Gold (XAUUSD) corrected towards the 2,920 USD support level

XAUUSD quotes are undergoing a local downward correction, falling to the 2,920 USD support level. Market participants are awaiting US GDP statistics this week. Find more details in our XAUUSD analysis for today, 24 February 2025.

XAUUSD forecast: key trading points

- Market focus: US GDP statistics for Q4 2024 will be released on Thursday

- Current trend: undergoing a local correction within the uptrend

- XAUUSD forecast for 24 February 2025: 2,920 and 2,955

Fundamental analysis

XAUUSD prices went into a local downward correction after setting an all-time high of 2,955 USD last week. Gold prices are now under pressure from the upcoming talks on a peaceful agreement to resolve the military conflict in Ukraine, which could ease the current geopolitical tensions.

One of the week’s key events will be the release of US GDP data for Q4 2024 on Thursday, with the economy expected to grow by 2.3%. Weaker-than-forecast statistics will put pressure on the USD and help Gold strengthen. Conversely, stronger-than-expected growth will support the US dollar, potentially pushing XAUUSD quotes lower.

XAUUSD technical analysis

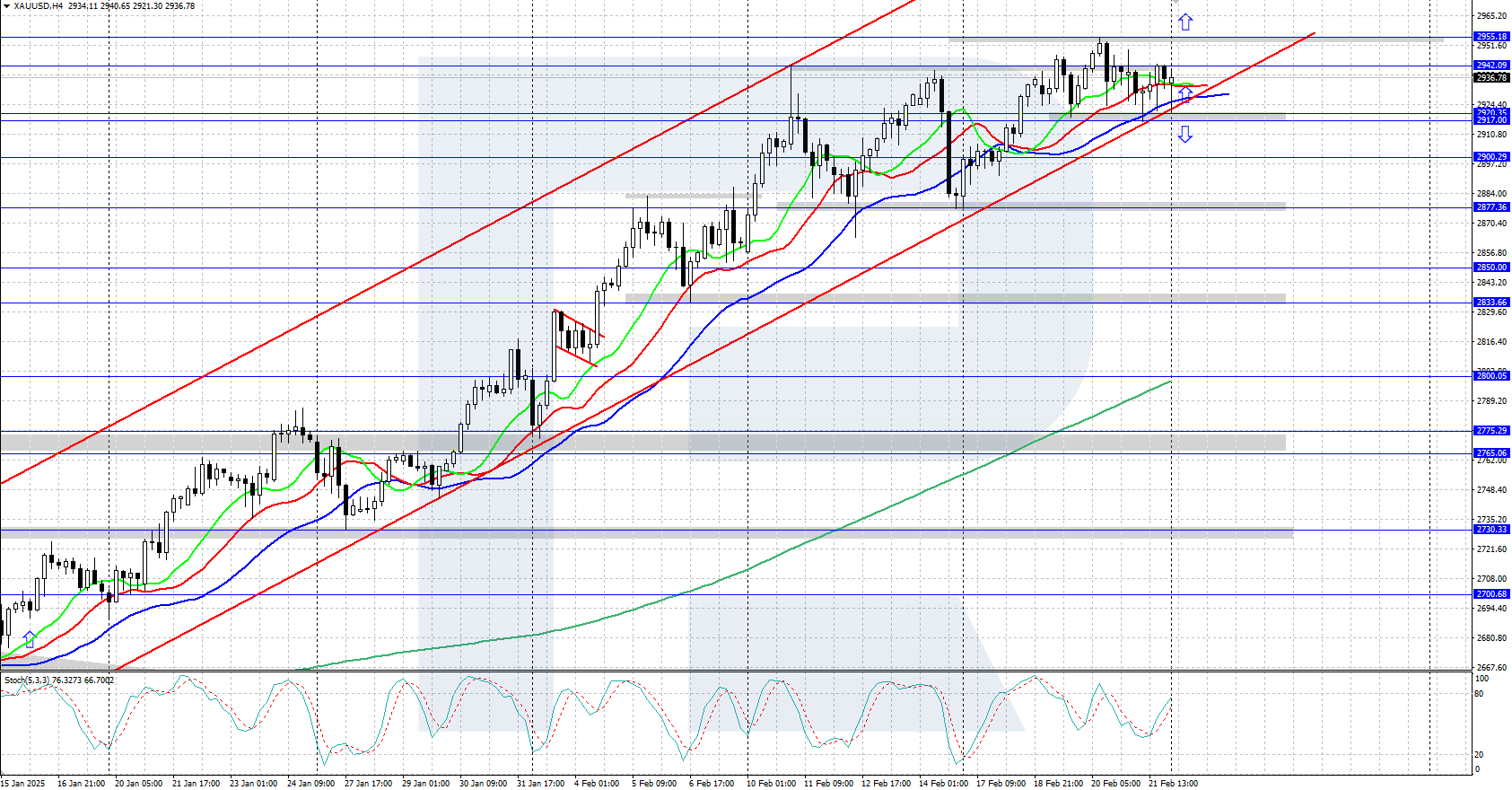

On the H4 chart, the XAUUSD pair fell to 2,920 USD today as part of a local downward correction. If Gold stays within the ascending price channel, quotes could continue their upward momentum. Conversely, a breakout below the channel’s lower boundary will open the door for a deeper correction.

The short-term XAUUSD price forecast suggests that the pair could rise to the all-time high of 2,955 USD again if the bulls retain the initiative and hold above the 2,917-2,920 USD support area. However, the downward correction could develop further if the bears gain a foothold below 2,917 USD.

Summary

Gold has corrected towards the price area around 2,920 USD, but the daily trend is still upward. The market will focus on US GDP statistics for Q4 2024 this week.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.