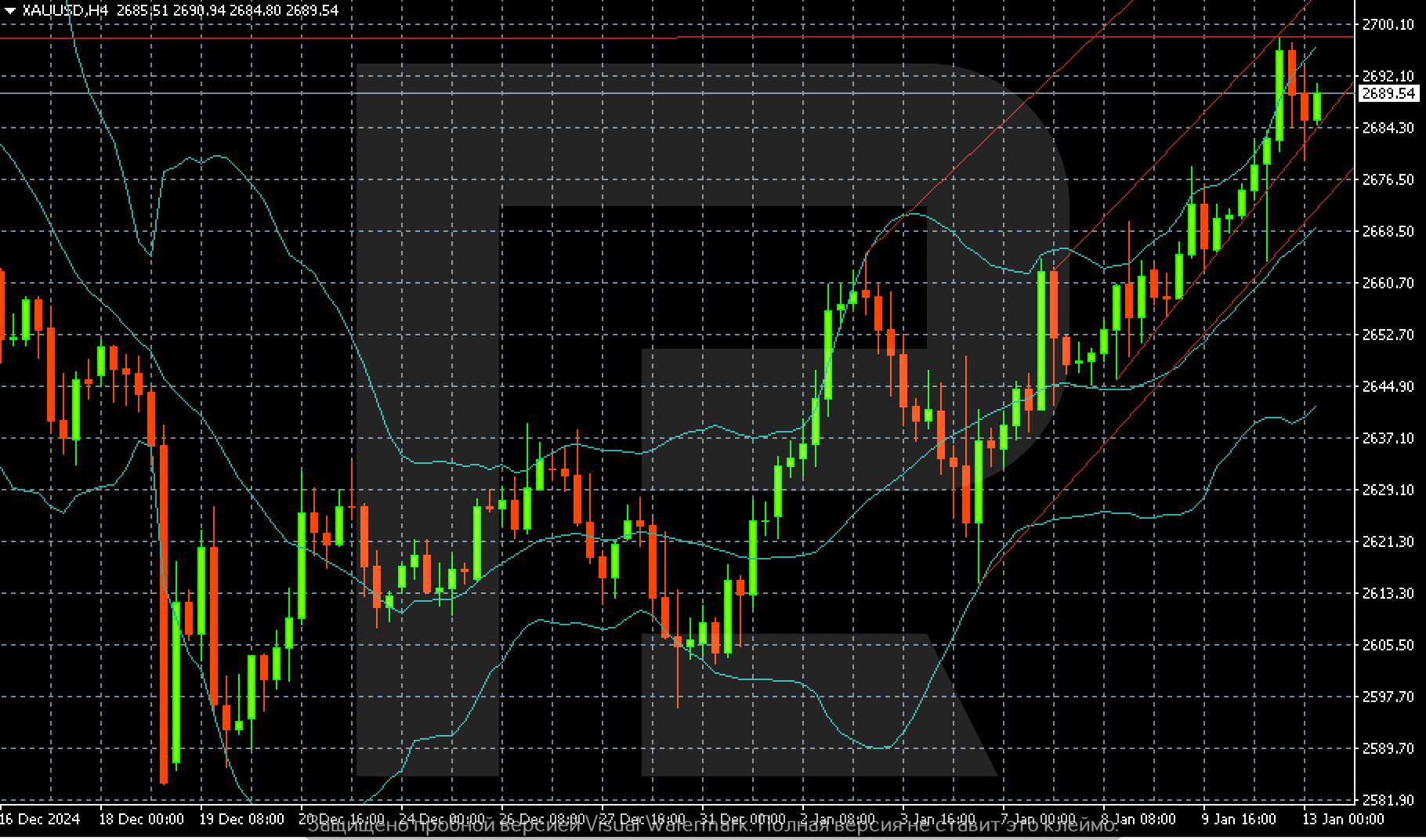

XAUUSD technical analysis

On the H4 chart, the primary near-term target for Gold (XAUUSD) is 2,700 USD. This level could be achieved if prices consolidate above 2,693 USD, with a further growth target set at 2,710 USD.

The Gold (XAUUSD) forecast for today, 13 January 2025, indicates the need to monitor the 2,680-2,692 USD area. Several intermediate support levels lie within this area, and a break below could drive the market down towards 2,676 USD.

Summary

Gold prices may continue to rise as demand for safe-haven assets strengthens. The nearest growth targets are the 2,693 and 2,710 USD levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.